Talk of currency wars have heated up as several events have converged to make the public increasingly aware of the on-going competitive devaluations around the globe. The increasing clamor came ahead of an IMF meeting Thursday and a G7 meeting this weekend where the topic of global trade and currency rates are hot topics. It is probably no coincidence that gold and silver started to go parabolic ahead of these meetings. The euro’s test of the 1.40 level against the U.S. dollar seemed to be a sufficient catalyst to cool off the rocket fuel quickly and abruptly. Even oil reversed sharply on Thursday. These moves have created “bearish engulfing” patterns which typically signal the end of a rally.

I show charts for gold and silver ETFs (SPDR Gold Shares ETF and iShares Silver Trust ETF) to highlight the confirming high level of selling volume.

I used the euro’s test of the 1.40 level against the U.S. dollar as a trigger to trim positions. Parabolic moves typically signal the end of a rally as the final skeptics and last buyers try to hop on a trend, so Tuesday and Wednesday’s moves put me on alert. I am now expecting some kind of correction that will cool things off and provide the next buyable dip (I will weight silver more than gold as silver’s rally looks particularly good). If I am wrong and the locomotive continues running from here, then I will ride with my remaining positions. Interestingly, the dollar index is also testing an uptrend line from the 2008 lows. A break below this trendline will signal a likely retest of the 2009 lows in short order (and next the 2008 lows). A successful bounce from this trendline could send the dollar hurtling right back to the 200DMA resistance.

The daily close-up shows once again how important the 200-day moving average (DMA) is in flagging the next major direction for the dollar.

*All charts created using TeleChart:

The news on currency wars has picked up lately as the Federal Reserve has promised to rain more dollars on the American economy (confirmed by subsequent statements from Fed members), and the Bank of Japan (BoJ) has directly intervened in the currency markets for the first time since 2004. On Thursday, the BoJ promised to remain active in the currency markets even as it lost the first round of battle with the Fed.

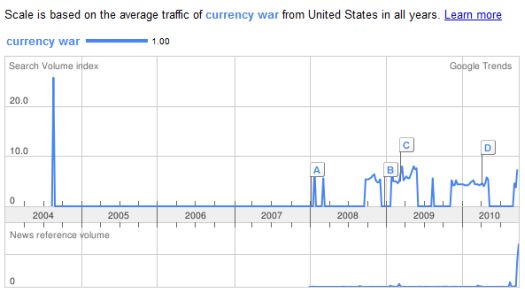

Google trends show a recent surge in searches in the United States on “currency wars” that has reached previous peaks. News reference volume has surged higher than those previous peaks. The even larger spike in searches in 2004 coincided with Japan’s last intervention.

Google’s news archives for articles referencing “currency war” have actually been higher in previous years. Not surprisingly, the 30s and 40s were peak years for these kinds of news stories.

Despite all this commotion, John Lipsky, the IMF’s first deputy managing director, insists that no currency wars exist and that it is the media fanning the flames of conflict. Such denial makes me more confident that no material change will come out of the IMF or G7 meetings. It will be devalue as you were with the lingering question being what is the market’s relative appetite for buying/selling devaluing currencies?

Be careful out there!

Full disclosure: long GG; USO (along with a covered call); long and short a basket of positions focused on a bearish bias on the yen, bearish on the euro, bullish the Australian dollar, and bullish the pound.