The last Housing Market Review covered data reported in October, 2017 for September, 2017. At the time, I lamented having too small an exposure to home builders while the entire sector rallied nearly non-stop. I was counting on seasonal patterns to deliver at least one buyable dip ahead of the seasonally strong period starting in November. The briefest of dips did arrive in the form of angst over the Republican tax reform bill. In a pattern familiar in this bull market, the angst lasted exactly one day before these stocks resumed their rallies.

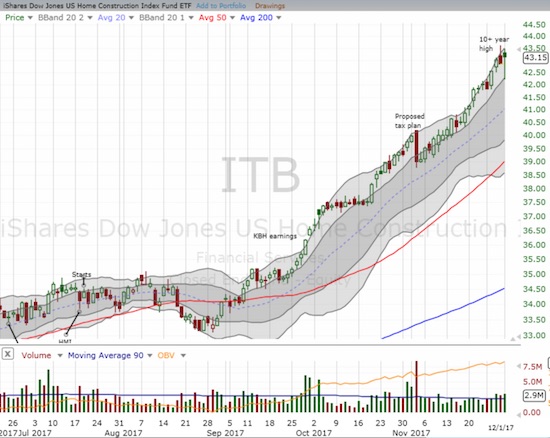

The iShares U.S. Home Construction ETF (ITB) has not traded higher since early 2007. ITB is up a whopping 57% year-to-date with a large chunk of that gain coming since the September breakout to a new high. ITB is up 23% since then.

Source: FreeStockCharts.com

I thought the selling was the beginning and not the end of a choice entry point; sellers lack follow-through. Once ITB completed a reversal of the one-day loss, I assumed the next phase of the rally was underway. D.R. Horton (DHI) was a key tell as the home builder which fared the best in the middle of the one-day sell-off: DHI closed near flat after a sharp intraday bounce that day. DHI erased that marginal loss in two days and returned to the racetrack from there. In just ONE MONTH DHI is up another 13%!

With my hand “forced”, I fired up my buying plan. I focused on the stocks that looked “cheap” before and after the day of angst. I finally made the plunge into Five Point Holdings (FPH) and M.D.C. Holdings (MDC). MDC in particular experienced the double-whammy of reporting less than stellar earnings news on the day of angst. The stock is still working on its own complete reversal. Per my trading plan, I bought after the 200-day moving average (DMA) appeared to hold as solid support.

Source for charts: FreeStockCharts.com

The day of angst stopped me out of my position in Tri Pointe Group (TPH) (set to preserve my profits), but I decided not to climb back in. Interestingly, TPH lost 2.6% on Friday, December 1st when ITB managed to GAIN 0.7% on its bounceback from earlier selling in the day. Other regional builders like Century Communities (CCS) and LGI Homes (LGIH) also ended the day with losses. I will be watching for a potential divergence going forward.

I am still taken aback by the breathless gains in home builders this year. For four years, ITB churned with a seasonal bias that allowed me to cycle through multiple bullish trades. I was clearly not quite prepared for a distinct change in the trading behavior. Panning out, I see that 2017 was a major breakout year with similarities to 2012 when home builders surged off major lows. The between years served as a very extended period of consolidation with a slight upward bias. The big question for 2018 will be whether 2017 priced in years of subsequent good news just as 2012 did for the 2013 – 2016 period. Unlike 2012, home builders are at highs in sentiment, home prices are relentlessly increasing, inventories are tight, labor and materials are tight, and demand is quite strong. At least housing bears still expect the market to collapse at any minute…

Source: Yahoo Finance

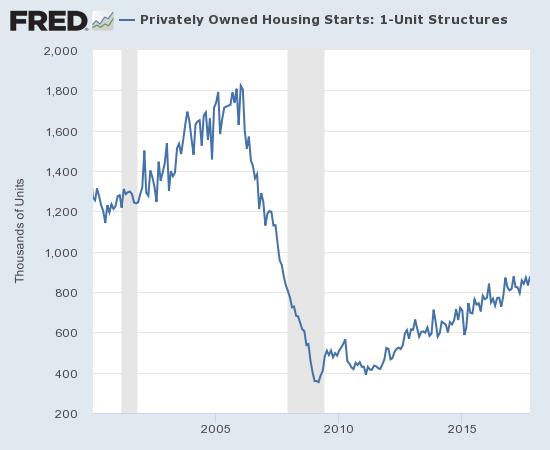

New Residential Construction (Housing Starts) – October, 2017

Single-family housing starts for September were revised upward from 829,000 to 833,000. October starts increased month-over-month by 5.3% to 877,000. On an annual basis, single-family housing starts eked out a gain of 0.7%, the lowest year-over-year growth rate since August, 2016 (-1.4%).

