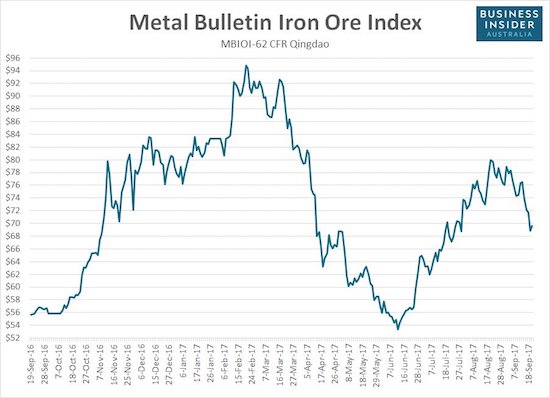

On September 19th, the Reserve Bank of Australia (RBA) released the minutes from its last meeting on monetary policy (September 5, 2017). Iron ore was perhaps the biggest headline coming out of those minutes. Surprisingly, the RBA called a top in the price of iron ore (emphasis mine):

“Iron ore prices had been supported at higher levels because of sustained strong demand for steel in China. However, prices were expected to fall in the period ahead because of the ongoing expansion of global iron ore supply following an extended period of strong investment. Members also noted that Chinese steel production per capita was likely to be close to its peak and that growth in Chinese steel production would not add much to global demand for iron ore in the future. Members observed that, in the longer run, there was potential for India to have a noticeable effect on commodity markets as investment in residential construction and transport infrastructure increased.”

The RBA is not specific about the duration of this topping action, but I have to assume it will be long enough to be significant. At a minimum, the assessment should mean that a recovery from the latest sell-off in iron ore should be faded.

Source: Business Insider

This news catches the two major miners of Australian iron ore at key technical levels. Both Rio Tinto (RIO) and BHP Billiton (BHP) are hovering above uptrending support at their respective 50-day moving averages (DMAs).

Source: FreeStockCharts.com

The numbers on the RIO chart indicate the approximate price of iron ore on that day. I use the notes as a reminder of the very loose correlation between iron ore stocks and the commodity. Yet, the major turning points are close enough for trading purposes. For example, the June bottoms in RIO and BHP roughly correspond to the bottom in June for the price of iron ore. This setup makes RIO and BHP good candidates for a pairs trade.

I like the current setup even better than past pairs trades. If the RBA is correct, iron ore is at risk of revisiting the lows from June. Also, at best, a fresh rally should only carry iron ore back to the high from August. Translating these bounds into short-term stock moves, the upside risk is around 5% and the downside opportunity is about 20%. The long side of the pairs trade is mainly a hedge in case the RBA’s expectations prove incorrect. I am more willing to bias to the downside given the iron ore inventories that have piled up. High inventories have been a story all year but did not prevent the relief rally over the summer. Current inventory levels were last seen over 5 years ago.

With the higher exposure to iron ore, RIO becomes the target for the short side of the pairs trade. BHP is a good candidate for the long side of the trade given it is a bit more diversified, and an activist investor is harassing the company to create more value for shareholders. Sizable dividends cushion both RIO and BHP: 4.6% and 4.1% respectively.

