The week ended with the S&P 500, SLV (a silver ETF), and GLD (a gold ETF) all approaching former 52-week highs. The U.S. dollar dropped 1.3% on Friday, decisively failing at resistance at its 200-day moving average (DMA) and putting an exclamation point on the week’s action.

The S&P 500 broke through its last battle lines in convincing fashion. As I claimed when I drew these lines, such a breakout suggests not only a retest of the 52-week highs but a sustained move past that high. Light holiday season volumes and the apparent waning will of sellers and shorts should put some wind beneath the market’s wings.

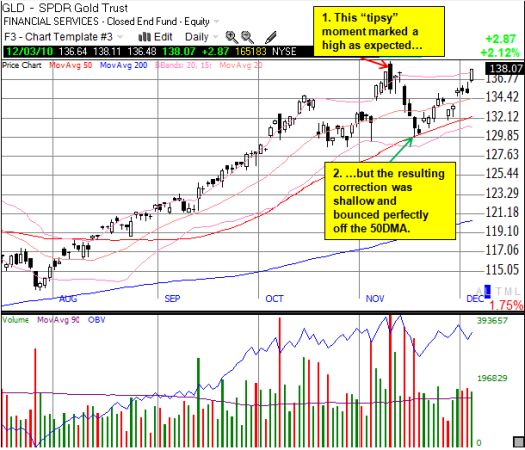

Gold and especially silver surprised me with relatively shallow corrections. I have gone from describing the healthy anatomy of silver’s rally to noting how gold and silver “almost” went parabolic and finally to detailing a real parabolic move in silver…all in the space of six weeks. Now it is time to take a deep breath and just appreciate the sheer persistence of the upward trends in both precious metals (using SLV and GLD as proxies).

For both gold and silver, I correctly noted the topping formations in November. However, the resulting corrections were much more shallow than I expected, especially for silver. I figured the change in the margin requirements that helped generate huge selling volumes following a strong, parabolic move would put silver into an extended “cooling off” period. As a result, I failed to take advantage of the dips in silver and gold and remain “naked” with my Australian dollars as my sole bet against the U.S. dollar (as I suspected, that head-and-shoulders formation was another bear fake-out). I have not decided on a re-entry strategy just yet for gold and silver, but I will be looking for a strong break to new highs to confirm November’s topping patterns are relics of the past. Before I relinquished my last precious metal holdings during November’s top, I had kept a core holding in silver and gold for almost three years and used the shares of miners to trade dips to rips. I will be looking to re-establish this positioning.

Source: stockcharts.com

The dollar’s relief rally really diverted my attention from the persistent strength in gold and silver. The dollar index made bounced off the important long-term support line from the 2008 multi-decade lows as gold and silver topped. The dollar briefly stumbled around its 50DMA, and at the same time gold and silver stopped selling off. Since the relief rally in the dollar continued as I expected, I just assumed gold and silver would respond by continuing their corrections. So, instead of being ready to start nibbling on silver and gold at lower prices once the dollar approached resistance at the 200DMA, I found gold and silver stretching for fresh highs. Oh the limitations of elaborate plans…

*All charts created using TeleChart (except where otherwise noted):

So where does all this action leave us? I am assuming that in the short-term, correlations are going to be poor directional guides, but intermediate and longer-term trends appear intact: dollar weakness (as always, using the 200DMA as a key guide), precious metal strength with gold regaining the advantage over silver, and a stock market ready to erase the rest of 2008’s last nasty slide – 1300 is “only” 6% away. It will take some new catalyst to change notably the momentum of any of these trends.

Be careful out there!

Full disclosure: long SSO puts and calls, long FXA, long AUD/USD