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis, November 27, 2017.

After three months of wide deviations, the regional changes were more uniform for the previous three months. Wide deviations returned for September and October. The Northeast, Midwest, South, and West each changed -13.2%, 10.4%, 3.0%, -5.6% respectively in October. For September these percentages were, respectively, 17.7%, 10.5%, -5.6%, and 26.1%. The strong starts in the West came to an abrupt end but were undoubtedly due for some cooling. The South is bouncing back from the hurricanes in Florida and Texas.

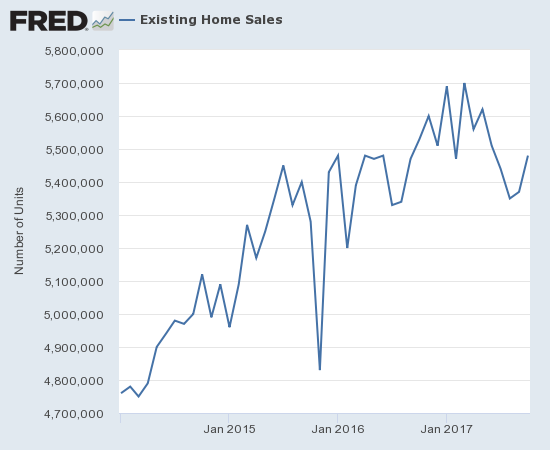

Existing Home Sales – October, 2017

The routine description for existing sales is usually sales decline because of a shortage of inventory and sales increase in spite of inventory shortages. For October, 2017, the National Association of Realtors® delivered a slight twist by applauding another small monthly increase in sales but complained that lack of inventory caused a year-over-year decline in sales.

“Job growth in most of the country continues to carry on at a robust level and is starting to slowly push up wages, which is in turn giving households added assurance that now is a good time to buy a home…While the housing market gained a little more momentum last month, sales are still below year ago levels because low inventory is limiting choices for prospective buyers and keeping price growth elevated.”

For January 2017, existing home sales rose to levels not seen since February, 2007. In February 2017, existing home sales dropped sharply and then rebounded sharply in March to a new post-recession high. Now, sales are on the decline and for the second month in a row went negative year-over-year.

The seasonally adjusted annualized sales of 5.48M were up 2.0% month-over-month from 5.37M in sales for September (revised down from 5.39M). Year-over-year sales decreased 0.9% consistent with a recent pattern of deceleration since April: November 15.4%, December 0.7%, January 3.8%, February 5.4%, March 5.9%, April 1.6%, May 2.7%, June 0.7%, July 2.1%, August 0.2%, September -1.5%. So October’s annual drop provided a final confirmation of a top in sales for 2017.

(recall that the NAR no longer makes data available before 2013. For more historical data to 1999 click here)

Source: National Association of Realtors, Existing Home Sales© [EXHOSLUSM495S], retrieved from FRED, Federal Reserve Bank of St. Louis, November 27, 2017.

The share of sales going to first-time buyers increased to 32% from 29%. First-timers made a reassuring rebound after declining in September below 30% for the first time since September, 2015. Year-to-date this share was stuck in the low 30s. The average for 2016 was 35% and the NAR’s 2017 Profile of Home Buyers and Sellers reported an average of 34% for 2017.

The absolute level of inventory of existing homes fell year-over-year for the 29th straight month. During the press conference, the NAR noted that October set a record low absolute and relative inventory level across all Octobers since data collection started in 1999. Recall that during the June press conference, the NAR talked about a housing crisis in supply in some housing markets. The 1.80M homes for sale represented a whopping 10.2% decrease from the previous October and a 3.2% decrease from September’s 1.90M. The string of year-over-year declines has been remarkable: starting from 2016…August -10.1%, September -6.8%, October -4.3%, November -9.3%, December -6.3%, January -7.1%, February -6.4%, March -6.6%, April -9.0%, May -8.4%, June -7.1%, July -9.0, August -6.5%, and September -6.4%.

In December, inventory hit 3.6 months of sales and a new absolute low measured from 1999 when the NAR began tracking. At 3.9 months of sales, relative inventory dropped precariously close to the record. September’s inventory was 4.2 months of sales. During the press conference, the NAR repeated its appeal for getting more supply into the market. The NAR warned that the market cannot afford multiple years of price increases that outpace wage growth at the same time mortgage rates go up.

Investors purchased 13% of existing homes in October, a decline from September’s 15% but within the recent range.

