If an asset bubble is characterized by accelerating euphoria as asset prices rise ever higher, gold is still not in a bubble. The skepticism directed towards gold continues to rise along with its price despite gold marking all-time highs the past two months. I decided to do a refresh of last year’s sentiment analysis on gold after I realized that the put/call ratio in GLD, the SPDR Gold Trust, has steadily risen for at least two years and now sits at two-year highs (data only available for past two years from Schaeffer’s Investment Research).

Source: Schaeffer’s Investment Research put/call equity ratio

The put/call ratio can rise because investors and traders are betting against the underlying equity or are increasingly concerned about protecting a portfolio from loss. Either way, a rising put/call ratio indicates fear, concern, and/or skepticism is on the rise. I would expect this ratio to drop to new two-year lows if a bubble were developing.

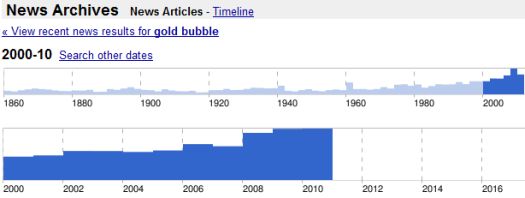

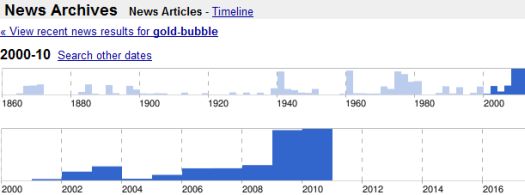

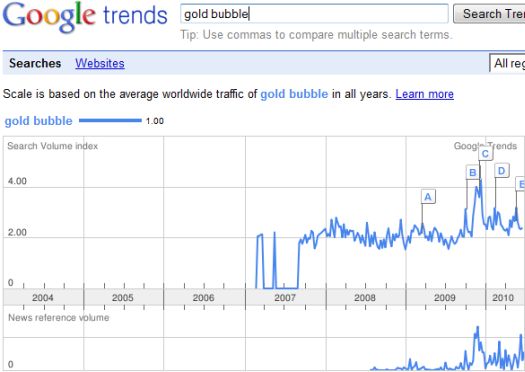

An updated review of the Google news archives and Google trends tells a similar story: the sentiment toward gold is increasingly steeped in skepticism.

According to Google’s news archives skepticism toward gold has steadily increased over recent decades. The news in 2010 has created a record flurry around the concept of a gold bubble. The two charts below show the results from the use of “gold” and “bubble” in the same news item and the use of the specific term “gold bubble.” Of course, these searches do not distinguish amongst news pieces supporting or debunking the concept of a gold bubble. However, I think it is reasonable to expect that the number of news items printed about a particular concept are highly correlated to the amount of interest in the topic as well as the size of the population that support or believe in the topic.

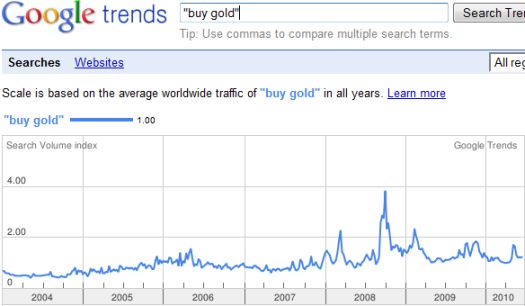

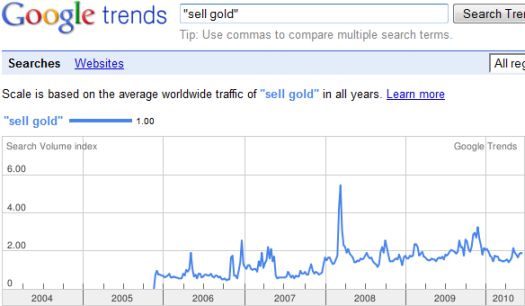

Trends in web searches show that interest in buying gold remains at a multi-year steady state. In classic fashion, buying interest spiked significantly just ahead of gold’s big plunge in late 2008 (turned out to be an excellent buying opportunity).

Similarly, searches for selling gold remain at a steady state. The last significant spike was in early 2008, ahead of gold’s temporary plunge. Between searches for “buy gold” and “sell gold”, it is possible we have a sufficient predictor for a major dip in gold’s price.

Finally, searches for a bubble in gold have settled back down from the spike in late 2009 that I noted when gold was making fresh highs at the time. This is the one indicator that now contradicts my thesis and defies explanation. It is a useful reminder of the potential limits in this kind of sentiment analysis. If this search declines further, perhaps even trends downward, we might get an indicator that a gold bubble is finally developing.

Interestingly (or ironically) enough, commodity-rich Australia leads all regions for searches on “gold bubble.” The United States comes in fourth after Denmark and New Zealand (click here to review the detailed results).

The euro has slightly rallied versus the U.S. dollar over the past month. The 2.4% spike on Thursday led to an approximate 3.8% plunge in gold prices (even larger when priced in euros). These are early signs that the financial markets are once again starting to get more comfortable with the debt issues in Europe. I consider this reversal the potential start of an excellent opportunity to rebuild my holdings in gold.

Be careful out there!

Full disclosure: long GG, short EUR/USD

Lifeline Community Care Queensland has teamed up with Australia’s leading buyers of gold, http://www.lccq.org.au/gold-for-good

Pretty cool that you can use Google trends to help predict these changes in price. I’ll add this to my list of indicators.