Stock Market Commentary

The stock market presented mixed messages amidst ongoing volatility. While a “softer than expected” CPI report presumably triggered an initial fragile rebound, I see persistent underlying weakness. Apple Inc. (AAPL) represents this fragility with a continued bearish breakdown casting a shadow over the broader market.

Apple Inc. (AAPL) declined 1.8% and confirmed its breach of the key 200-day moving average (DMA) (blue line in the charts). The confirmed breakdown below the 200DMA, evidenced by two consecutive lower closes, presents a significant bearish technical signal for AAPL. From a technical perspective, I now classify AAPL as being in a bear market. While a 20% decline from peak levels is a common bear market definition, the 200DMA provides a more responsive indicator, particularly following periods of steep upward price momentum. AAPL needs to reclaim 200DMA support to return to bullishness. However, it could become a (short-term) buy once/if the market finally plunges into official oversold conditions.

Special note: This post is a heavily edited version of the transcript from my latest video summarizing the market action. I used Google Gemini to help me transform the script into a formatted blog post. Along the way, Gemini created some formatting that I have now adopted. I edited the text for voice, grammar, and accuracy (the YouTube transcript quality is poor, and Gemini was not able to access my video directly for some reason).

The Stock Market Indices

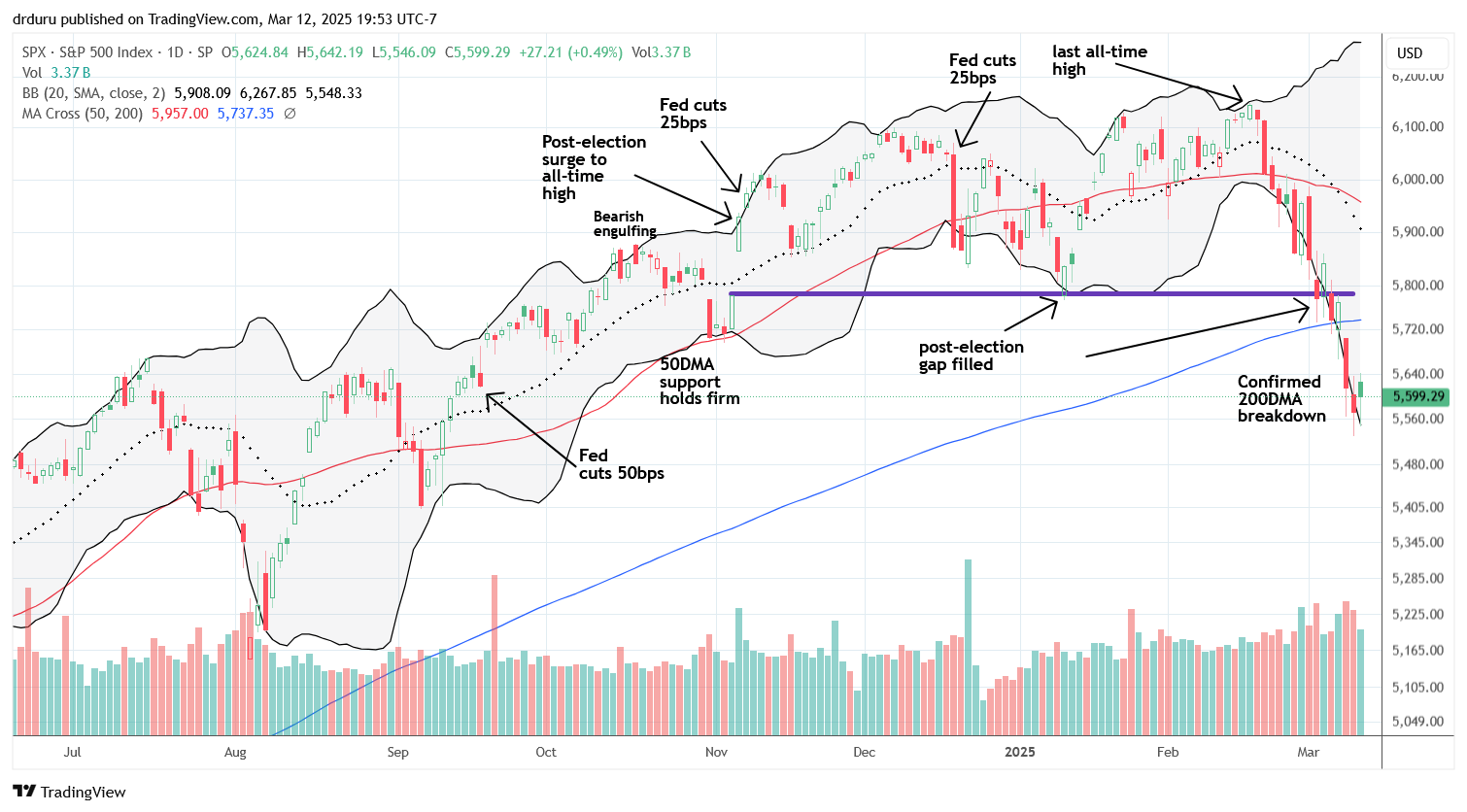

The S&P 500 (SPY) registered a modest gain of 0.5%. This increase, part of a fragile rebound, does not negate the significance of the confirmed 200DMA breakdown. I maintain an overall bearish technical posture on the S&P 500, and I expect an expanded rebound to encounter resistance at the 50-day moving average (50DMA) (red line) and the former post-election gap support level (See the horizontal purple line below).

