In the previous week, forex traders extended existing positioning trends. This consistency reveals an on-going confidence in the given trends. Where these changes are consistent with currency moves, traders seem indeed justified in the confidence. However, there are some cases where these positions are starting to run counter to potential shifts in currencies. I expect divergences to get resolved with big moves in coming days.

The following data cover the latest from the CFTC’s Commitment of Traders as reported by Oanda from the week of Monday, April 18, 2016. From Oanada:

“The Commitments of Traders (COT) is a report issued by the Commodity Futures Trading Commission (CFTC). It aggregates the holdings of participants in the U.S. futures markets (primarily based in Chicago and New York), where commodities, metals, and currencies are bought and sold. The COT is released every Friday at 3:30 Eastern Time, and reflects the commitments of traders for the prior Tuesday.”

In this edition of “Forex Critical”, I focus on notable changes in the currency positioning of non-commercial traders, also known as speculators. While speculators do not necessarily drive market action, they can provide good proxies for the market sentiment that DOES drive currency moves. Wherever meaningful, my snapshots of currency charts show U.S. dollar currency pairs to provide a common point of reference and a direct comparable to the charts provided by Oanda (the yellow line in the positioning charts). These charts come from FreeStockCharts.com. I provide Oanda’s embeded tool at the end of this post for your convenience.

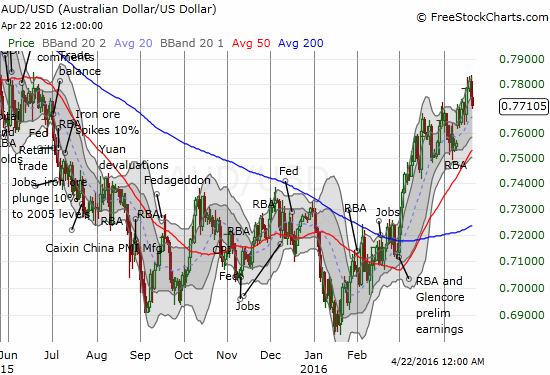

Australian dollar (FXA)

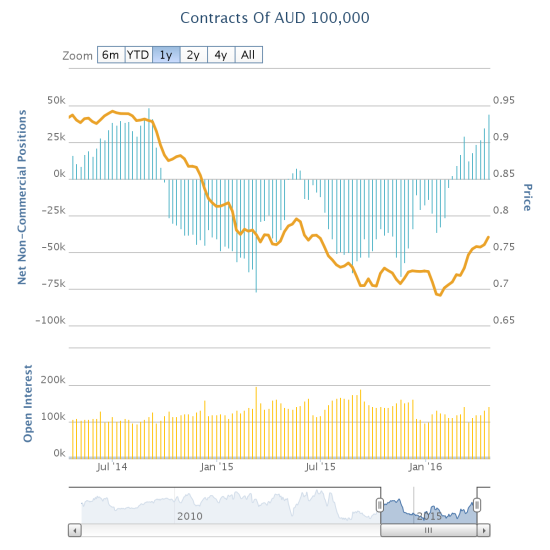

Traders are racing to get long the Australian dollar. Net positions have not grown to the current size since the week of September 1, 2014.

I do not think the Australian dollar can maintain this blistering pace. However, as long as the U.S. Federal Reserve appears to get softer and softer on “rate normalization,” the more AUD/USD can continue running. I imagine the rampant, credit-fueled speculation occurring in Chinese commodities markets is also boosting the attractiveness of the Australian dollar. If the Shanghai Composite Index is any lesson, we all know how badly this story will end.

