(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 20.1% (Oversold day #3)

VIX Status: 22.0

General (Short-term) Trading Call: Keep closing bearish positions. Do not add to bullish positions unless you are overweight bearish (click here for a trading summary posted on twitter)

Reference Charts (click for view of last 6 months from Stockcharts.com):

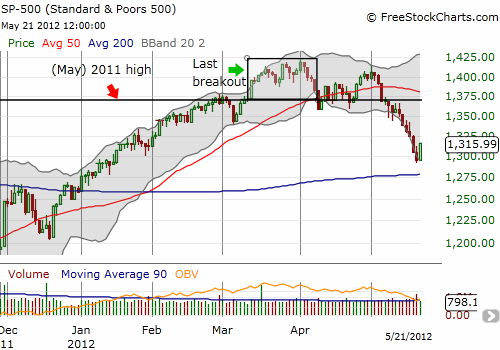

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar)

Commentary

My youngest brother asked me why the market rallied today. I simply said “it was oversold.”

Give me a fundamental reason to explain today’s 1.6% bounce in the S&P 500, and I will call your bluff and raise you two hundred. Not one thing changed over the weekend, but the selling that led to today apparently emptied the coliseum of sellers. Today was an old-fashioned, classic oversold bounce. It served as a great example of why I prefer to stick with the odds and stick with the rules: when the market gets oversold, start closing out the bearish trades, start building the bullish trades. HOWEVER, the slide leading to today’s oversold rally was steep, slippery, and showed an amazing inability to hold support. This means that there is no reason yet for bulls to get excited. Indeed, the 200DMA still looks like it is waiting for a retest.

T2108 also managed to stay oversold by landing directly on the 20% threshold; I could not even round the number up and over the boundary. I found myself this morning with a much smaller than desired bullish trading position. I went ahead and sold my SSO calls into the close rather than holding them overnight (they expire Friday). Next round, I am going to focus more on SSO shares so that I can exercise more patience if needed. I sold my JPMorgan Chase (JPM) puts early in the trading day and looked smart for all of 30 minutes. JPM’s ability to lose another 3% on a rally day is certainly cause for continued concern. I wanted to buy some VXX calls to hold as a hedge (I sold my last ones on Friday); the VIX remains above the critical tripwire at 21. I did not get any by the close, and I will be looking for another opportunity soon after Tuesday’s open. VXX experienced a tremendous 11% loss today.

Last Thursday, I created some scenarios for Friday’s trading. I assumed that market makers sold a lot of puts coming due on Friday and were exaggerating the selling by their hedging activities. I figured this would lead a climactic gap down on Friday to wash out final sellers and facilitate repurchasing (short-covering) stock. Instead, the market headfaked to the upside before selling off for the rest of the day. In other words, the selling pressure worked exactly opposite of my expectations.

So, I was extremely intrigued to read Schaeffer Investment’s Monday Morning outlook titled “Did Delta Hedging Cause the Market’s Latest Swoon?“. While author Todd Salamone does not provide conclusive proof (I do not think it is possible to do so!), his explanation of market-maker driven selling made a lot of sense to me. Here is the critical passage from his piece:

“…was last week’s price action driven in part by a delta-hedging decline related to the huge build-up of put open interest on major equity indexes and exchange-traded funds (ETFs)? As popular put strikes were violated one after another during expiration week, sellers of the puts may have been forced to short futures to keep a neutral position, creating a steady but sure stream of selling. The heavy put open interest strikes essentially act like “magnets,” as one strike after another is taken out. Delta-hedging risk certainly grows during expiration week if the market gets off to a weak start, as it did last Monday, and there is heavy put open interest just below current prices…If indeed the puts acted as magnets after the key 140 area was breached earlier in the week, it would explain the steady bleed down to the 130 strike.

If last week’s sell-off can be partly attributed to delta hedging — which is a high probability — the market could right itself fairly quickly, as the short trades put on during expiration last week are covered, and mean reversion sets in after heavy selling in 11 of the past 13 days.”

And, yes, delta hedging is exactly the kind of trading that got JPM in such deep trouble. Clearly, on a broad and comprehensive scale, these activities can serve as negative feedback loops. Whenever this oversold period ends, we should not be surprised to find ourselves riding swiftly upward toward resistance around 1368 or so on the S&P 500.

Delta hedging could even explain Apple’s (AAPL) sickening slide and then its incredible one-day rebound today.

(Note – as of May 11, 2012, some glitch in FreeStockCharts.com is screwing up the overlay of the S&P 500 with T2108).

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SDS