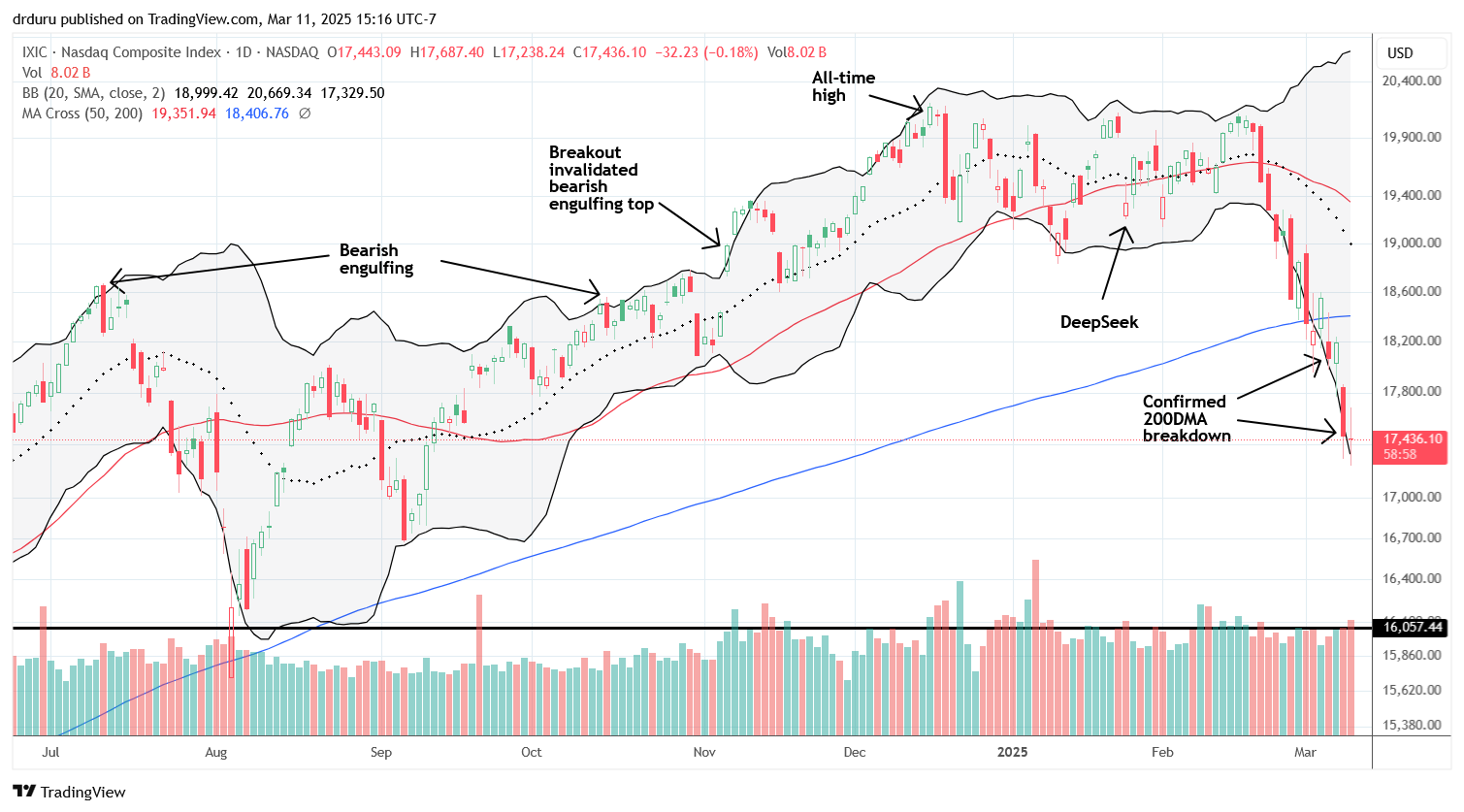

The NASDAQ (COMPQX) enjoyed a strong rebound, advancing 1.2% within this fragile rebound. This relative outperformance likely reflects a natural snapback from significant losses going into this bounce. Nevertheless, the NASDAQ, similar to the S&P 500, remains in a confirmed bear market phase, signaled by its 200DMA breakdown. Similarly, an expanded rebound is likely to meet stiff resistance at the 200DMA.

The iShares Russell 2000 ETF (IWM) underperformed the broader market with its own fragile rebound. Despite an opening gap to the upside, IWM traded lower throughout the day, closing with a marginal 0.2% gain and briefly trading in negative territory. The IWM continues to exhibit technical vulnerability and appears to be trending towards a formal bear market, officially defined as a 20% decline from its all-time high. Again, from the technical perspective of trends, IWM has been in bear market for almost a month thanks to its 200DMA breakdown in mid-February.

The Short-Term Trading Call With A Fragile Rebound

- AT50 (MMFI) = 24.0% of stocks are trading above their respective 50-day moving averages