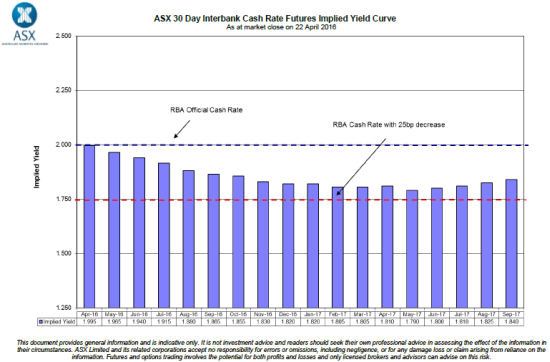

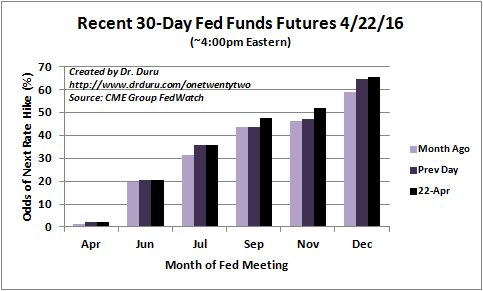

Moreover, there is still an expected, albeit slight, rate divergence between the Reserve Bank of Australia (RBA) and the Fed. Futures markets are pricing in roughly one more rate cut from the RBA early next year whereas Fed Fund Futures are pricing in another rate hike from the Fed in November of this year (that tipping point was December just the previous day).

Source: The ASX RBA Rate Indicator

Source: CME Group FedWatch

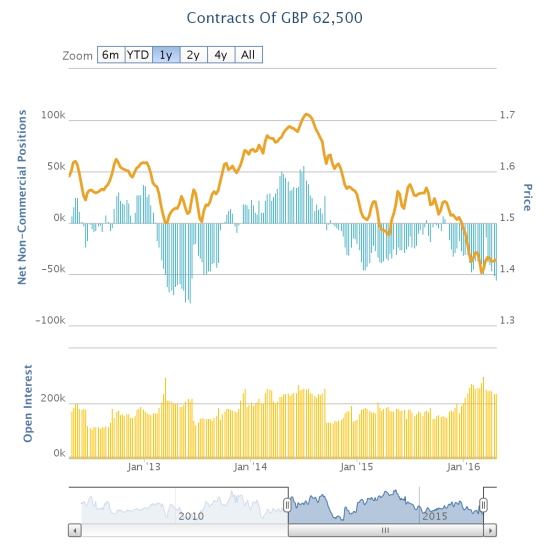

British pound (FXB)

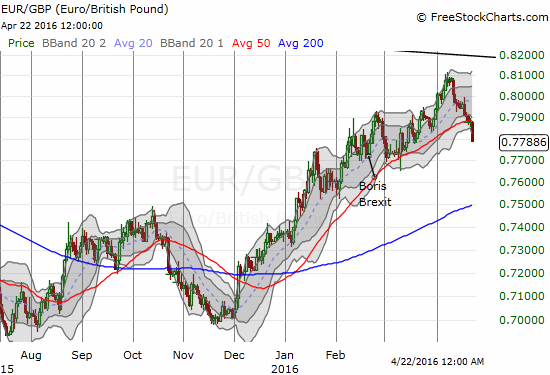

We have to go back almost 3 years to find a time when the market was THIS bearish against the British pound. Bulging net short positions are now bumping up against a potential turn in sentiment and direction. According to Hard Currency, a podcast produced by the Financial Times, this past week was a good one for the “stay” side of the Brexit referendum. Apparently, the United Kingdom’s treasurer came out with a distinct argument against leaving the European Union (EU). The “Leaves” have yet to generate a strong response. In the meantime, the British pound has produced a sharp turn in momentum.

GBP/USD is still bouncing within a range from around 1.40 to 1.45, a pivot around its 50DMA. The change in momentum can be most clearly seen against the euro (FXE). EUR/GBP, shown above, distinctly broke through support at its 50-day moving average (DMA) for the first time since early December. This move ended a dramatic run-up.

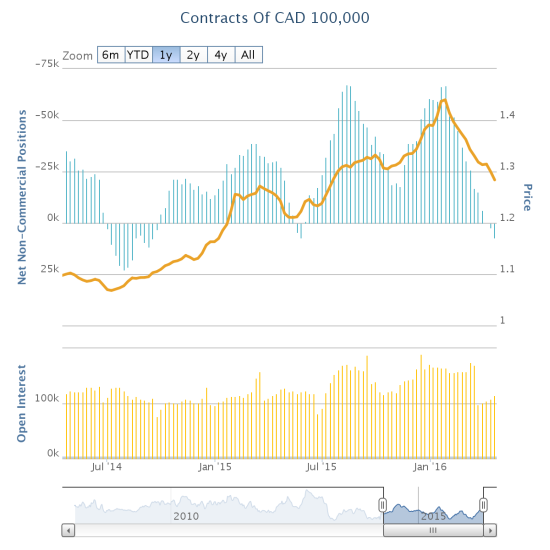

Canadian dollar (FXC)

Open positions speculating on the Canadian dollar are still well off recent highs. Yet, net positions made incremental progress in getting more bullish. Speculators were last this bullish back in May, 2015. As I noted in my last post on the Canadian dollar, USD/CAD now looks like a burst bubble! The downward slope in positioning has been more dramatic than the last one and has had even greater apparent impact.

