TSLA Revs Higher

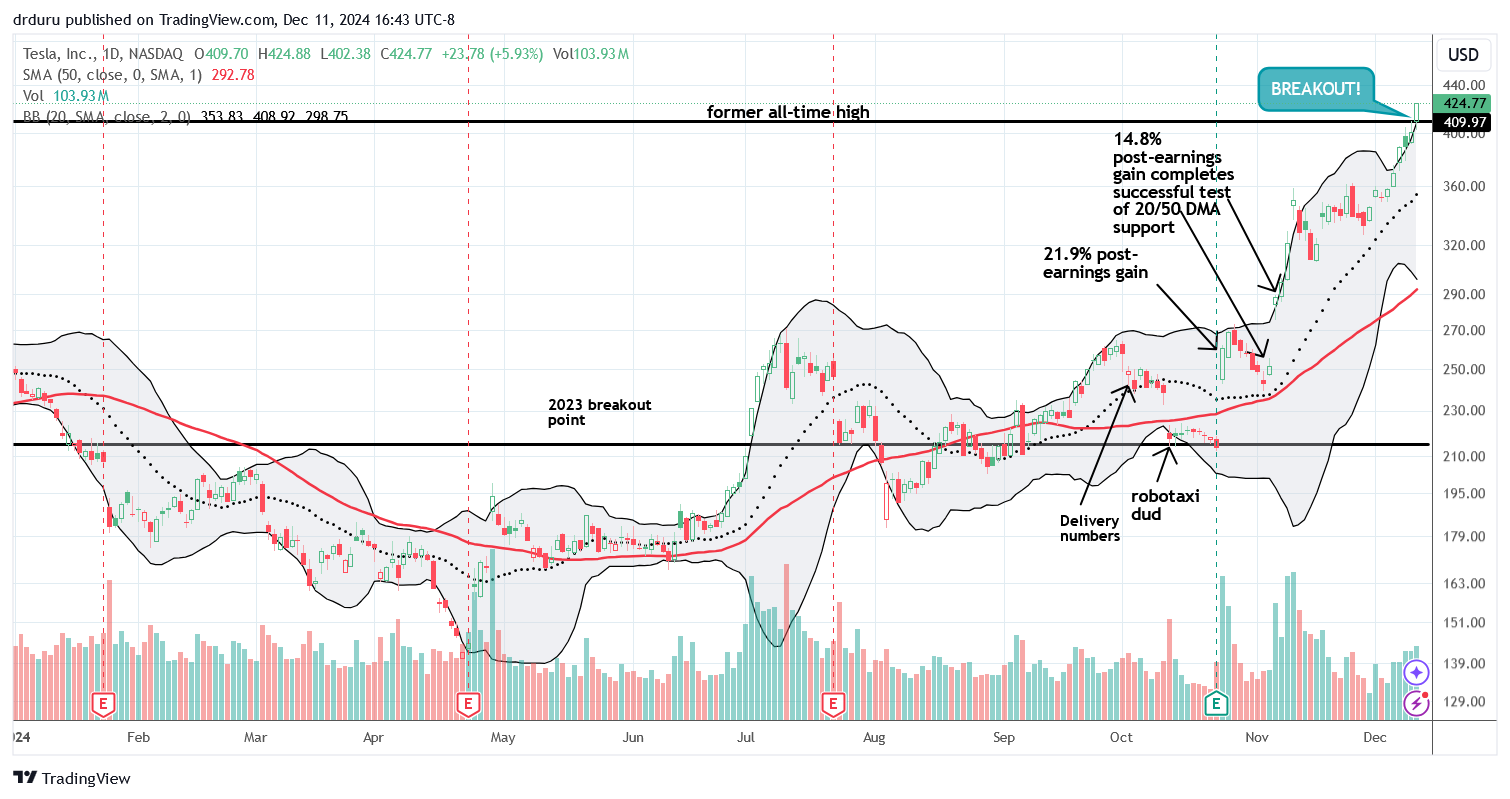

Incredibly, Tesla Inc (TSLA) has nearly doubled since a loud thud greeted the company’s robotaxi rollout. That bearish breakdown below support at the 50-day moving average (DMA) (the red line in the chart below) now looks quite quaint. Since then, a 21.9% post-earnings gain and an initial 14.8% post-earnings pop have ignited TSLA’s rocket. The post-election tailwind was so clear that I picked TSLA as my momentum upside pick in order to prevent me from over-speculating on a whole herd of hot post-election stocks. Once again, my TSLA trade proved too conservative. I took profits on my December $360/$380 call spread yesterday as I watched TSLA approach its all-time high. Today TSLA closed at a new all-time of $424.77.

TSLA is another great example of a stock where momentum is so strong, the technicals were more than sufficient to understand how to trade it. The post-election pop confirmed converged support at the 20 and 50DMAs. When TSLA stalled into a churn, it never broke below its 20DMA uptrend. Buyers could not even wait for a proper test of 20DMA support before sending TSLA up 8 of the last 9 trading days. Now TSLA is over-stretched well above its upper Bollinger Band (BB). The stock SHOULD slow down and at least consolidate in coming days.

