(This is an excerpt from an article I originally published on Seeking Alpha on April 16, 2012. Click here to read the entire piece.)

I have been writing more and more bearishly on the Australian dollar this year (for example, see “Reserve Bank Of Australia Seems Biased Toward More Monetary Easing“). After BHP Billiton (BHP) announced it would close a metallurgical coal mine in Queensland, my alarm bells rang even louder. BHP was unable to resolve a severe labor dispute that Queensland Resources Council chief Michael Roche claims will eliminate about $1B AUD in export revenues.

{snip} The Reserve Bank of Australia has repeatedly noted that Australia’s terms of trade have peaked and this mine closure likely further confirms that peak. Moreover, turbulence in Australia’s mining industry is unwelcome at a time when it is leading the way in an otherwise softening economic environment. {snip}

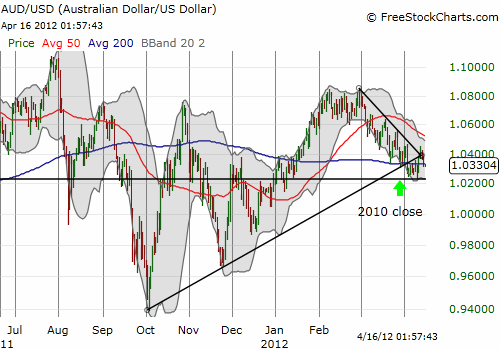

As the RBA gets more dovish and economic conditions apparently begin to weaken a bit, the Australian dollar has notably faded against the U.S. dollar. {snip}

Source: FreeStockCharts.com

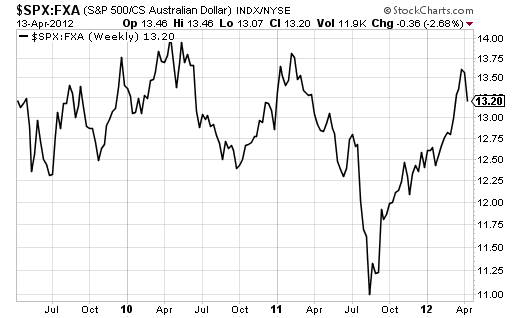

As the Australian dollar struggles to hold on against the U.S. dollar, it has managed to stop the sharp under-performance versus the S&P 500 (SPY). {snip}

Source: Stockcharts.com

{snip}

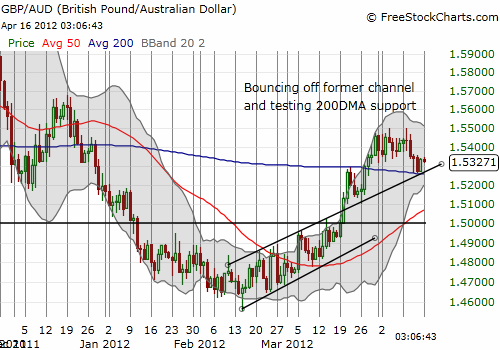

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 16, 2012. Click here to read the entire piece.)

Full disclosure: long AUD/USD, AUD/JPY, AUD/CHF, GBP/AUD, BHP, ANR, and CNX calls