At the 9th Annual J.P. Morgan Homebuilding & Building Products Conference on May 17, 2016, Meritage Homes (MTH) released good news on guidance for the second quarter and fiscal year 2016 (link updated 8/23). MTH expects notable year-over-year gains for FY2016 across all its top metrics except home closing gross margins:

- Home orders: +4-6%

- Home closings: +10-17%

- Home closing revenue: +16-24%

- Home closing gross margin: -50-100 bps

- Diluted EPS: +15-25%

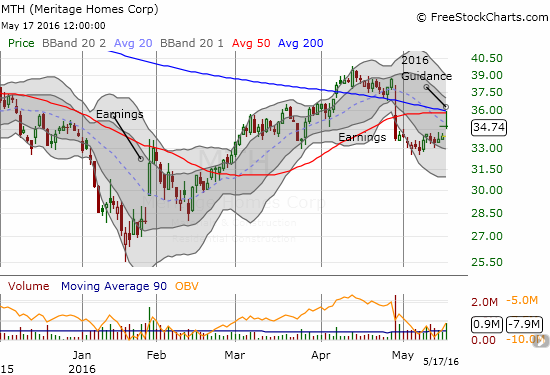

The market initially reacted well with the stock gaining as much as 5.8% in a move that finally started to reverse some MTH’s post-earnings loss. The high of the day happened to occur right at converged resistance from the 50 and 200-day moving averages. The sellers took over from there and drove the stock back to a 2.4% closing gain.

Source: FreeStockCharts.com

In some ways, this guidance is “too late.” The seasonal trade on homebuilders ended with the onset of Spring selling season, so traders and investors will be less inclined to buy homebuilder stocks. The guidance is also late in the sense that talk about Fed rate hikes is likely to speak louder than MTH expectations. That Fedspeak took on a new volume this week. Finally, the guidance came late in that analysts pressed management less than three weeks ago for guidance that was not forthcoming. The lack of visibility surely motivated some investors to sell until further notice.

During the Q&A portion of the last earnings conference call, Chairman & Chief Executive Officer Steven J. Hilton appeared to get irritated with the constant probing. He even became a bit defiant or defensive. The quotes are from the Seeking Alpha transcript of the conference call).

First this…

“It’s too early, I think, for us to commit to a very specific pinpoint number. It’s certainly possible, I think, for us to match the gross margin that we had last year…But I don’t want to commit whether it’s going to be 19% or 19.2% or 18.8% or specifically what it is, but it’s very, very possible that they could match up to last year, so.”

Next this…

“Number one, we’re not starting off in a hole. I’d take offense to that. I think we had a really good quarter from EPS, we had a really good quarter back on conversion revenues. We knew our margins were going to be down in the first quarter from a year ago. Obviously, margins were declining all last year. You can expect that they were going to be equal to or better than and I’m not giving margin guidance. So it’s not a repeat of last year where we gave guidance several times and we didn’t hit it. I’m not giving guidance, you guys want to pin me into a corner and try to nail down a number, but we’re not. Certainly, we couldn’t match up the last year. We could be a little bit below, we could be a little bit above. I’m just telling you to be patient and wait another quarter.”

And then this…

“Well, it still can be flat. I’m not saying that they won’t be flat. I just learned a lesson last year, I’m not going to stick my neck out in this market and give guidance on that.”

In the middle, an analyst explained the concern on margin guidance: “…I think people were kind of looking for some reassurance, but you guys don’t seem to want to submit. I think the reason was probably because of last year you guys – or last quarter it seemed like you made a comment that this year you thought that margins will be flat…” Hilton cut him off shortly after that.

Hilton even refused to give guidance on orders although he provided guidance on closings. The presentation at the J.P. Morgan Homebuilding & Building Products Conference did not indicate why the company suddenly felt comfortable providing guidance when management had gone to pains to wave analysts off until the next earnings report.

There were three items that generated the most focus from analysts, some of which certainly contributed to the stock’s whopping 12.6% post-earnings loss:

- The intentional slowdown in sales pace in Northern California and in Colorado (right in the middle of the Spring selling season).

- Potentially lower margins for the year, including higher labor costs.

- The long-awaited offering of the new “entry level plus” home targeted at the mid-30s first-time home buyer looking for something a little better than a stripped down entry-level home.

On the slowed pace, Hilton tried to reassure analysts that the strategy was a very purposeful response to a shortage of labor. He thinks the company is postponing sales, not losing them altogether (approximately 100 homes). Demand was strong enough for MTH to raise prices a bit on the homes that were sold. Still, supply constraints are never a good thing in the middle of the strongest selling season of the year. In this market environment, investors are rarely forgiving to home builders who suffer supply issues.

Hilton expressed some exasperation with the stream of questions on the slowed sales space: “So I think there’s been a lot of questions about it and I think it’s starting to get a little bit overplayed.”

No analyst expressed direct concerns with the entry-level plus homes, but I imagine they are a bit wary on the true demand for this product when entry-level buyers have consistently under-performed (and have been under-served by builders). MTH will have to show and prove on this new product this year.

While I sold out of my MTH position as part of my phased close-out of seasonal homebuilder trades, I was still tempted to buy back into MTH in the post-earnings selling. My on-going, over-arching strategy with homebuilders has committed me to buying the dips. MTH’s persistently low valuation makes it a very attractive buy on the dips. MTH has a trailing P/E of 10.9. Forward P/E for fiscal year 2016

is 9.0 to 9.8 based on the company’s guidance. Price to sales is a paltry 0.5. Most importantly, price to book sits at 1.1, the magic valuation number for homebuilders. Still, I am sitting pat and remaining patient. Patience has delivered consistent reward in timing entries on homebuilder stocks. Meritage’s late offering of guidance has started the process that will bring the next buying opportunity. At this point of the trading cycle, the news for MTH is not likely going to get much better.

Be careful out there!

Full disclosure: no position