(This is an excerpt from an article I originally published on Seeking Alpha on July 1, 2012. Click here to read the entire piece.)

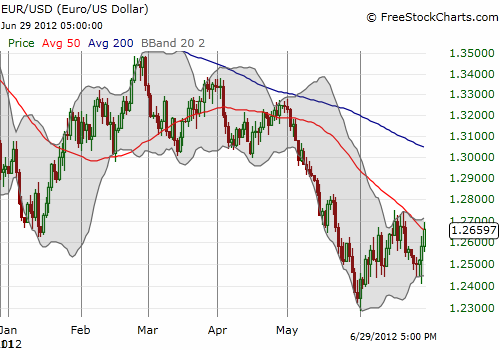

Thanks largely to the surging euro, the U.S. dollar index (UUP) took one of its nastiest one-day tumbles since last October, falling 1.3%.

I believe this drop all but confirms staunch resistance to further gains for the dollar index above what I have called the QE2 reference price, the price level of the dollar index right before Ben Bernanke telegraphed QE2 at the end of August, 2010. If the dollar continues to fall from here, such a move will likely take some pressure off the Federal Reserve to come up with more quantitative easing magic. However, it is not so easy to say that the dollar will continue to plunge from these levels either. {snip}

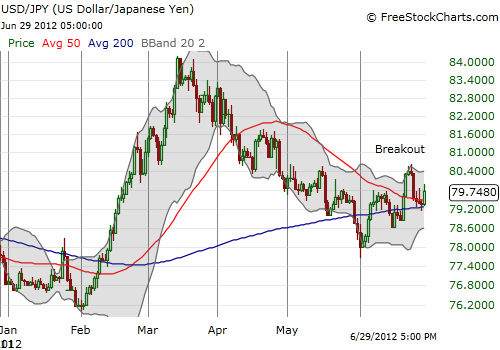

The U.S. dollar’s bounce continues against the Japanese yen (FXY) with the 200DMA still providing a general uptrend for June’s bounce. {snip}

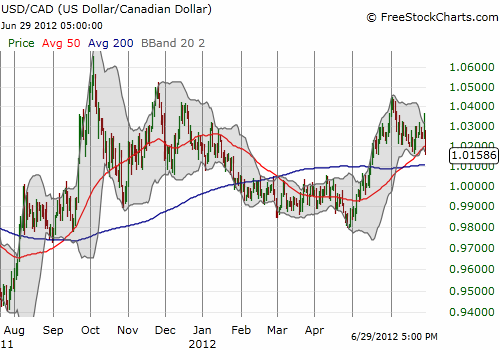

The Canadian dollar (FXC) is not too informative. It has simply bounced around parity since last September/October. {snip}

Overall, on balance, it looks like a near wash of bullish and bearish forces playing against the U.S. dollar. {snip}

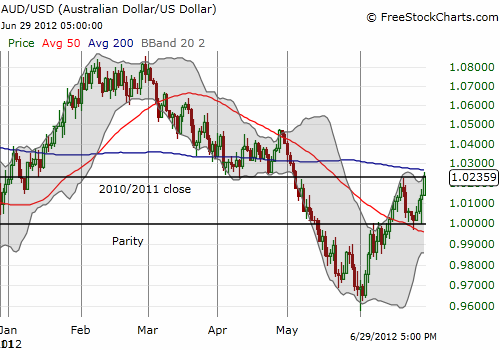

Perhaps the Australian dollar is the wildcard. {snip}

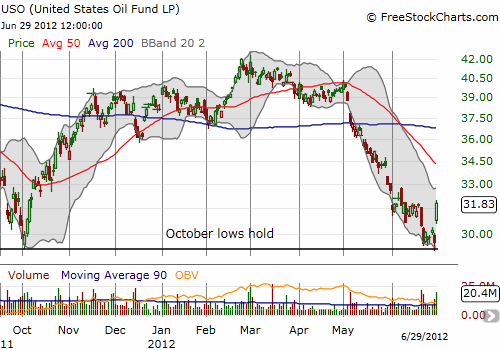

Finally, the plunge in the dollar just happened to coincide with other important levels in oil (USO) or (DBO), gold (GLD), and silver (SLV). {snip}

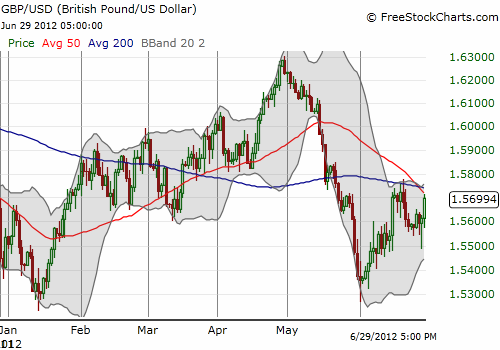

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 1, 2012. Click here to read the entire piece.)

Full disclosure: long EUR/USD, AUD/USD, USD/JPY, USO, GLD, SLV,