“Most participants judged that if incoming data were consistent with economic growth picking up in the second quarter, labor market conditions continuing to strengthen, and inflation making progress toward the Committee’s 2 percent objective, then it likely would be appropriate for the Committee to increase the target range for the federal funds rate in June…Some participants were concerned that market participants may not have properly assessed the likelihood of an increase in the target range at the June meeting, and they emphasized the importance of communicating clearly over the intermeeting period how the Committee intends to respond to economic and financial developments…

It was noted that communications could help the public understand how the Committee might respond to incoming data and developments over the upcoming intermeeting period. Some members expressed concern that the likelihood implied by market pricing that the Committee would increase the target range for the federal funds rate at the June meeting might be unduly low.” – Minutes of the Federal Reserve Meeting April 26-27, 2016, released May 18, 2016.

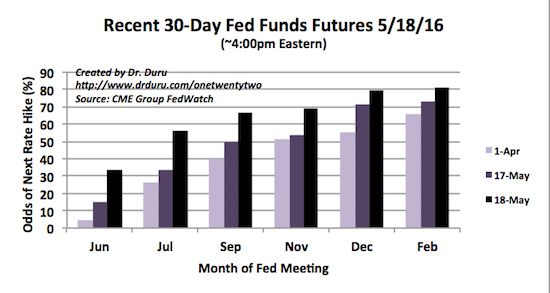

The timing could not have been better. Right on the heels of Fedspeak insisting that financial markets are under-appreciating the odds of a rate hike in June, minutes from the last meeting of the Federal Reserve underlined the Fed’s general commitment to pushing multiple rate hikes through the turnstyle this year. The discussion was convincing enough to rush market expectations for the next rate hike from November of this year to July. The odds for a December hike are high enough to suggest the market even expects two rate hikes this year. The odds for a June rate hike soared from 15% to 34%.

Source: CME Group FedWatch

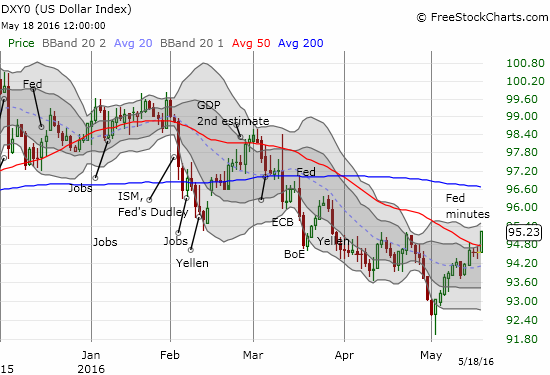

As I mentioned in my last post on this topic – A Reluctant Market Nudges the Expected Timing for Fed Rate Hikes – the market’s slow appreciation of the Fed’s seriousness presented an opportunity to get long the U.S. dollar, short emerging markets, and short commodities. I missed one other opportunity: get long financials. I honestly forgot about the Fed minutes as the next catalyst. Still, I think the market is only going to adjust reluctantly to the changing reality surrounding the prospects for rate hikes. (Since I follow what the Fed Fund futures do, I was also reluctant to believe!) The futures can move a lot faster than portfolio managers with positions spread across some poor plays for a rate-hiking cycle.

The U.S. dollar index (DXY0) convincingly broke through resistance at its 50-day moving average. This confirms the dollar has indeed bottomed for now.

Source: FreeStockCharts.com

I will say it again, as I feel I cannot emphasize it enough… traders are generally leaning the wrong way. The unwind I claimed was coming in various currencies has begun. I cannot estimate how strong it will get, but I have duly noted the huge amount of confidence speculators have expressed in existing/previous currency trends.

Oil is in an interesting spot for commodities. On the one hand, fundamentals have apparently turned the corner to support higher prices (production cuts, turmoil with suppliers, etc…). On the other hand, a strengthening U.S. dollar will work against further price appreciation. It just so happens that United States Oil (USO) is testing critical resistance at its downtrending 200DMA. I am gratified that my call for a more sustainable bottom in USO proved true these past several months, but I am lamenting the potential (temporary?) rollback on my long-term, mixed options position.

Source: FreeStockCharts.com

I closed out my latest short on commodity giant BHP Billiton Limited (BHP) and plan more aggressive fades of rallies in the stock. BHP broke down below 50DMA support again but is not yet at a new low for the month.

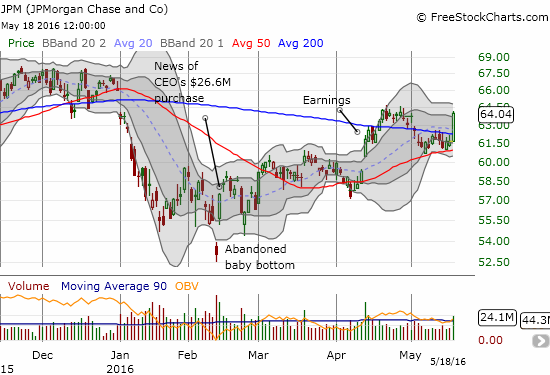

While I have turned bearish on the stock market, one of the last long positions I recommended did astoundingly well today: JP Morgan Chase (JPM). The presumed explanation is that higher rates help banks achieve better returns on capital. Even so, I was taken aback by JPM’s 3.9% surge on the day. Traders are moving quickly to reposition in financials!

