I did not think the bulls could pull off an Act 2 defending the 50-day moving average (DMA) support on the S&P 500, but defend they did. Presumably, the stock market left behind fears of a Korean conflagration and an implosion of European sovereign debt in favor of encouraging economic news, like unemployment claims dropping below 440,000 for the first time since the recession began (excluding statistical or seasonal adjustments).

Whatever the reason, the price action was impressive given it immediately wiped away memories of Tuesday’s sell-off. The tepid volume is consistent with a pre-holiday trading day and market rallies in general for 2009-2010, but it still serves as a non-confirming signal for the rally. The market now looks like it is bouncing between two important battle lines over the past seven trading days. A break of either line should usher in the next sustained move up or down.

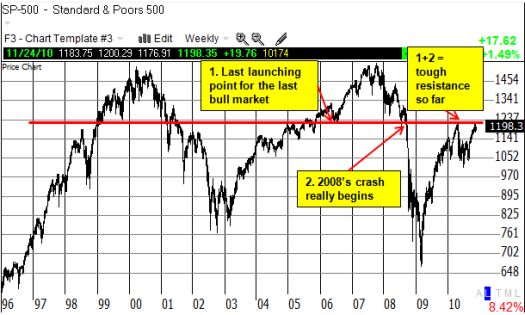

Whenever the market stalls out at important support or resistance points, I like to zoom out and see whether the given price levels have any historical importance. Sometimes traders act like they are carrying the painful or pleasant memories of trading days long gone. In this case, November’s marginal new 52-week high and the former high in April are right where the market’s 2008 slide really accelerated. This point also served as critical support in 2006 that launched the bull market’s final mad dash. If you stare hard enough, this single battle line seems to neatly separate the S&P 500’s last two peaks from the rest of the market action.

*All charts created using TeleChart:

So, it appears that the current technical levels have multiple levels of significance. If the holiday season brings the same light volume as it did last year, I will place my odds in favor of the market floating ever higher to fresh 52-week highs. Given such a move would finally erase the imprint of 2008’s worst losses, it could get bulls salivating after fresh all-time highs for the index. The Federal Reserve may want to give that printing press a few extra cranks to be on the safe side.

Be careful out there!

Full disclosure: long SSO puts