On May 18th, I wrote that Amazon.com (AMZN) had triggered a post-earnings short by closing below the low of trading in the immediate aftermath of the last earnings report (at $220). However, I did not recommend pulling the trigger because the market was oversold at the time. Surprisingly, AMZN did not benefit from the market’s recovery from oversold conditions and instead just churned in place for several days. When it sold down with the market, AMZN generated a successful retest of its 50-day moving average (DMA). I missed a decent trading opportunity as AMZN lost 4.6% moving from the trigger point to its retest of the 50DMA.

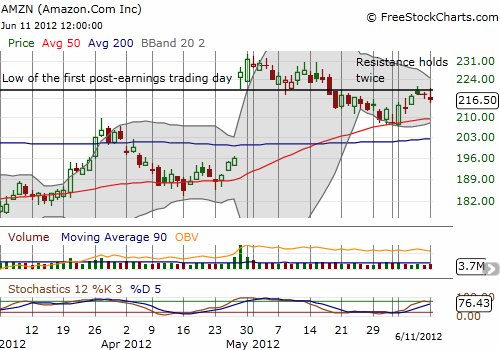

Since then, AMZN has twice failed to close above the $220 trigger point. Each failure came with an intraday fade that returned the stock below $220. It now looks like this resistance is firm and a short makes sense at this point. Moreover, the stock market is not oversold (although close to it!). A reasonable stop loss could be set at $222, the high from the first test of $220 as resistance. Both the 50 and 200DMAs linger directly below as potential support. The chart below summarizes the setup. Note that stochastics are also essentially becoming overbought.

Source: FreeStockCharts.com

I am guessing that a successful break above resistance will motivate buyers to pile into AMZN’s stock. A break below the 200DMA will all but assure a fill of AMZN’s post-earnings gap up and lead to even lower prices.

Be careful out there!

Full disclosure: no positions

Good stuff. I have been doing BECS for a few weeks now and just did a July BECS 230/235. Others have suggested 530 AAPL BUPS are safer, but I feel given the macro climate along with AMZN $220+ headwinds bearish AMZN plays are better.

Thoughts?

I have never heard anyone use the terms BECS and BUPS before! I assume these stand for bearish call spread and bullish put spread? Meaning you go short the spreads? I think for bearish bets, going with AMZN is better than AAPL. But if you are trying to play macro headwinds, going directly at a major index is always the better bet. Individual stocks can move contrary to your market expectations for company-specific reasons and completely ruin your strategy.