The rally in the British Pound may finally be on its last legs. I am sure the Bank of England hopes so as it meets to decide interest rates tomorrow.

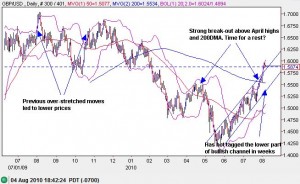

I wrote just last week about the potential for the pound to break out versus the U.S. dollar, and it has done so quite convincingly. The pound experienced a sharp move above the April highs and its 200-day moving average (DMA). However, now the current run has many of the characteristics of the final phase of a bullish move, not the beginning of a new one.

Note in the chart below that the pound has pressed against the upper-Bollinger Band for over two weeks. Similar recent episodes eventually gave way to lower prices. More importantly, the pound has even stretched outside of the old bullish channel and has gone roughly three weeks without correcting back to the bottom of that channel. I would not short the pound on this setup given its bullish fundamentals, but I would not begin a fresh long position here (I am looking to unload my now very small position ahead of the rate decision). I would instead wait to see how the pound behaves on a move back to support – whether that support is the 200DMA or the bottom of the old bullish trading channel.

Source: dailyfx.com charts

(Click for a larger view)

The U.S. dollar index is adding to the tension by trading right at critical support at its 200DMA ahead of a much anticipated jobs report on Friday. The U.S. dollar is also sitting at historic lows against the yen. On Wednesday, the dollar bounced perfectly off the 200DMA and finally showed a hint of life against the yen. (charts not shown this time). This would be a perfect time for a decisive reversal in many on-going trends that have been uncannily consistent for two months and running.

Be careful out there!

Full disclosure: long GBP/USD, long USD/JPY