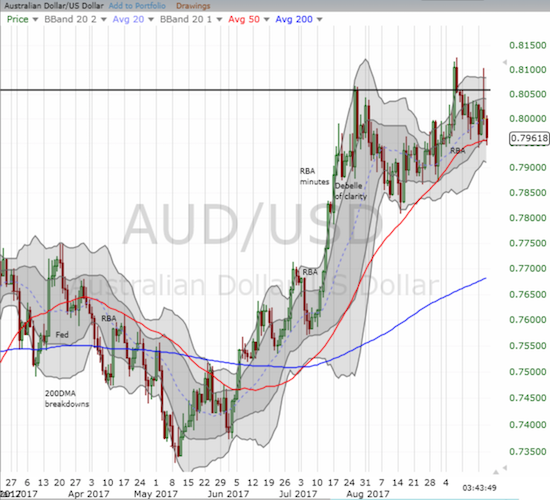

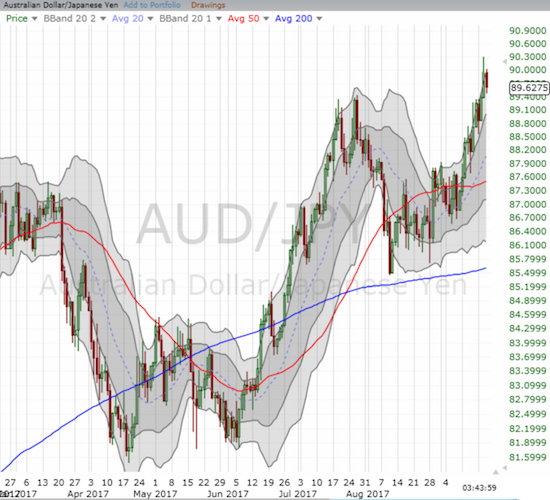

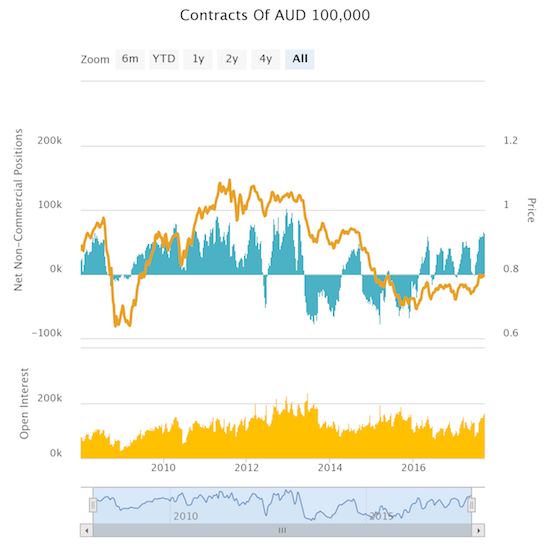

So what about the Australian dollar (FXA)? A peak in iron ore prices should eventually put pressure on the Australian dollar. Yet, AUD/USD surged to a new 28-month high earlier this month in the wake of the RBA’s last policy announcement. AUD/JPY has streaked higher nearly straight up since the end of August. Moreover, currency speculators are holding net long contracts at a level unseen since April, 2013.

Source: FreeStockCharts.com

Source: CFTC’s Commitments of Traders

Under the circumstances, I have an instinct to short the Australian dollar – especially since the RBA continues to try to dissuade the market from marking up the currency. However, Australia’s economic data are quite strong and should remain so for months to come and more. Perhaps at worst, the Australian dollar will embark on a wide trading range that frustrates both bulls and bears. If so, I will prefer to trade from the top of the range.

On a related note, the RBA pointed out that Australia’s adjustment to the boom and downturn in the mining industry is nearing an end. This means that a fresh sell-off in iron prices should not impact the economic strength of Australia enough to catalyze a marked sell-off in the Australian dollar.

“Employment growth had been broadly based across the states, suggesting that the adjustment to the end of the mining investment boom was nearing completion. Solid growth in employment was expected to continue, which would support household incomes and thus spending in the period ahead.”

Be careful out there!

Full disclosure: long and short positions on the Australian dollar

My bias currently is that the reflationary trade has further to go. When I commented the Irma effects likely to be pro- growth, I meant that the growth negative effects would be overshadowed by the positive effects from the fed pulling back on rates.

I haven’t followed iron ore much lately but in think late cycle resource stocks look very attractive here. I would take the other side of the pairs trade and be long RIO as it is higher beta and leverage.

We have unemployment everywhere declining, in the US unemployment will be printing with a 4 soon. Australia and Canada have a horrendous property bubble but they are also running out of spare capacity in employment. I would not be short AUD here as the reflation trade will be AUD bullish. But I would not be long AUD here either as AUD longs are so crowded. Trump will probably install some doves on the fed, and try to generate jobs stimulus

I failed to note that share buybacks are also cushioning these stocks. RIO just added $2.5B to its on-going buyback!

http://www.riotinto.com/media/media-releases-237_23208.aspx

Right on the heels of writing this, the Aussie had one of its weakest days in a while. “Something” may be in the air.