For October, regional areas experienced mixed year-over-year results as the Midwest and the South were the big drags: Northeast 0%, Midwest -1.5%, South -1.8%, West 0.8%. All regions logged substantial year-over-year jumps in their median price: Northeast 6.6%, Midwest 7.1%, South 4.6%, West 7.8%.

October’s 5.5% year-over-year increase in the overall median price of an existing home incredibly represents the 68th consecutive month of year-over-year increases. The median price of of $247,000 is up slightly from September’s $245,100 and a step closer to August’s record $253,500.

Single-family sales increased 2.1% on a monthly basis and decreased on a yearly basis by 1.0%. The median price of $248,300 was up 5.4% year-over-year; the past six months have delivered similar year-over-year gains.

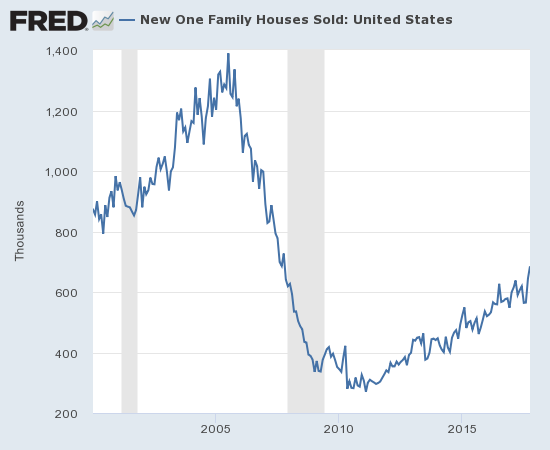

New Residential Sales – October, 2017

New single-family home sales declined in July steeply enough to threaten a break of the years-long uptrend. August’s hurricane-impacted sales numbers seemed to seal the fate of that uptrend. And then September happened: despite broad-based declines in existing home sales in September, new home sales soared on both a year-over-year and month-over-month basis. October delivered a repeat performance.

The Census Bureau revised September sales of new single-family homes downward from 667,000 to 645,000 (which means that September’s reported 17.0% year-over-year jump was instead about 13%). New home sales for September increased 6.2% month-over-month and soared 18.7% year-over-year to 685,000. Year-over-year gains have regularly hit double digits since 2012; October’s jump was only the highest since March of this year. New home sales hit a new post-recession high and have not been this high in 10 years. Note well that year-to-date new home sales have increased 25% while they increased 37% during the 4-year period of consolidation for ITB. Sales were up 57% from December, 2012 to the previous post-recession peak in July, 2016.

Source: US. Bureau of the Census, New One Family Houses Sold: United States [HSN1F], retrieved from FRED, Federal Reserve Bank of St. Louis, November 28, 2017.

In September, sales were strong enough to drive new home inventory from 6.1 months of supply to 5.0 months. October’s inventory slipped slightly to 4.9 months of supply. A market for homes is in balance at 6 months of supply, so the market is further unbalanced. August’s inventory was the highest since October, 2011, so the current numbers represent a remarkable change in character. I wondered out loud about a downward revision for September’s number. I have to do the same for October. Perhaps a downward revision of sales will occur for the next report.

Despite the sales jump, the median price actually decreased (the average price continued its upward march). The median price of $312,800 returned close to August’s (revised) $311,700 and was a 3.3% decline from September’s median. The median price decreased 3.3% year-over-year. The downward shift in the median came from a huge rise in the share of homes sold in the $200,000 to $299,999 price range and a large drop in the share of homes sold in the $300,000 to $399,999 price range. Small gains in higher price brackets did not compensate for the downward shift.

On a regional basis, new home sales brought a convincing end to divergent behavior. The Northeast experienced its THIRD month of sharply higher sales with a 64.7% year-over-year gain (compare to 65.2% for August and 54.8% for September). The Midwest increased 16.2%. The South put hurricane woes behind it with a 14.0% increase. The West soared 20.1% year-over-year.

Home Builder Confidence: The Housing Market Index– November, 2017

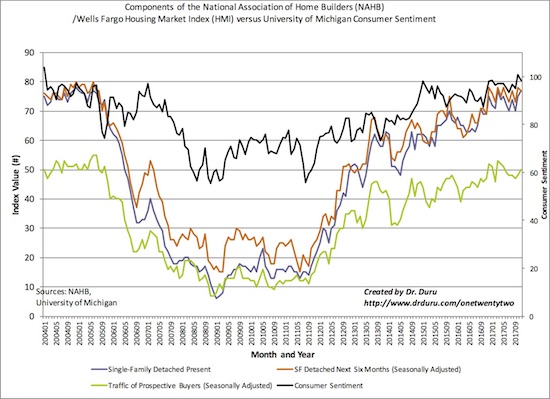

In March, builder confidence soared to a new 12-year high at 71. For the remainder of the year, the HMI hovered just under that 12-year high. November’s reading of 70 marked a near return to that 12-year high. The hurricane-related drag on sentiment is clearly a distant memory, and The National Association of Home Builders (NAHB) dropped any mention of the hurricanes. Instead, it returned to its boilerplate applause for the strong demand for housing and warning about the headwinds facing builders: “…lot and labor shortages and ongoing building material price increases.”

