Stock Market Commentary

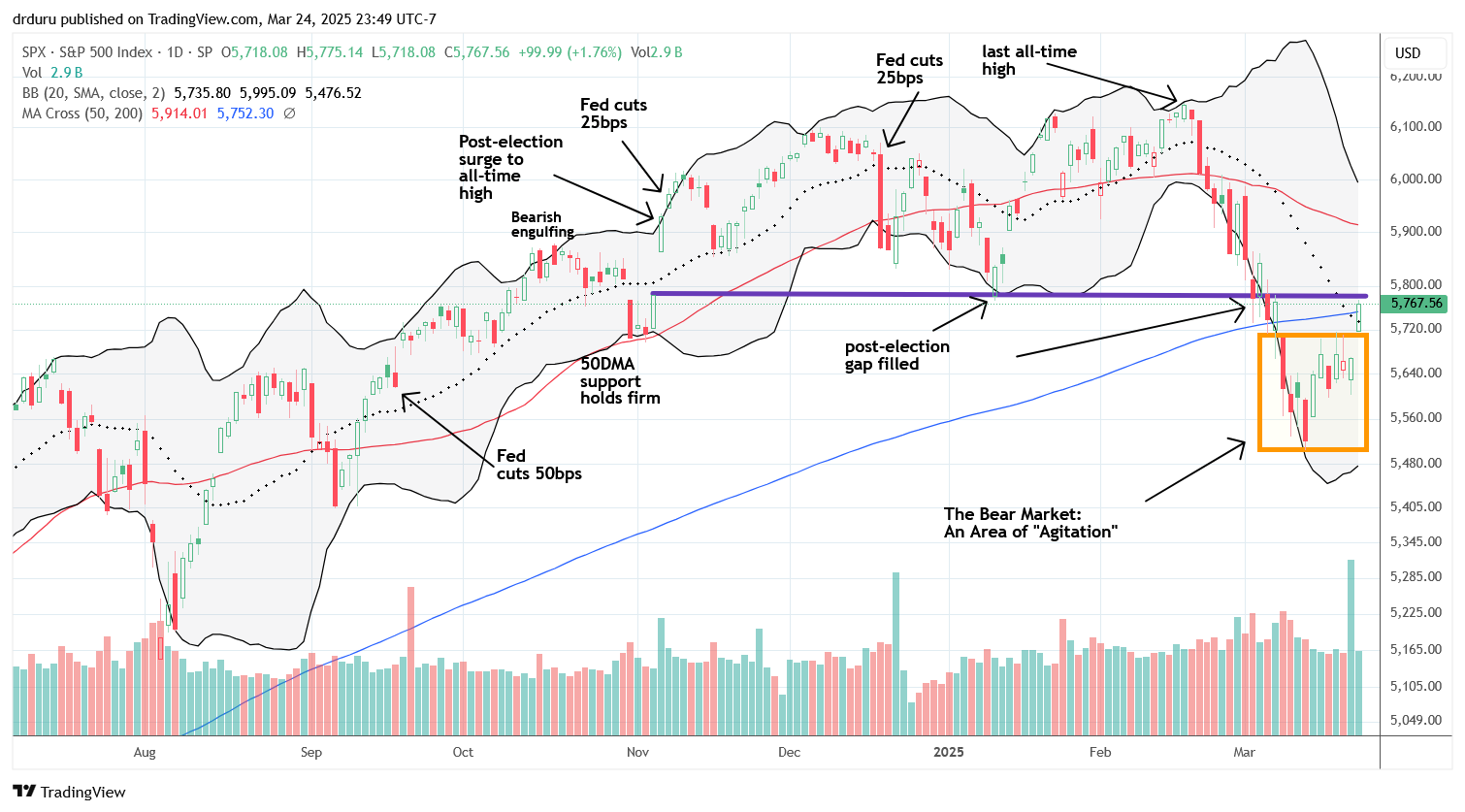

And so a bear market ends, for the S&P 500 at least. The stock market enjoyed a strong follow-through day supported by previous oversold conditions. To represent the most recent technical developments, I created a well-defined area for the bear market called the “area of agitation”. The S&P 500’s breakout above this area of agitation represents the end of its bear market given the close above its 200-day moving average (DMA). Unlike conventional definitions, I consider a bear market as a confirmed breakdown below the 200DMA – this definition provides faster, more meaningful trade signals. Historical data shows that when indices are down 20% from all-time highs, the bear market is already ending.

The “area of agitation” represents a cauldron of volatility driven by headlines – tariffs, geopolitical tensions, recession fears, and so on. Friday’s announcement of tariff flexibility added to the Federal Reserve’s confidence to form double barrels of supportive tailwinds. Monday provided the confirmation this with a powerful gap-up at the market’s open.

While political headlines will continue to shift, the market itself remains the best indicator to follow. The price action is the signal that matters. For example, over time, the market will become numb to the same headlines of tariffs and economic warfare. When that happens, the price action will be much more useful than the latest political headlines.

The Stock Market Indices

The S&P 500 (SPY) gapped up and closed the day with a significant 200DMA breakout, marking a bullish technical shift from the “area of agitation.” The index is now challenging resistance from its election day close. A breakout above this level could set the stage for a stronger rally. Notice that while this support held in January, it failed to hold in the middle of the market’s steep sell-off.

The downtrending 50DMA would likely stall an on-going rally. The good news is that the first failure at this resistance would provide a fresh buying opportunity for bulls and investors before a presumed 50DMA. In the meantime, I took on a small hedge on my remaining short-term trading positions with a put option on SPY.