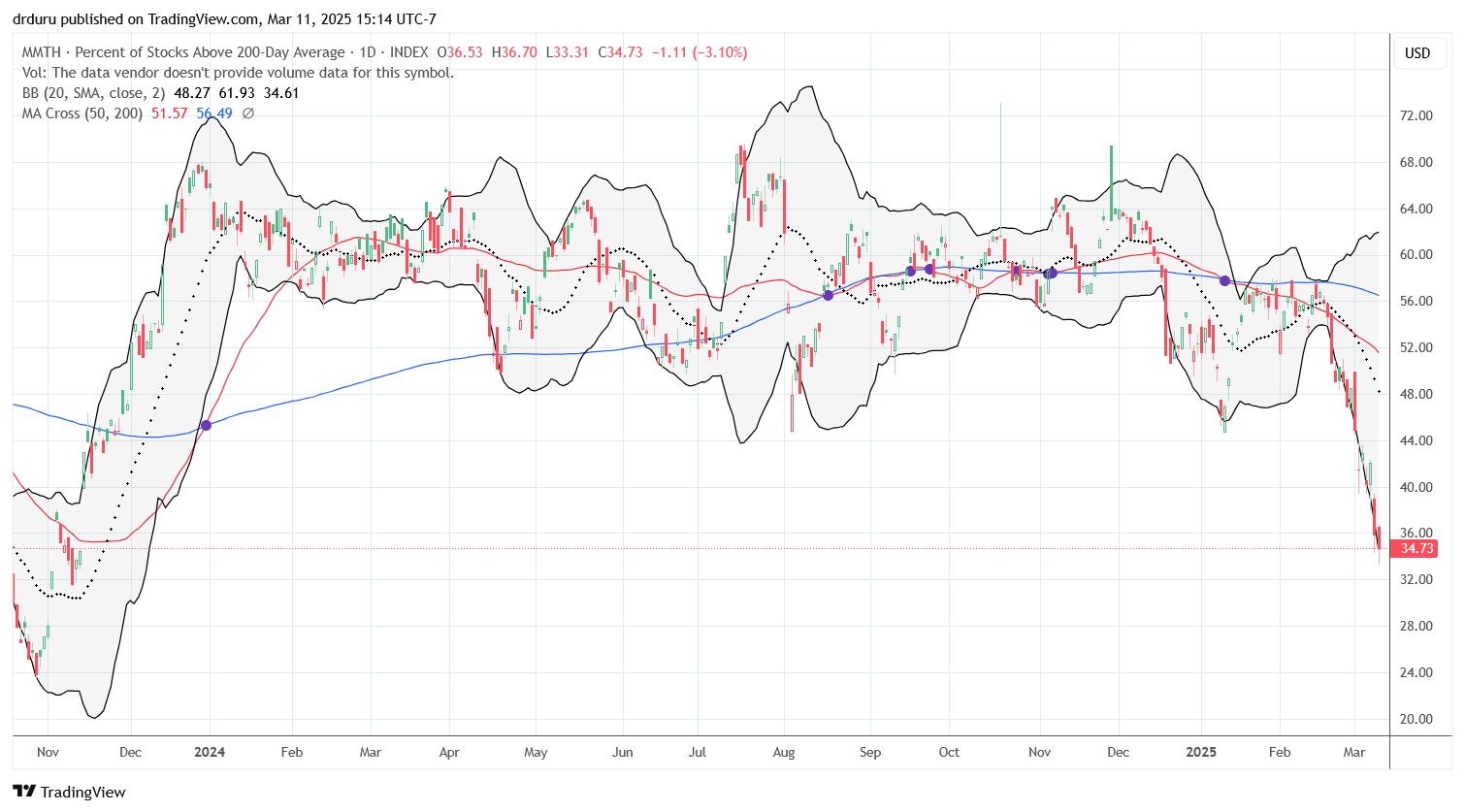

- AT200 (MMTH) = 35.6% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, closed at 24.0%, nearly flat with the previous day. AT50 is approaching the oversold threshold of 20%, but too slowly for my taste! The VIX (volatility index) declined by 10%, reflecting a decrease in implied volatility and market fear. However, this pullback did not quite deliver the definitive implosion that clearly signals a (short-term) market bottom. While the VIX sharply receded from its recent peak, the extent of the decline is less pronounced than previous volatility collapses. In the recent past, substantial VIX implosions (e.g., 24% and 28% drops) have justified aggressive bullish positioning. Thus, while the VIX pullback is a potentially constructive sign within this fragile rebound, I believe the possibility of renewed VIX spikes and associated market volatility remains an immediate risk.

The longer-term market breadth indicator, AT200 (the percentage of stocks above their 200DMAs), increased by one percentage point. While this move is encouraging, this longer-term indicator of market health remains at levels last observed in November 2023. The divergent moves in market breadth, the large decline in volatility, and the divergent indices indicate the conflicting signals of a fragile rebound. The overarching market trend remains bearish given the 200DMA breakdowns even though market breadth is oh so close to official oversold levels which would trigger automatic bullishness according to the AT50 trading rules.

The Equities: Divergences in a Fragile Rebound

iRobot Corporation (IRBT) – Continued Decline Amidst Fragile Rebound. IRBT extended its downward trajectory, declining 36% to reach new all-time lows, even as a fragile rebound lifted some parts of the market. I am now even more relieved by my decision to take losses about 9 months ago after a month-long trade. My expectation for a “financial conclusion” seems ever closer now. The company’s latest financial report even strongly suggests the end is near.

Credo Technology Group Holding Ltd (CRDO) – Momentum-Driven Breakout Defies Fragile Rebound. CRDO demonstrated continued momentum, adding another 10% to the previous session’s gains. My earlier analysis identified CRDO as a potential buy candidate upon a 200DMA breakout. While momentum chasing carries inherent risk, CRDO’s technical strength is notable. I bought an April 50/60 call spread to profit from potential further upside over time, assuming 200DMA support.