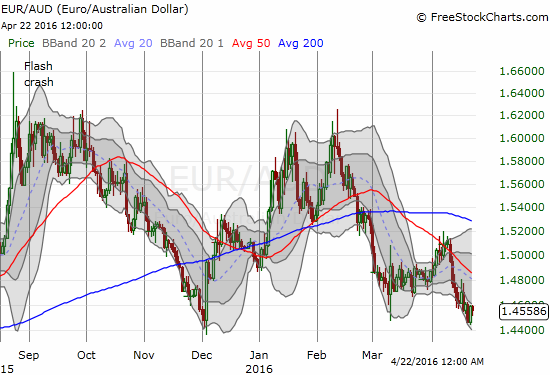

Euro (FXE)

Traders continued to back off net short positions against the euro going into the latest meeting of the European Central Bank (ECB). Now that the euro seems to have finally blown off in the wake of the ECB, I think the tide will soon turn toward bearishness again.

The euro is a bit of an enigma for me. The currency SHOULD be a lot lower given the wide gulf in policies and prospects with the U.S. It should also be a lot lower from being sold to fund risk-on, or carry, trades that typically come into vogue when commodity prices are rallying. Or maybe I am looking at the wrong currency pairs or wrong timeframes? From Bloomberg (April 22, 2016)…

“Carry trade returns reached the highest levels this week since Dec. 7, according the Deutsche Bank G10 FX Carry Basket Index. Since April 1, 29 of the 31 major currency carry trades funded in euros have made money, the most since October, according to data compiled by Bloomberg.”

Note that against the Australian dollar, the euro is only challenging lows from last year.

Otherwise, I can only attribute the on-going resilience in the euro to stubborn traders who are trying to think several steps ahead of the ECB and (over) anticipate the end of accommodative policies. This positioning in turn forces the ECB to continue easing or maintain a threat of easing.

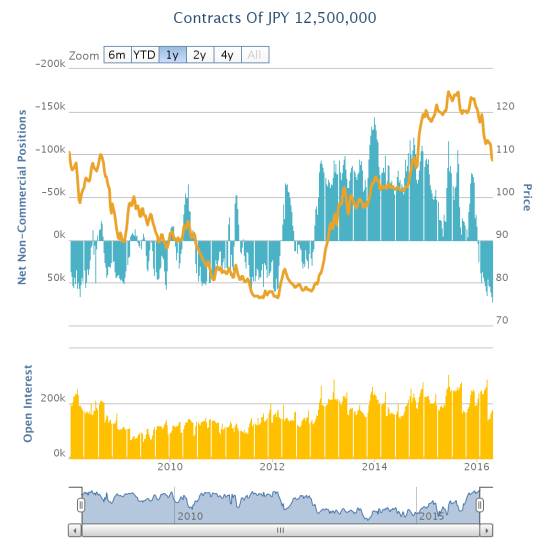

Japanese yen (FXY)

I have to show ALL available data when it comes to the Japanese yen because speculators are now at “maximum” bullishness. The sentiment change this year has been quite remarkable paritcularly since yen bullishness usually erupts during times of trouble. Sure the market swooned for the first six weeks of the year, but the rally since those lows has only accompanied even more desire to own yen. Perhaps no forex trader expresses more confidence right now than the yen bulls.