The NASDAQ (COMPQ) had a strong day but remains well below its 200DMA resistance. The tech-heavy index is still in bear market territory. For bullish traders in large-cap tech, this gap offers runway before resistance comes into play. Note the neat gap up above 20DMA resistance (the dotted line).

The iShares Russell 2000 ETF (IWM) contributed to Friday’s pullback in market breadth, but I bought a call option position on the dip as part of my trading strategy. That paid off with a 2.5% gain on Monday. IWM gapped higher and cleared prior congestion levels, including downtrending resistance from its 20DMA. I locked in profits as part of my routine early in bounces from oversold conditions.

The Short-Term Trading Call With a Bear Market End

- AT50 (MMFI) = 33.8% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 42.3% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their 50DMAs, climbed back above 30%, reaching a 3-week high. This breakout clears the way for a run to the 40–50% zone. AT200 (MMTH), the percentage of stocks above their 200DMAs rose to 42%, almost a 3-week high. AT200’s runway is clear to about 50%.

Swingtradebot supports these bullish developments with bullish momentum indicators across indices. Short-term trends are up, and three of the five indices now carry long-term up signals as well.

The volatility index (VIX) plunged again, closing at 17.5. I was not positioned to take advantage of the continued decline in volatility, but a further drop below 15.35 – a common pivot – would make me start worrying about market complacency.

The Equities

Micron Technology (MU):

MU fell hard Friday, dropping 8% post-earnings and away from resistance at the 200DMA. The stock recovered 2.3% Monday, but the prolonged churn since last July makes MU unappealing to me. I am waiting for a breakout or breakdown for the next trade.

Robinhood Markets, Inc. (HOOD):

HOOD surged 9%, reaching 50DMA resistance. I’ve been bullish and added on dips. If buyers can push past this level, HOOD could revisit all-time highs in short order. Likely catalysts include strength in March Madness betting and rising risk sentiment, likely supported by Bitcoin’s weekend momentum.

Bitcoin (BTC/USD) broke above its 20DMA, removing resistance and offering a bullish “proof point.” If buyers can clear the declining 50DMA, the move would generate a risk-on breakout that would likely support further strength in equity markets.

Apollo Global Management (APO):

APO continues its rebound from bear market losses. I view the stock as a sentiment indicator tied to dealmaking. A break above the 50DMA would support general bullish sentiment in the market.

Okta (OKTA):

I re-entered OKTA after it made a marginal new high. Although not near support, the weekly chart shows room to rally toward $200. I want exposure to this longer-term recovery potential.

ARK Innovation ETF (ARKK):

ARKK confirmed a 200DMA breakout that began on Friday. Resistance at the 50DMA could present a short-term hurdle. I’m not a “bull” per se, but I don’t want to miss out and might sell a call option at 50DMA resistance.

Tesla, Inc (TSLA):

TSLA played a pivotal role in ARKK’s 5.2% surge. Before I continue, I acknowledge that TSLA is a hot button, battleground stock. So treat my analysis here as a market-driven discussion and not an expression of political opinions. I created One-Twenty Two on the concept of identifying and trading market extremes, so this TSLA narrative represents important lessons revalidating the niche this blog serves.

Over the past week, I discussed with friends how negative sentiment around TSLA appeared increasingly overdone and how the stock was setting up for an upside move. Despite recognizing this setup, I chose not to take a bullish position. Instead, I used TSLA as a hedge, establishing a put spread positioned well below current levels and aligned with a bearish analyst’s target. This approach reflects a “just in case it collapses” risk strategy. TSLA surged along with a flip in market sentiment, but I did NOT expect such a strong one-day move.

TSLA exemplifies how sentiment and technicals can be more important trading signals than the latest political war of words. During TSLA’s selloff, ignoring sentiment led to pain for bullish traders who continued to buy away. Now, the reverse risk exists – those bearish traders who ignore the improving sentiment could suffer similarly.

The stock gained 12% today, following a 5% move on Friday. This rally has coincided with public demonstrations of federal support: the President promoting Tesla vehicles, the Commerce Secretary recommending buying the stock, and high-profile figures discussing TSLA as a political symbol. TSLA is now firmly in battleground territory.

Key fundamental catalysts are on the horizon. Delivery numbers are expected within the next week, and earnings follow next month. Based on prior data and headlines, I anticipate poor fundamental results. However, as a battleground stock, TSLA may not react bearishly to negative news if sentiment has already washed out. The market could easily discount weak fundamentals if selling pressure has exhausted itself and investors and traders choose to focus on some distant, glorious future.

From a technical perspective, TSLA recently suffered a 15.4% down day. Yet, sellers failed to follow through for a true bearish extension. I’ve been watching the 2023 breakout point closely. Sellers couldn’t break below that level – even on multiple attempts – despite clear fatigue in the rebound. This failure to break support marked a key turning point.

The rally was then reinforced by highly visible support from political leaders, adding fuel to the sentiment reversal. Now, bulls must closely monitor how TSLA performs at 200DMA resistance, followed by potential resistance at the 50DMA.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #319 over 20%, Day #1 over 30% (overperiod ending 1 day below 30%), Day #16 under 40% (underperiod), Day #28 under 50%, Day #55 under 60%, Day #156 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long SPY put, long HOOD, long BTC/USD, long ARKK, long OKTA call spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

* Blog notes: this blog was written based on the heavily edited transcript of the following video that includes a live review of the stock charts featured in this post. I used ChatGPT to process the transcript.