Crowdstrike Holdings, Inc. (CRWD) – Bearish Hedge Invalidated. I bought a put spread hedge on CRWD based on post-earnings weakness. CRWD invalidated that bearish call after rallying above its 200DMA, a full participant in the fragile rebound. CRWD now flips to a bullish prospect.

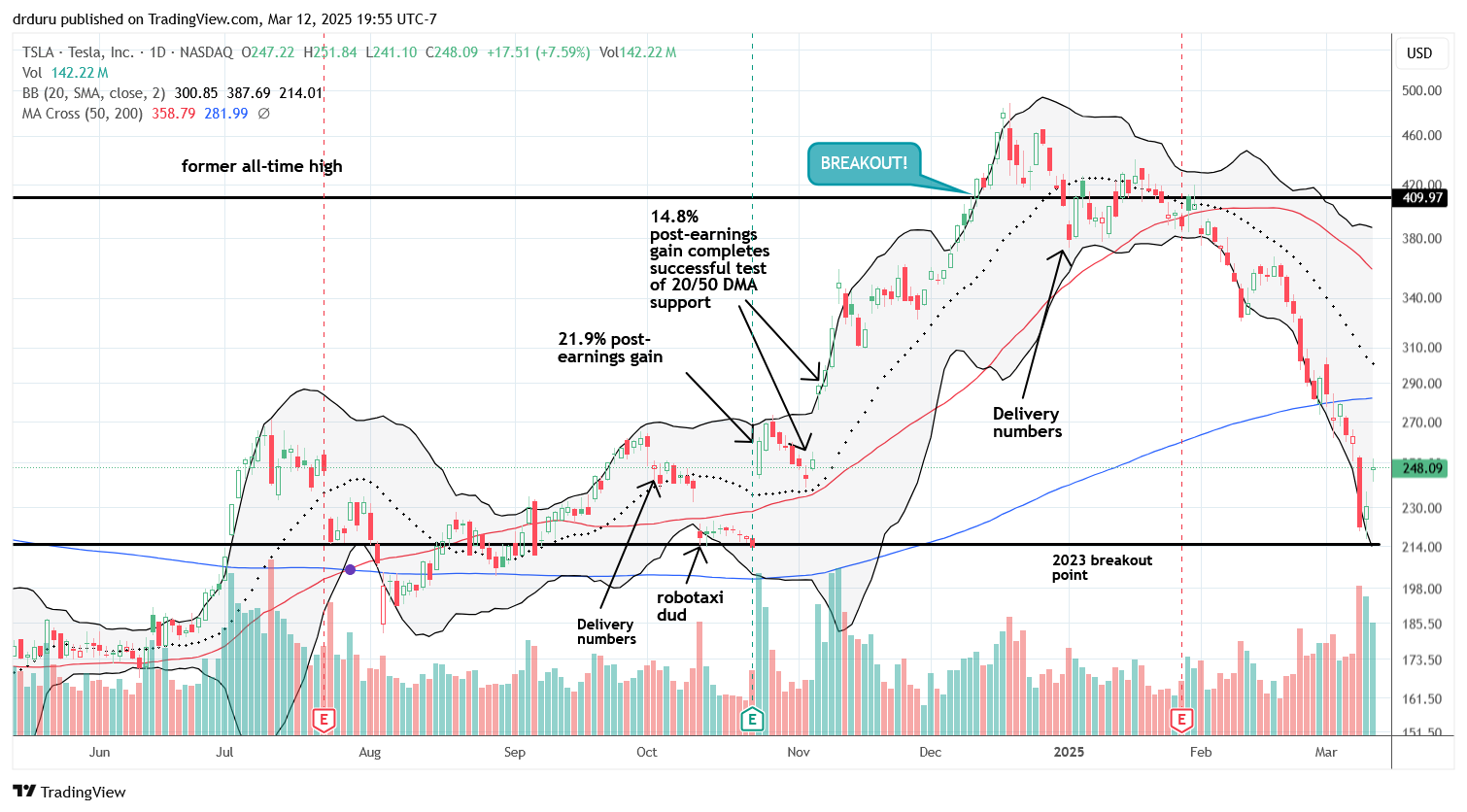

Tesla Inc. (TSLA) – Timely Influence in a Fragile Rebound. TSLA enjoyed a 7.6% price increase, potentially driven President Trump’s public purchase of a red Model S. While this fragile rebound supports my trade in ARK Innovation ETF (ARKK), I maintain my doubts. Like most stocks still trading under their 200DMAs today, I expect a rebound to meet with resistance at that long-term trendline. I even added a highly speculative purchase in the Tesla 2x Bear ETF (TSLQ) as a tactical hedge.

Granted, even ARKK remains in a bear market as the ETF trades below its 200DMA. Still, I am sticking to my longer-term trading strategy in ARKK given my intent to have a stake whenever Cathie Wood and crew get this thing turned around.

Spotify Technology S.A. (SPOT) – Shorting 50DMA Resistance Like A Fragile Rebound. SPOT tested resistance at its 50DMA at the top of a 5.4% rebound. The stock managed to remain well above its 200DMA. I will re-evaluate this short if SPOT decisively breaches 50DMA resistance. Technically, SPOT also printed a potential “abandoned baby bottom” formation, signalling a (short-term) exhaustion of sellers and motivation for buyers to “rechase” the stock.

