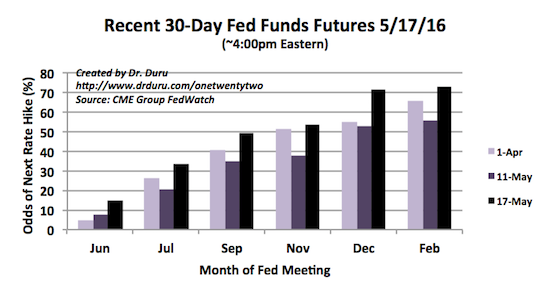

The message is clear: the U.S. Federal Reserve WANTS to hike rates a few more times this year. Various Fed officials started this week with speeches and interviews discussing their desire to hike rates again as early as June and for a total of two or three hikes in 2016.

The response is also clear: financial markets remain very skeptical that the Fed can or will get away with more than one rate hike this year. The odds for a hike in June remain a paltry 15%. The odds for the next rate hike are set to November, exactly the expectation on April 1st after the jobs report for March.

Source: CME Group FedWatch

(I periodically collect CME’s data and report it from my own spreadsheet given inaccuracies in the way CME reports “previous day” and “previous month” odds.)

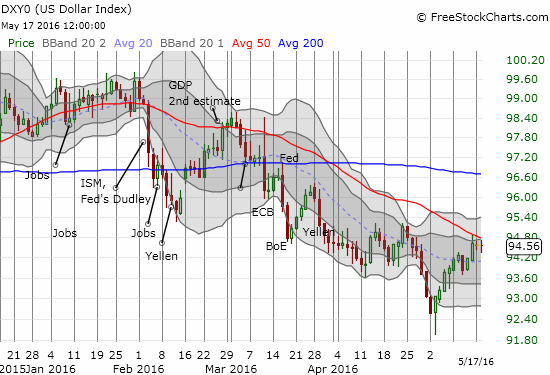

The Fed’s pronouncements could not even nudge the U.S. dollar index (DXY0) over resistance at its downtrending 50-day moving average (DMA).

Source: FreeStockCharts.com

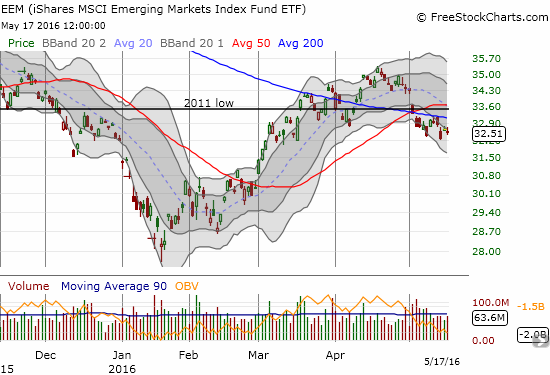

Assuming the Fed is trying to prime the market, I fully expect the rate hike rhetoric to heat up in coming weeks leading into the June meeting. The Fed may want to hike rates, but I still believe in the simple calculus: the Fed tries to nudge the market where it wants to go and then moves rates according to market expectations. The current divergence between market expectations and Fed desires likely sets up a window of opportunity from here until at least the June meeting for going long the dollar and even shorting commodities and emerging markets.

Here are the key quotes from a Reuters article describing the Fedspeak from today:

“Dallas Fed President Robert Kaplan told reporters in Texas that he will advocate for an interest-rate hike at the Fed’s upcoming policy meetings. ‘Whether that’s June or July, I can’t say right now,’ Kaplan said.”

This next quote reminds me of the infamous 2014 warning from Bank of England Governor Mark Carney about the market’s mispricing of the timing for the launch of rate hikes in the UK. We are still waiting for that first hike.

“Atlanta Fed President Dennis Lockhart said at an event in Washington that he still assumes there will be two to three rate hikes between now and December, and that markets are more pessimistic on the U.S. economic outlook than he is.”

“San Francisco Fed President John Williams, in a joint appearance with Lockhart in Washington, echoed the optimistic view of the economy. Two to three interest rate hikes this year ‘seems reasonable,’ he said”

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long EEM put and call options, net long the U.S. dollar