Bob Shullman, President of Ipsos Mendelsohn, appeared on CNBC Tuesday to hawk the latest results of his market research company’s “Affluent Survey.” The affluent are afflicted with recession-related blues but remain ready to spend.

The affluent control the majority of America’s income and wealth: they constitute 20% of all American households, but earn 60% of its income and hold 70% of the country’s wealth. These statistics make the economic opinions of the affluent noteworthy. I was indeed fascinated by the mixture of findings from this survey:

- Afflicted by recession-related blues

- 85% making 100K+ say still in recession

- 80% making 250K+ say still in recession

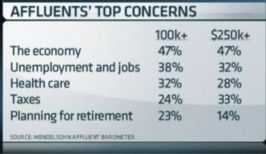

- 47% rate the economy as a #1 concern while concern over taxes depend on income level

- Still plan on spending at average levels (lower than two years ago, right before the collapse of Lehman Brothers)

- 54% are going to vacation outside the U.S.

- 32% are planning to buy or lease a car

- 21% will take a cruise

As so often seems to be the case, sentiment seems poorly correlated to spending patterns; although in this case the spending is planned, not actual. (See a related BusinessWeek article describing “a nation of schizophrenic consumers” as the new abnormal). Concerns over the economy, jobs, and taxes are not significantly impeding spending plans. I also took note that those households making $100-$250K list taxes at the bottom of their list of concerns. Households making over $250K have known for almost two years that their taxes are going up, so perhaps it is not surprising that they are not even more concerned than they already are.

I do not know the overall accuracy or margin of error for this survey, but at least the company has been conducting these surveys since 1977 and seems recognized as an authority on this topic. I am also not clear whether this survey accounts for the difference in earning $100K in, say, San Francisco, versus Cleveland or the number and age of children in the household. Regardless, these data make for an interesting backdrop to debates over deflation versus inflation or whether Americans cannot function because of paralyzing uncertainties.

Be careful out there!

Full disclosure: no positions