The U.S. dollar rallied into the Federal Reserve’s latest decision on monetary policy. This move seemed to launch (finally) the start of a relief rally that I have tried to anticipate as the dollar approached its support at the 200-day moving average (DMA). The uncertainty over the outcome of the Fed decision encouraged me to hold on to bets on a relief rally despite the break below support. The Fed’s near-symbolic announcement that it will maintain the current size of its portfolio of assets launched an immediate reversal in the dollar’s fortunes.

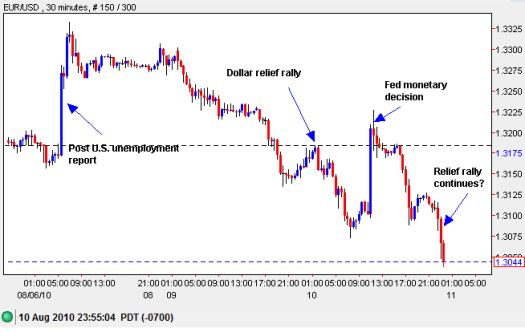

This trigger-finger reaction stalled within 30 minutes across most major currencies. Within another 12 hours (the time of writing), the relief rally in the U.S. dollar had essentially picked up where it left off before the Fed announcement (trading versus the yen remains a notable exception). Trading in the euro versus the dollar demonstrates the violent churn:

Source: dailyfx.com charts

The Federal Reserve’s matter-of-fact proclamation that “…the pace of economic recovery is likely to be more modest in the near term than had been anticipated” has put the final official stamp of acknowledgment that the economic recovery in the U.S. remains fragile and sluggish. With rates now likely to stay near zero into 2011 (2012?!) any lingering notions of an imminent V-style recovery should also be buried for a good while. The market has had plenty of time to adjust to this dour reality, so I do not expect a major new move downward until some new news hits. Some kind of small correction does seem long overdue with T2108 still above the 70% overbought threshold.

*Dollar and S&P 500 charts created using TeleChart:

Now, I think attention will once again turn outward. While China should remain a beacon of hope for worldwide economic recovery, Europe should receive renewed scrutiny. For example, under this sharper microscope, the euro could look over-valued again. Or, more importantly, the dollar will appear “cheap” to the “safe haven” crowd.

Ultimately, I will continue watching the 200DMA for clues on my next steps. However, until the recent lows break, I am assuming a stronger dollar is the better (short-term) risk/reward bet. I think the impact will be best seen versus the euro (which dominates the dollar index anyway). I will consider interactions with other major currencies on a case-by-case basis. For now, none of my earlier stated opinions have changed; particularly, long-term bullish the Australian dollar, generally bullish the British pound but think it is over-stretched here, and a relief rally is overdue against the yen. I am least confident about my opinion on the yen.

Be careful out there!

Full disclosure: short EUR/USD, long USD/JPY, long FXA, long AUD/USD, short GBP/JPY, short EUR/JPY, long SSO puts