Source: FreeStockCharts.com

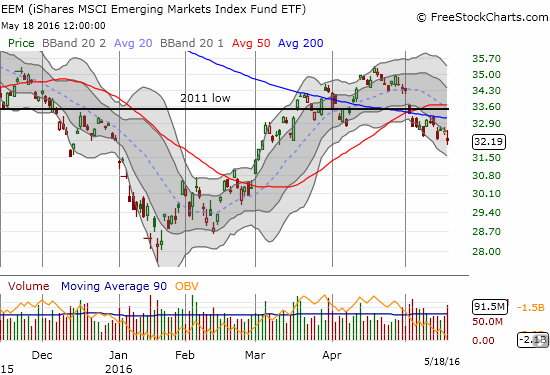

Shares MSCI Emerging Markets (EEM) continues its breakdown.

So what is all the fuss about anyway? As it turns out, the minutes are VERY clear in the reinforcement of this week’s Fedspeak on rate hikes. Starting with my lead-in quote, I think it is fair to assume that the Fed will be on a mission to get the market as comfortable as possible with imminent rate hikes. Here are some other quotes that particularly interest me…

The Fed did NOT intend for financial markets to walk away from the MARCH meeting even MORE dovish than before on the prospect of rate hikes. In other words, expect Fedspeak to get more clear on the real prospect for imminent rate hikes.

“Federal Reserve communications following the March FOMC meeting were interpreted by market participants as more accommodative than expected. In particular, investors were attentive to the larger-than-expected downward revisions to the projections of the federal funds rate in the FOMC’s Summary of Economic Projections as well as to references in the March FOMC statement and the Chair’s prepared remarks at the press conference to risks to the U.S. economic outlook stemming from global economic and financial developments. Meanwhile, domestic data releases were mixed and elicited only modest market reactions. On net, financial market quotes implied that the federal funds rate path expected by investors flattened notably, and that their estimated probability of a rate hike by the June FOMC meeting declined significantly. In the Survey of Market Participants, the median investor’s modal path for the federal funds rate also moved down substantially, while in the Survey of Primary Dealers, the median dealer’s modal path was little changed.”

Having said that, I am surprised that there is any bias for rate hikes given on-going risks that data will move away from the Fed’s targets.

“Consistent with the downside risk to aggregate demand, the staff viewed the risks to its outlook for the unemployment rate as skewed to the upside. The risks to the projection for inflation were still judged as weighted to the downside, reflecting the possibility that longer-term inflation expectations may have edged down…

Several FOMC participants judged that the risks to the economic outlook were now roughly balanced. However, many others indicated that they continued to see downside risks to the outlook either because of concerns that the recent slowdown in domestic spending might persist or because of remaining concerns about the global economic and financial outlook. Some participants noted that global financial markets could be sensitive to the upcoming British referendum on membership in the European Union or to unanticipated developments associated with China’s management of its exchange rate.”

Might the Fed even push through a rate hike in June to get ahead of potential turbulence from the Brexit vote? Fallout from the vote could make it impossible for the Fed to even talk rate hikes…much like the experience last year with Chinese economic policies causing global financial turmoil.

Overall, the Fed had a lively debate about the economic justification for rate hikes:

“Despite the recent rise in core inflation, some participants continued to see progress toward the Committee’s 2 percent inflation objective as likely to be gradual…Several commented that the stronger labor market still appeared to be exerting little upward pressure on wage or price inflation. Moreover, several continued to see important downside risks to inflation in light of the still-low readings on market-based measures of inflation compensation and the slippage in the past couple of years in some survey measures of expected longer-run inflation. However, for many other participants, the recent developments provided greater confidence that inflation would rise to 2 percent over the medium term. Some viewed the recent firming in core inflation as broadly based and unlikely to unwind, with several noting recent increases in alternative measures of the trend in inflation, such as the trimmed mean PCE and the median CPI, or citing evidence that wage growth was picking up. In addition to the ongoing tightening of resource utilization, the recent depreciation of the dollar and the firming in oil prices suggested that the downward pressures on both core and headline inflation from declining prices of non-oil imports and energy should begin to subside.”

Members of the Fed are definitely itching to get on with rate hikes…

“Some participants saw limited costs to maintaining a patient posture at this meeting but noted the risks–including potential risks to financial stability–of waiting too long to resume the process of removing policy accommodation, especially given the lags with which monetary policy affects the economy. A couple of participants were concerned that further postponement of action to raise the federal funds rate might confuse the public about the economic considerations that influence the Committee’s policy decisions and potentially erode the Committee’s credibility.”

The itching is SO great that a few Fed members wanted to get moving in April…

“A few participants judged it appropriate to increase the target range for the federal funds rate at this meeting, citing their assessments that downside risks associated with global economic and financial developments had diminished substantially since early this year, that labor market conditions were consistent with the Committee’s maximum-employment objective, and that inflation was likely to rise this year toward the Committee’s 2 percent objective. Two participants noted that several standard policy benchmarks, such as a number of interest rate rules and some measures of the equilibrium real interest rate, continued to imply values for the federal funds rate well above the current target range. Such large and persistent deviations of the federal funds rate from these benchmarks, in their view, posed a risk that the removal of policy accommodation was proceeding too slowly…”

So the pendulum has swung back toward imminent movement on rate hikes. The path higher for rate-friendly trades will not be a straight line, especially since economic data will likely continue to send mixed messages. Regardless, I am now on-board with biasing my trading as if rate hikes are on their way this summer.

Full disclosure: net long the U.S. dollar, long JPM call options, long EEM call and put options