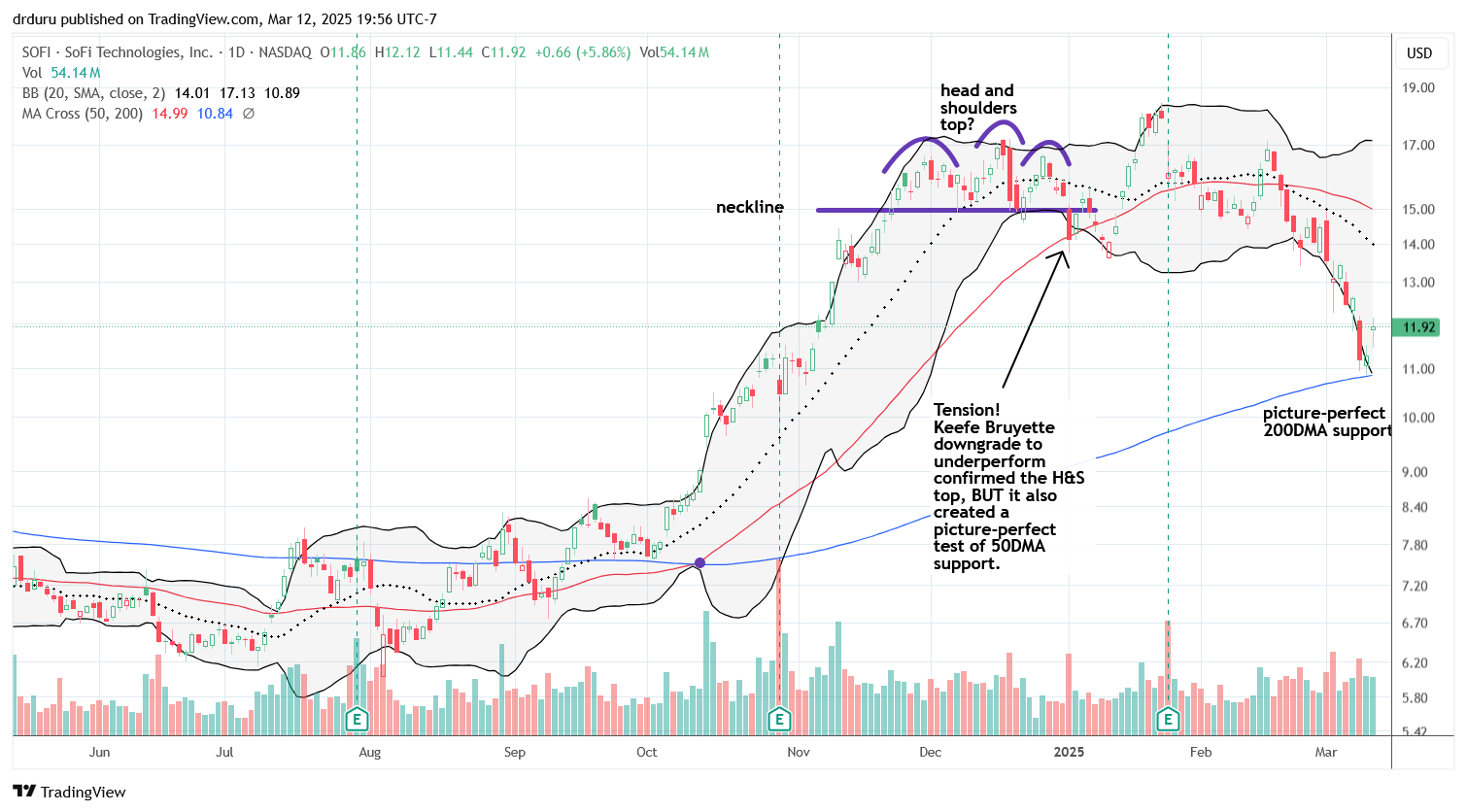

SoFi Technologies, Inc. (SOFI) – Bullish Position on Oversold Rebound: SOFI demonstrated a textbook test of 200DMA support followed by a subsequent rebound. Briefing.com directed my attention to extremely high call volume in SOFI. This observation clinched my trade to both buy shares and call options expiring next week. Like any stock bouncing off 200DMA support, I am trading in anticipation of an eventual run toward or even test of 50DMA resistance.

Netflix, Inc. (NFLX) – Missed Bottom Reversal Pattern. NFLX, a (former?) stock market bellwether, succumbed to selling pressure and broke below its 50DMA support last week. Looking back, I can see a near one-two-three bottoming pattern in NFLX, a pattern I now see in a number of stocks. Yet, while I was overly aggressive buying a call option last Thursday, I was not even in the game for this bounce!

