(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 29%

VIX Status: 21.7

General (Short-term) Trading Call: Hold – make sure bullish trades have some kind of hedge and do NOT have aggressive shorts in place!

Reference Charts (click for view of last 6 months from Stockcharts.com):

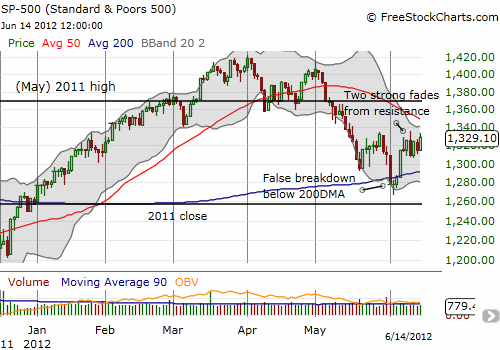

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

T2108 jumped to 29% as the S&P 500 surged into the close. Both T2108 and the index remain locked in tight, churning ranges. T2108 has hovered directly above oversold levels for seven trading days. The S&P 500 has bounced around for 6 straight trading days and has yet to break resistance formed by the bounce from May’s oversold period. The declining 50DMA is quickly meeting this resistance and will soon clash with the gently rising 200DMA to create a major high stakes technical setup that will likely generate a very powerful move (up or down) this summer.

Until this afternoon, I thought this high stakes setup would get resolved to the downside. However, today, headlines from Reuters claimed that major central banks stand ready to provide liquidity to financial markets in case they heave after the results of Greek elections this weekend. While I try to strictly focus on the technicals in the “T2108 Update,” I cannot ignore the major potential impact of global central banks pushing more liquidity into global financial markets in a coordinated fashion. Such a prospect places very high stakes on any trading ahead of the weekend and even immediately following. (For an additional perspective see “Why Joint Central Bank Action Is Unlikely and Won’t Work” from CNBC).

We can think of these prospects in two ways. First, the very fact that the G20 has floated this message into the media means that financial authorities are seriously concerned about what may happen after this weekend. We should then be worried too. But can you bet on a negative outcome? Perhaps…if you have quick fingers and trade futures Sunday night and Monday morning before the U.S. opens up for trading. Otherwise, you put yourself at risk of getting caught up in a major liquidity surge featuring short-covering and buyers rushing into the vacuum that will be left by all the sellers and pessimism leading into the weekend. If you buy ahead of this weekend, you are facing the possibility that central banks do not act fast enough or swift enough to prevent major damage before the good times roll again. Hedging is a better approach. Doing nothing is just as good!

I am personally not making any major moves and will sit on current positions, but I will be on high alert in foreign exchange. I did buy some VXX shares that I hoped to quickly flip on Friday, but it is looking likely those will go out at a loss. I may consider loading up some SSO calls if the S&P 500 dives back toward the current trading range (but I highly doubt that will happen!). Finally, any close above the 50DMA will flip me back into the bullish camp until T2108 turns overbought again.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS, long VXX calls and shares