I just saw news of RIO extending its buyback program, so this pairs trade is probably not a great idea at all. In fact, it seems itmay be better to bet AGAINST the RBA for the short-term!

I think out of the anti-dollar trades, yen has not had much of a run, so I like that more than long AUD. Long AUD is just so overcrowded, but the RBA hasn’t caved to a rate hike, so it could be a range as you suggest for a while. Hard to embrace long yen that fully, but it looks the best out of the bunch at the moment- as far as currencies go. I must be getting reflation mania,

I even find silver and gold sort of attractive here also. Hell, I am tempted to just buy all manner of soft and hard commodities here.

I also did my first bitcoin trade today. I bought 2 whole bitcoins for $3650 usd each. Even though I think it is a bubble, my first tendency with bubbles is to buy when I first realise it Is a bubble. It certainly is volatile enough to trade.

I think the Fall is good for commodities? Don’t quote me on that. What a wild twist and turn for AUD over the last 24 hours. Any idea what happened? Good luck on Bitcoin? Looking forward to your tales of battle. 🙂

I’m not aware of any other newsflow other than repositioning post FOMC and Moody’s on China. Basically full range days that reverse each other. This was amplified in AUD due to severe position. The only other newsworthy thing seems to have been S&P downgrading credit rating for China and Hong Kong and as Australia is currently on negative credit watch, that may have also had an effect.

I got in and out of the commodities trade and tried very small trades in Bitcoin. The reason I’ve started trading bitcoin was because my brother, who is a sensible investor told me he bought a bitcoin recently and got into bitcoin mining (!). Surely, I thought, must be a bubble. My first impulse was to look at ways of selling it. But then I remembered how awfully that had gone last time I tried to fight a bubble. So I started buy-side trades. Hopefully I can channel the 1999 internet bubble memory and remember to change that bias before the peak. The internet bubble. Ah, those were the days. I remember trading using a telephone then.

With the reflation trade. I think everything has moved enough currently. The dollar may be headed for a bounce, but it is hard to trade forex at the moment. I think a bit of a sleeper and possibly due for a move is the US long bond. The 30 year rate doesn’t seem justified at this point. I was reading an analysis post FOMC that the market is projecting negative real FOMC rates for the cycle and that does not seem right. This seems excessively negative. The first puke up in rates was based on Trump and that was reversed. However, although there has been a soft patch, nothing has emerged to indicate that the US is moving towards recession, so I think the long US bond is attractive here for a sell. This is a indirect long dollar position. I’ve reconsidered the short AUD thing and just went short AUD. With the current positioning and with a countertrend dollar rally emerging, it is not a bad punt.

Currently short US 30 year, long bitcoin, short AUD.

Well that was a quick flip! 🙂 Thanks for the macro info on AUD.

The yen was excessively weak this week. I am looking for that to reverse in due time as well.

I remember the dot-com days well too. My big lesson was how easy it was to make money and then suddenly it got very easy to lose money. I remember reviewing my account one day in late 1999 and noticing that of 20+ positions just 2 or 3 were accounting for all my profits. The rest of my positions were in the red. I had not noticed the imbalance because I typically just looked at my account total. I was new to investing and trading then, but something about that concentration of profit didn’t seem right. Sure enough, it was a sign of how the market had narrowed into a few winners carrying the indices higher. While I can look back and clearly see the warning signal, at the time I just kept riding that account right into the crash!

— Duru

I remember trading Dotcom stocks on a pay phone between lectures at uni at the time. It was crazy. I had no idea. Really glad I didn’t drop out of my degree to daytrade internet stocks. As probably you and almost everyone else did at the time, was up big then ended up down big by the end (big by what I could afford at the time). Funny thing is that the only thing that seemed to teach me was to avoid markets for a few years and then I got sucked into the resources bubble. It’s only after losing my shirt on forex that I really learned how to trade. ultimately though my best plays have been buying when institutions have been liquidating or identifying 10 baggers on fundamentals (very rare though). I’ve found it much easier to identify fundamental trends in real estate than in liquid financial products. I think the ultimately only real edge I have is taking the other side of institutional liquidation and a minor edge is being involved in markets that institutions are not permitted to enter until they are. But for some reason it is more fun to dabble in the more liquid stuff. Maybe it’s because of the intellectual challenge, or maybe I like wasting time or being break even or losing. That is a real dilemma to me that I spend 90% of the time on the .01% (or even less) of my portfolio that is least profitable (this month contemplating bitcoin).

