(This is an excerpt from an article I originally published on Seeking Alpha on May 20, 2012. Click here to read the entire piece.)

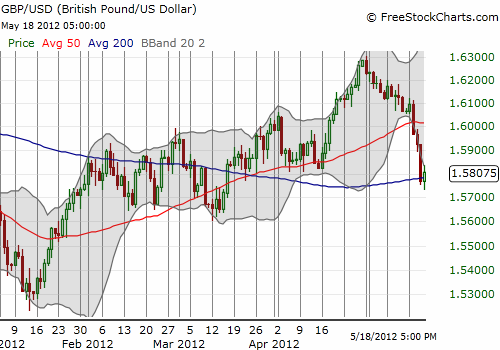

I have written about my skepticism regarding the British pound’s newly found “safe haven” status (for example, see “Hard Currency: My Reactions To The Financial Times’ Promising Podcast“). During my last post, I forgot to point out that the British pound has declined versus the U.S. dollar (FXB) for the entire month of May while the euro crisis has heated up. This decline has currently taken a pause right at the support of the 20-day moving average (DMA), but I doubt this reprieve will last long.

{snip}

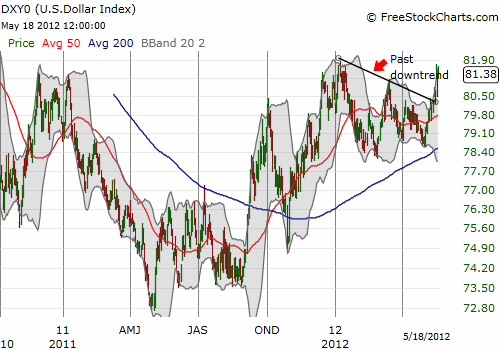

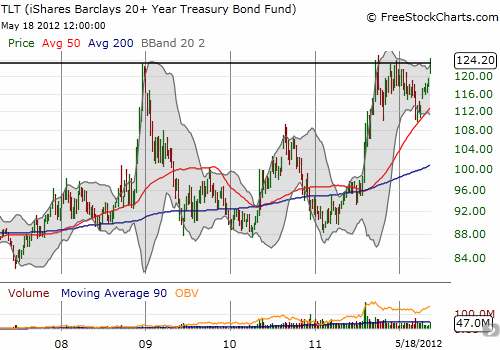

{snip} I am assuming the recent surge in U.S. government debt is at least partially responsible for helping the dollar to surge this month. {snip}

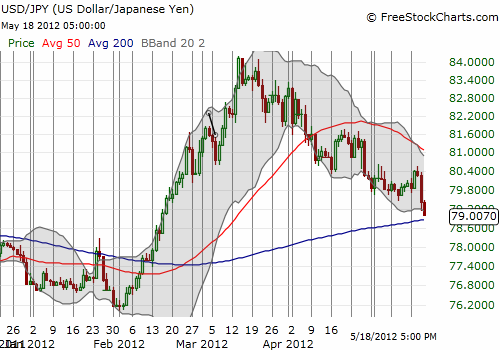

Overall, the biggest story is the resurgence of the Japanese yen. {snip}

Source for charts: FreeStockCharts.com

The plunge in USD/JPY was exacerbated on Thursday, May 17 by a very disappointing Philly Fed (Philadelphia Federal Reserve Business Outlook) report. {snip}

{snip}

“Mr. Yen” says that Japanese exporters are fine down to 78 or 79 on USD/JPY:

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on May 20, 2012. Click here to read the entire piece.)

Full disclosure: net long yen, net short euro, net long dollar