This is an excerpt from an article I originally published on Seeking Alpha on December 29, 2011. Click here to read the entire piece.)

On August 15th, Mark Smith, the President and CEO of rare earth producer Molycorp (MCP) made one of the strangest insider purchases I have ever observed. {snip}

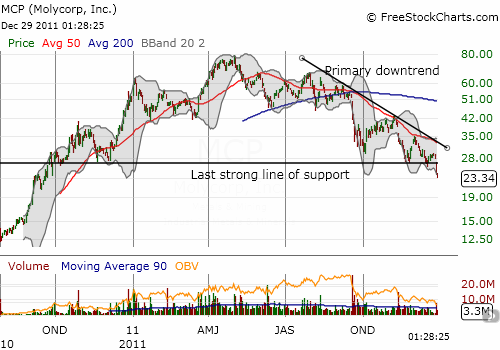

Two weeks ago, on December 15th, Smith doubled down on his purchase. This time he paid a much more reasonable $27.95 for 5,000 shares, a total value of $139,750. While MCP reported very strong and promising profits and revenues in November, I continue to wonder why he is buying these shares.

If Smith is trying to signal his bullishness in the company, he should be reinvesting a lot more than a paltry 4% of his 2011 take. If he expects to make money on these shares, again, I would think he would make more sizable purchases. Is he crazy like a fox, or crazy like a bat?

{snip}

I continue to think that MCP has tremendous upside potential over the long-term but that a portfolio of rare earth companies must include hedges: either very small positions and/or puts. (Note that MCP has still not erased its QE2-inspired gains, an event that would put it on the “commodity crash” buy list. The QE2 reference price is $16.75.)

Source: FreeStockCharts.com

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on December 29, 2011. Click here to read the entire piece.)

Full disclosure: long MCP shares and puts