The single family (SF) detached next six months was the one of the three components of the Housing Market Index (HMI) that actually lost ground; it backed off by a point from a 12-year high. The two point gain for the traffic of prospective buyers was its biggest since March. Despite a small retreat in consumer sentiment, the odds of HMI hitting a new 12+ year high this year still look good. One more month to go…! (Certainly the Spring selling season will deliver higher levels).

Source: NAHB

For May and June, there was an interesting disparity in the regional changes in HMI. In May, the West finally broke out from the flatline of the previous 4 months with an 80 reading. The West plunged in June back to 71 to a near 1-year low and since then has inched its way higher. The West hit 77 for November. The Northeast surged “out of nowhere” to 63 from 49. The previous high for the year was 53 in March. The Northeast HMI was last this high 12 years ago. At 72, the South HMI hit a new high for the year by one point. The Midwest is the regional laggard as it stayed flat with October’s 65 reading and is still 7 points behind its March high.

Parting thoughts

While the stocks of home builders quickly left behind the angst of the Republican tax reform legislation that reduces the tax incentives of home ownership, the NAR remains emphatic in its opposition to the tax bill. During its press conference for October existing home sales, the NAR claimed that the removal of tax incentives for home buying presented a wildcard that threatened an otherwise positive outlook for 2018. In a previous call to action, the NAR called the House’s version of the bill a tax increase for middle-class Americans:

“Make no mistake, middle-class homeowners will see their home values fall if this proposal moves forward, while large corporations walk away with the bulk of the tax cuts.

American homeowners shouldn’t have to pay for corporate tax cuts with their home equity. It’s a matter of basic fairness; 1.3 million Realtors® have known since the beginning, and America’s 75 million homeowners are just beginning to learn, that homeowners will be the ones paying the tab. Realtors® will do our part to spread the word as we work with the Senate to address this impending assault on homeownership.”

With the Senate passing its own version of tax reform in the middle of the night December 2nd, the NAR shut down the call to action and replaced it with a eulogy of sorts called “Realtors®: Senate-Passed Tax Legislation Bad News for Homeowners“:

“The U.S. Senate today passed tax reform legislation that the National Association of Realtors® believes puts home values at risk and dramatically undercuts the incentive to own a home.”

The NAR estimates a 10% drop in home values and even more in high cost areas.

On November 17th, the NAHB had this to say about the Senate tax reform bill:

“Though NAHB believes the Senate tax legislation is better for the housing sector, like the House, it fails to provide a meaningful incentive for homeownership for the middle class.”

The NAHB did find some redeeming qualities in the bill:

“The Senate tax plan would, however, protect important provisions to boost the production of affordable housing, including the Low-Income Housing Tax Credit and the tax-exempt bond program. The Senate plan would also provide sufficient tax reductions for small businesses to enable them to remain major drivers of job growth and maintain a level playing field with large corporations.”

The on-going rally in home builders either reflects the hope that the NAR and NAHB can still convince Congress to stay the knife on housing incentives and/or a belief that the industry’s fears are unwarranted. Presumably, the first real test will come during the 2018 Spring selling season. Until then, I will remain content with my refreshed, albeit small, housing positions. Any new positions will likely be short-term in nature like the hedged trade I implemented on KB Home (KBH).

My first set of call options on KBH were too early, and the position withered away as KBH went into a consolidation period. I sold the position ahead of expiration at a loss. I immediately rolled into a new set of call options. The second time was a charm as I notched a double when my limit order to sell executed on Thursday’s rally extension. The put options still have some small residual value. With a January expiration, I will treat them as an on-going hedge on bad fallout from tax reform. My expectations for the impact of this legislation will continue to evolve in coming weeks and months, but I am heavily biased to believe the industry over the politicians and their economists.

Source: FreeStockCharts.com

(Technicians will note the healthy breakout from a Bollinger-Band (BB) squeeze that formed in the wake of the day of angst).

Be careful out there!… and look out for a very important earnings report from Toll Brothers (TOL) this week.

Full disclosure: long FPH, long KBH puts, long MDC