The concrete stock you mentioned made me think about distressed investing. I think the idea is to short the stock down, buy the upper tiers of the bonds before bankruptcy and the equity out of bankruptcy. I am not sure whether to try it in the next recession or just put my money into a vulture fund instead. I was listening to the YouTube video on George Schultz on distressed vulture investing. He wrote a book about it apparently and runs a fund, which I haven’t looked into.

Interestingly, I can’t find a broker who will allow me to buy on the Athens stock exchange for the Folli Follie stock so I think I will give up on it as it isn’t that compelling anyway.

Interesting news in NZ is a minority government. NZD could dip next week and may be a potential buy.

Very interesting curve steepening and interest rate futures pricing in the U.K, indicating the market is buying into the BOE hiking story. Now 2 hikes are starting to be thought about. Short pound might be a better expression of long USD than short AUD. I might move from AUD short to GBP short. Perhaps some here and some at 1.38. 1.38-1.4 should be a real battleground for GBP.

If you read books on trading/investing, I think you would enjoy “You Can Be A Stock Market Genius” by Goldblatt. It talks about trading some of the special situations you mention here. I have not been disciplined in scanning the market for the setups he talks about. When I *have* stumbled upon them, they have generally worked out well. One potential exception right now is my investment in Cars.com (CAR) which is still struggling to get some upward momentum back.

Considering the increasing odds for rate hikes, I am surprised you want to move so quickly to short GBP. I would think the most effective short might be right before the next policy meeting?

Very true DD, I was initially inclined to wait, but I wonder whether GBP may not get to 1.38. The recent 800 pip straight up move has potential short sellers wary. So paradoxically, it may not have much further to go. Also, I think the MPC would have to walk back expectations well before the next meeting. I have no idea how Carney will pull that off. A 65% chance of 1 rate hike by year end and talk of 2 hikes in the next year is getting a bit rich, so I am inclined to take the other side. It would be 10% of the position with a very wide stop, say 1.42 but it is a small, long term play, targeting 1.2 again on brexit fears in the next 18 months. Euro looks like it is capped around 1.21 in the short term. That appears to be the ECB’s sensitive spot. Also there is a nice synergy between the fed and ecb that may keep euro capped. The ECB seems to cover for the fed to hike and the fed covers for the ecb tapering with the aim it seems to be from allowing the dollar from strengthening much or the euro from moving too high.

After wondering what the point of buying 2 bitcoins was on Friday, I was rewarded with a $400 profit which I took today. Ok, it doesn’t move the needle on portfolio value or yearly results, but it is certainly interesting and a volatile little thing to trade. I’ll put it on my radar to watch for peak pricing at some stage in the next 2 years.

The massive irony, which my wife keeps reminding me about is that she actually did ask me whether we should buy 100 bitcoins when they were $10 each and now that would be about 350k. She tells me there is a lesson in this that I should listen to my wife more in the future.

So it was quite funny when I asked her whether I should buy 2 bitcoins for $3500 each last Friday. That is the great thing about bubbles, they can make us look so silly.

Well that potential long term trade on gbp turned into a quick one. Soon after entering, I found myself up 50 pips so closed.

Moved to long nzd. Close election as expected.

Thinking the whole bitcoin thing through. The real mistake was not buying any at $10 and buying or selling 2 at 3500 is just farting around. I did feel good making $400. But it’s really silly because I missed the big picture 350k that could have been picked up. Was it like Lotto or could the bitcoin bubble have been vaguely foreseen ? Hard to say in retrospect. Hindsight is 20/20.

OK. I am with you on a longer-term short on the pound. Highly unlikely it can sustain a rally under the weight of the coming economic damage from Brexit.

Well congrats on making Bitcoin money! How are the transaction fees for exchanging real money for Bitcoin and back again?

That’s a great story and lesson! I wonder whether even your wife could have held those bitcoins this long given the multiple crashes Bitcoin has already suffered…?