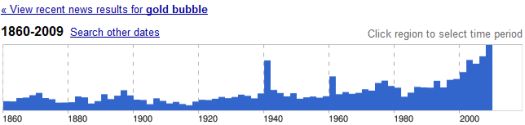

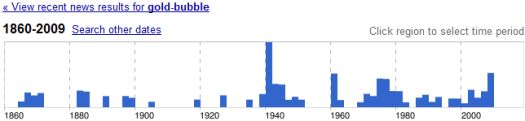

In “That’s one long gold bubble,” Tim Ianaco created an illustrative animated graphic from Google news archives comparing the news coverage of “housing bubble,” “credit bubble,” and “gold bubble.” He rightfully observes the following:

“…my understanding of how bubbles work is that they materialize rather quickly, fueled by media coverage toward the end and then they burst spectacularly – like the stock market bubble, the housing bubble, and the credit bubble.

The news coverage that you see above for the ‘gold bubble’ looks nothing like the other three, rising gradually since 1970, the early-1980s gold price peak almost imperceptible in the graphic.”

In fact, not only has skepticism toward gold steadily increased over recent decades, Google news archives shows that skepticism is at or near “record” highs. The appearance of “gold” and “bubble” has never been higher in the news; only the early 1940s even come close. Google’s records are more spotty for the use of the specific term “gold bubble,” but they still seem to show that this term’s current usage is at historic levels.

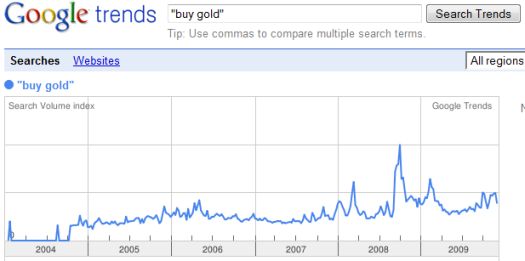

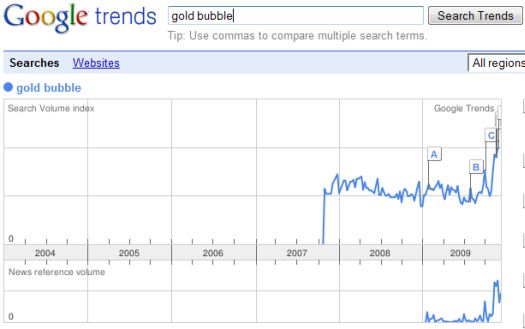

A friend likes to send me periodic updates from Google trends which I find even more informative regarding current gold sentiment. According to Google trends, interest in buying gold is lower than last year at the height of the financial crisis when gold went “on sale.” While buying interest has settled back down, bubble-watching has surged. Google trends shows searches including “gold” and “bubble” have spiked sharply just in the last three months. (The trends shown below use all regions because Google’s data for just the United States for “gold” and “bubble” are extremely limited. Google’s trend data are also very limited for searches on the specific term “gold bubble.”)

Taken together, these graphics suggest a growing “bubble” in skepticism in gold – even if some portion of this data comes from refuting claims that gold is in a bubble. This run may continue until some event finally delivers the validation that so many require before buying gold and that so many buyers of gold are trying to anticipate – for example, a surge in inflationary pressures (I am part of “Inflation Watch“), a persistent extension of the near decade-long weakness in the U.S. dollar, a disorderly run on the dollar, a major sovereign default, etc..

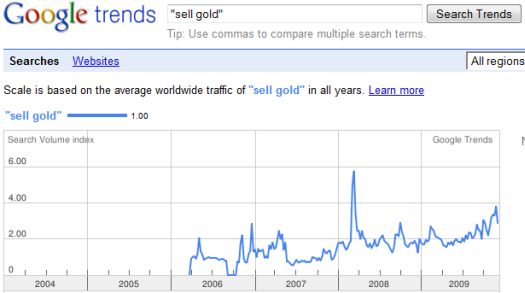

Interestingly enough, Google trends shows that a spike in “sell gold” might be an indicator for a short-term top in gold. The spike in the first quarter of 2008 preceded the collapse in gold prices around 6 months later. The trend is currently increasing again, but no spike.

Be careful out there!

Full disclosure: long GLD, GG

1 thought on “The Rising Skepticism In Gold”