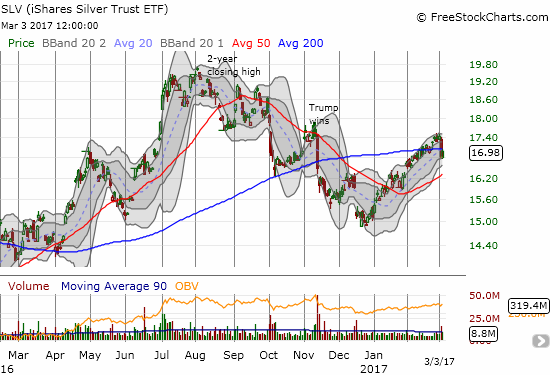

The iShares Silver Trust (SLV) made a major peak last summer when it hit a 2-year high. The rally year-to-date seemed to come to an abrupt end when SLV plunged through support at its 200-day moving average (DMA) and its 20DMA uptrend.

Source: FreeStockCharts.com

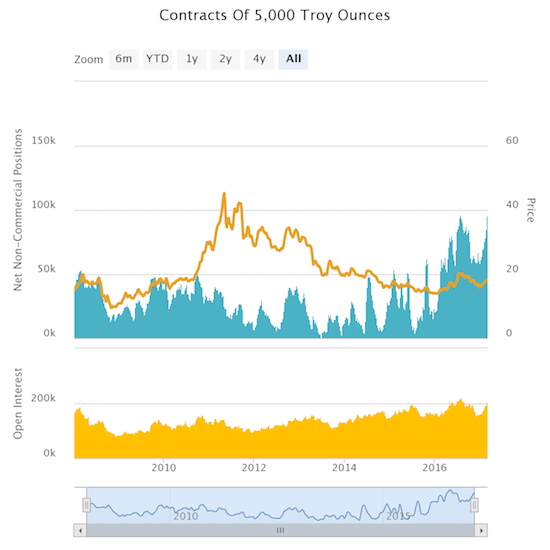

However, don’t tell speculators any sad tales about silver. Speculators increased net longs on silver throughout 2017. The latest data show extreme bullishness with net long 95,423 contracts. This level is just short of last summer’s historic high (since at least 2008) of 96,077. At that time, silver hit a 2-year high and a major peak.

Source: Oanda’s CFTC’s Commitments of Traders

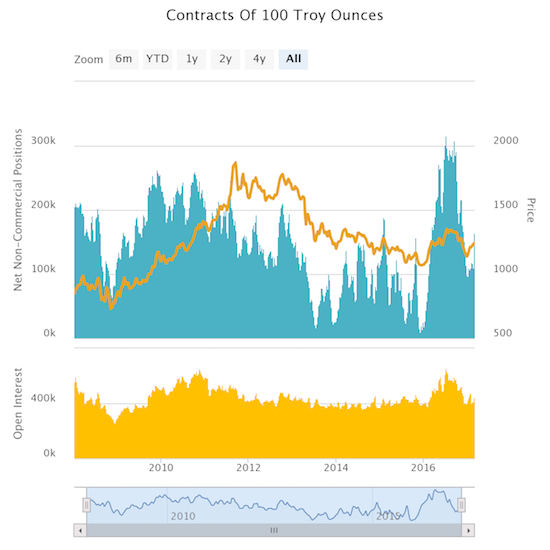

Contrast this bullishness with the behavior of speculators in gold futures contracts. In 2017, speculators in gold were relatively non-committal even as gold rallied. The spike in the last week was a 3-month high but still nowhere near last summer’s levels.

I cannot explain the large contrast in sentiment between silver and gold. Yet, this contrast could help explain why or how SLV’s sell-off was one-day delayed from GLD’s. GLD’s fall made sense because the odds of an interest rate hike in March soared that day from 35.4% to 66.4%. SLV actually GAINED that day.

I will be at the edge of my seat waiting for the next CFTC report. Did gold and silver bulls rush into more long contracts in anticipation of a reticent Fed on the issue of a March rate hike? If so, the net longs should promptly decrease. Are gold and silver bulls betting (again) that the Fed’s hawkish stance will trigger the next economic calamity that then forces rate back down? If so, then perhaps net long contracts will remain elevated or even increase further. In THIS case, I will be very inclined to trade around my core SLV position by buying call options on SLV and/or put options on ProShares UltraShort Silver (ZSL). I have already added to my call options on GLD as part of a “phase two” on my gold versus bonds hedge.

Stay tuned…

Be careful out there!

Full disclosure: long GLD shares and call options, long SLV