The dramatic weakening in the yen on Friday was at least in partial response to a series of financial reports released by the Bank of Japan (BoJ). One of these reports, the Financial System Report (April 2016), includes language that both speaks to the difficulties imposed by negative interest rates and attributes the yen’s current appreciation to “heightened volatility in global financial markets” (emphasis mine)…

“…a broad range of entities in financial markets have postponed their transactions as they have been in the midst of reviewing their investment strategies and operational arrangements, including their IT systems. Investors and firms have avoided transactions with a negative interest rate. As a result, signs of a holdup in the flow of funds have been observed, for example, a large sum of funds have remained within trust banks and major banks. Meanwhile, the heightened volatility in global financial markets after the beginning of 2016 has led to a decline in stock prices, yen appreciation, and an increase in foreign currency funding costs. It has also worked to restrain risk taking among financial institutions and other entities to some extent. The policy effects are expected to propagate further as these issues are resolved…

The shrinking population and customer base — in addition to the low interest rate environment — is exacerbating the problem of low profitability of regional banking especially.”

The BoJ just cannot win with negative rates it seems. Clearly, negative interest rates are not yet working as hoped in Japan. The run-up in the currency since implementation of the negative rates has acted as a double-whammy. The currency appreciation hurts Japan’s export-dependent economy and reduces the odds Japan will obtain its lofty inflation goals on schedule.

Interestingly, one of many of the BoJ’s talking points on solutions is to cooperate more with central banks. That sounds like the underpinnings for “currency cooperation”…

“As part of its effort to respond to financial globalization, the Bank will increase its coordination with overseas central banks and other organizations, while deepening its understanding of developments in the overseas financial system and financial markets.”

The Wall Street Journal’s Asia Today discusses the prospects for the BoJ taking more action against the Japanese yen…

I personally did not note a smoking gun to directly explain Friday’s notable weakness, but it is possible traders are finally anticipating action by the BoJ in the coming week. The Bank of Japan has its next rate policy meeting coming up April 27 to 28th. Mercifully for the BoJ, this meeting will come AFTER the U.S. Federal Reserve issues its statement on April 27th. So if Janet Yellen and company move to soften up the U.S. dollar yet again, the BoJ will know better just how much “scare” they need to put into the market to soften up the yen…that is, assuming the BoJ is indeed starting to worry about the unwanted strength in the currency.

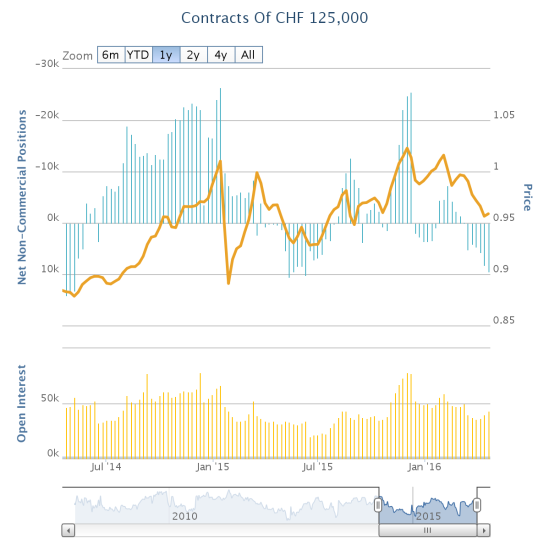

Swiss franc (FXF)

The Swiss franc has experienced another bout of major weakness. In the previous week, traders incrementally added to net long positions. Given the bounce from 200DMA support for EUR/CHF, this franc weakness could extend beyond the top of the previous EUR/CHF run-up. Trader confidence could quickly wilt, especially if the British pound continues to strengthen on lowered Brexit fears.

So, across the board, speculators in major currencies are amplifying weeks-long, sometimes months-long, trends in bearishness or bullishness. There is even little to no vacillation in these trends. Some of this confidence is surely primed for testing…

Be careful out there!

Full disclosure: long and short various forex positions related to the currencies discussed above. I am solidly short the euro and the Australian dollar and long the U.S. dollar. Also long FXC.

Foreign Exchange Trading Market is the mondial business market where international currencies are freely exchanged and traded. Traders engage to buy a certain quantity of one currency with a certain quantity of another currency. Today, Foreign Exchange Market Trading is done directly by traders. Forex trading market can be considered as a single market. It is the world’s largest financial market. Tons of dollars are traded everyday in this business market. Everyone is invited. It is in reality international market. It is a varied market with forex centres spread over all around the world. Forex unlike major stock exchanges works 24 hours a day but relaxes on the weekends. It is absolutely based on the info tech platform. The forex market is a great opportinuty for you. Are you ready?