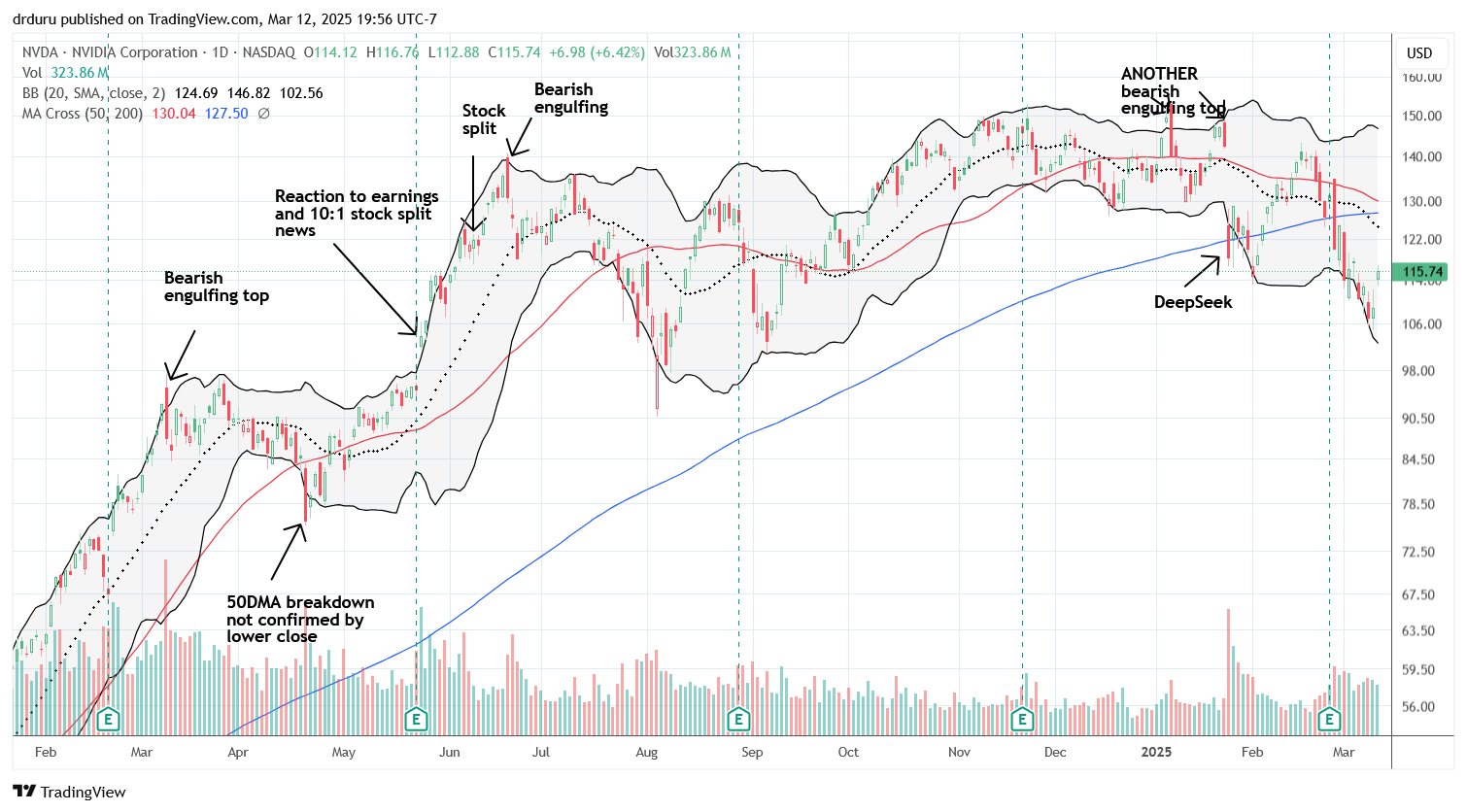

NVIDIA Corporation (NVDA) – Bearish Engulfing Top Still Constrains Upside: NVDA experienced a 6.4% rally, allowing me to close out the last leg of a calendar call spread profitably. However, the previously identified bearish engulfing top pattern in NVDA remains a technical concern. Like so many trades anticipating rebounds, I look to overhead 200DMA resistance as a natural limit an d a reminder of the overall bearishness in the stock. NVDA’s inability to ignite a broader based rally is one more sign of a fragile rebound.

IonQ, Inc (IONQ) – Quantum Computing Sector Strength. IONQ is my favorite stock in the quantum computing sector. It surged 16.7% and broke above its 200DMA. I added IONQ to my shopping list, but I am loathe to chase the stock here. The risk/reward will look a lot better with a pullback to cool things off a bit. Still, IONQ offers tremendous upside with just a rally back to its 20DMA (the dotted line).

Reddit, Inc. (RDDT) – Sharp Reversal Off 200DMA Support: RDDT put on a show with a significant reversal off 200DMA support. Following a breakdown from a consolidation range and a subsequent, steep three-day selloff, RDDT held 200DMA support in perfect-picture form. RDDT is now on my shopping list. However, similar to IONQ, a period of consolidation or a retest of the 200DMA support would provide a more favorable entry point.

Broadcom Inc. (AVGO) – Pre-Earnings Support Trade: AVGO held its ground going into and coming out of earnings. AVGO tested and confirmed 200DMA support prior to its earnings release. As I planned (see previous post), I bought some shares as a play off 200DMA support and potential rebound back to 50DMA resistance.

Oracle Corporation (ORCL) – Bullish But Fragile Setup. I missed buying ORCL as it bounced toward 200DMA resistance. The support line I drew (the purple line) held firm. I was just too tentative placing an order for a calendar call spread at a bid price that never executed.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #311 over 20% (overperiod), Day #3 under 30% (underperiod), Day #8 under 40%, Day #20 under 50%, Day #47 under 60%, Day #148 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long IWM calls, long TSLA put spread, long TSLQ, long SPY, long QQQ call calendar spread and call, long AVGO, long CRDO, long CRWD put spread, short SPOT, long SOFI shares and calls

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.