Iron ore may have reached a new inflection point with a price rally coming to a halt in January and some related stocks consolidating near multi-year highs. When I last made an iron ore trade in September, 2017, I was responding to a surprise projection from the Reserve Bank of Australia (RBA) that suggested a top in iron ore. From that post I concluded the following:

“If the RBA is correct, iron ore is at risk of revisiting the lows from June. Also, at best, a fresh rally should only carry iron ore back to the high from August. Translating these bounds into short-term stock moves, the upside risk is around 5% and the downside opportunity is about 20%. The long side of the pairs trade is mainly a hedge in case the RBA’s expectations prove incorrect. I am more willing to bias to the downside given the iron ore inventories that have piled up. High inventories have been a story all year but did not prevent the relief rally over the summer. Current inventory levels were last seen over 5 years ago.”

I bought call options on BHP Billiton (BHP) and put options on Rio Tinto (RIO) as part of a pairs trade. While iron ore prices continued to drift down to an October low, both RIO and BHP went into a multi-month consolidation; the pairs trade slowly wilted on the vine. A major breakout in December saved the long side of the trade and allowed me to salvage some value.

Source: FreeStockCharts.com

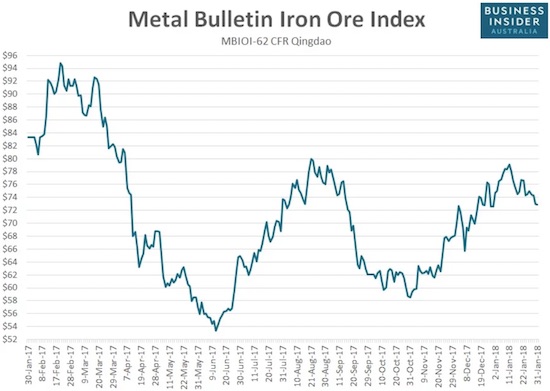

As the chart below shows, August has indeed held as a top for iron ore. However, the price decline from that top did not quite reach the June low. In early January, 2018, the price of iron ore completed a 2-month rally by peaking at the high made last August. If the upward momentum does not return soon, 2017’s peak in February will loom large from a seasonal standpoint.

Source: Business Insider

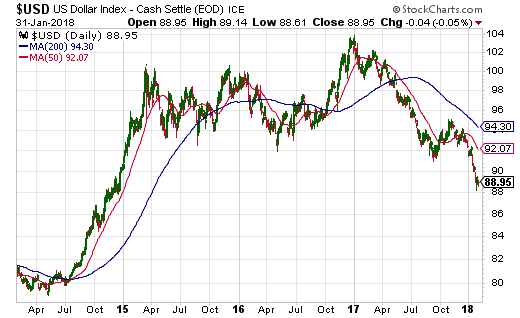

For my latest trade on iron ore, I took a lesson from the last round and decided to try a one-way bet first. The apparent end of the U.S. dollar’s collapse motivated me to make a bet against a new breakout for iron ore and purchase put options on BHP. If a fresh breakout does unfold, I will rush to play that move with a fistful of call options on RIO.

Source: StockCharts.com

Price projections for iron ore are currently all over the place (as usual), so it makes sense to prepare for a breakout even though my base case is a pullback. Here is a sample of projections from different sources:

Reuters: “The SGX futures curve isn’t currently suggesting a rapid retreat in prices, with the April contract at $72.20 a tonne and December’s at $68.43…This is in stark contrast to the forecast from the Australian government, which expects the iron ore price to drop 20 percent in 2018 from 2017 to an average $51.50 a tonne.”

Reuters: “Benchmark 62-percent grade iron ore for delivery to top market China will average $62 a ton in 2018, down from around $71 last year, according to the median estimate in a Reuters poll of 18 analysts.”

Business Insider: “‘We [Citibank] are bullish on iron ore for [the March quarter of 2018] and expect prices to rise to over $80 a tonne in the next 1-2 months…An acceleration of steel mills’ restocking activity around the Chinese New Year should support physical demand for iron ore.’…Over the medium-term, Citi sees the benchmark falling back to $65 a tonne in Q2 before sliding to $60 a tonne in Q3.”

Bloomberg: Zhao Chaoyue, an analyst at China Merchants Futures: “‘The restocking cycle — where mills build up their raw materials inventory in preparation for output restarts — has also come to an end.’…Benchmark iron prices will decline to average $50 between April and June, according to Barclays’s Dane Davis, while ING has said they’ll sink below $70 this quarter and are seen at $55 in the second to fourth quarters.”

I think the bearish case is more compelling as Chinese inventories are at a record high. According to Bloomberg, “stockpiles stand at 154.4 million tons, enough to cover more than 50 days’ of imports.” The RBA’s call for a top in the price of iron ore still makes sense.

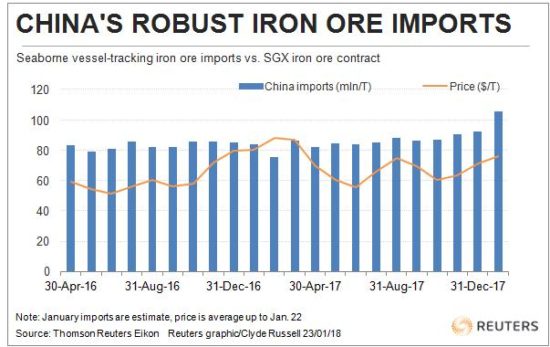

Record imports have contributed to this pile-up in iron ore. According to Reuters, China imported a record 1.07 billion tonnes of iron ore in 2017. The monthly chart below shows a steady creep higher in imports to close out 2017 with an estimated surge in imports for January.

Source: Reuters

I am fully on-board with the synchronized global growth story, but it sure looks like the market for iron ore has already fully anticipated China’s contribution to that story. It is hard to imagine prices for iron ore pushing higher against the stockpile.

There are two other iron ore plays that I am putting aside for now: Vale (VALE) and Cleveland-Cliffs (CLF).

VALE’s consolidation period last year occurred at a lower level than RIO and BHP. The subsequent breakout took VALE to a 3+ year high and a near V-like recovery from a precipitous slide from September, 2014 to February, 2016. CLF is struggling. In February, 2017, CLF tested resistance from the 2009 (then) historic low. The stock sold off from there and did not stop until it had lost half its value. CLF is now in the middle of a fresh sell-off triggered by last week’s earnings.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long BHP put options