(This is an excerpt from an article I originally published on Seeking Alpha on April 27, 2012. Click here to read the entire piece.)

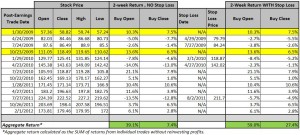

After Amazon.com’s (AMZN) last earnings at the end of January, I recommended buying the stock (or call options) right at the open based on historical trading patterns (see “Why Amazon.com Was A Buy At the Open After Reporting Earnings“). That trade was a huge success as AMZN’s record for buying the post-earnings open since 2009 grew to 8 positive gains and 5 losses in the two weeks following earnings. This time around, I am a little more wary.

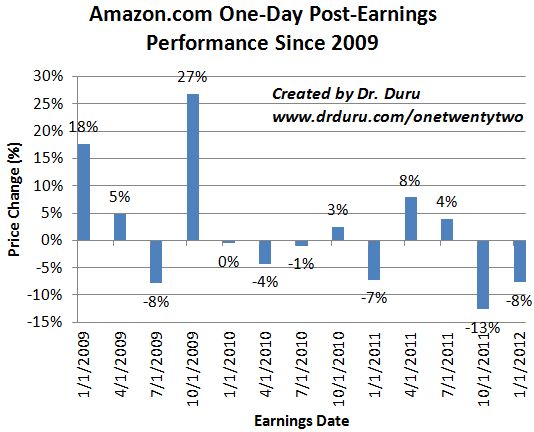

AMZN traded up 14% in the after-hours session following earnings. If AMZN holds those gains into Friday’s close, this performance would rank as the third best since 2009.

After the two top performing one-day, post-earnings performances, AMZN still delivered positive gains in the subsequent two-week period. See the first and fourth rows highlighted in yellow in the updated table below:

Click image for a larger view…

See the original post for a complete analysis of these data). Here is an explanation of the columns again:

{snip}

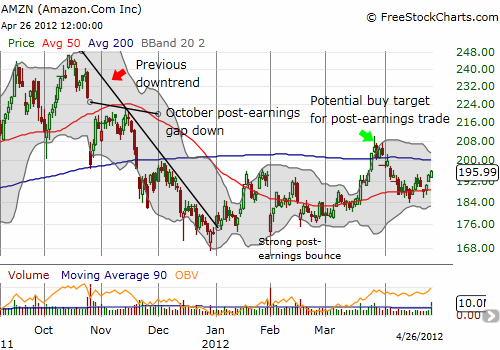

What makes me wary is that these two other large performances occurred in 2009 during a much more volatile period of trading. AMZN was also trading at much lower prices and a much lower valuation. I have to believe delivering a strong two week performance will be much harder with the stock trading near all-time highs and the NASDAQ trading near 11-year highs. To accommodate what I perceive as higher contextual risk, I am calling an “audible” here and recommending that traders wait until AMZN dips during the day.

I cannot say how much of a dip is “enough,” but the bigger the pullback, the higher the odds for the post-earnings trade to work. {snip} I will be mitigating risks by targeting a call spread for purchase.

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 27, 2012. Click here to read the entire piece.)

Full disclosure: no positions