The former all-time high is now the key support in the spotlight. A successful test of that line refreshes the bull case. A confirmed breakdown is not necessarily bearish, but such a slide would set up TSLA for its next test of 20DMA support.

TSLA Recharges Momentum for the ARKK Trade

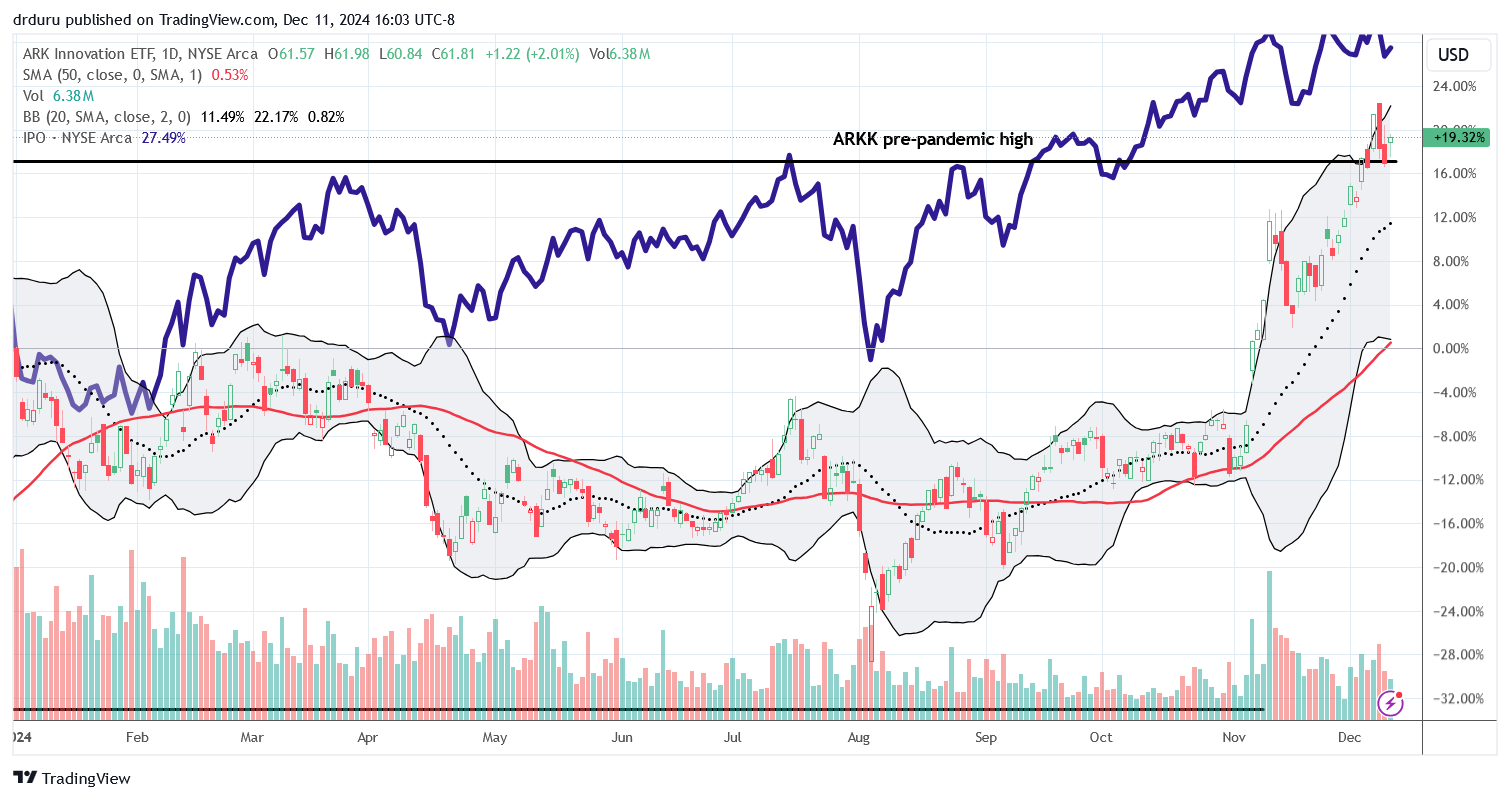

In a video last week, I laid out the case for getting long and staying long ARKK on an important pandemic-related breakout. TSLA helped drive the breakout in ARKK: TSLA is 14.3% of ARKK. Unfortunately, or maybe fortunately now with the breakout, ARKK is highly concentrated in a few speculative names. Of the 31 constituent stocks, just five stocks make up 48% of this vehicle for speculating on innovation: TSLA, Coinbase (COIN), Roku (ROKU), Roblox (RBLX), and Palantir (PLTR). At current levels for each of these stocks, and many others in ARKK that are finally doing well, an ETF is the best approach to get investment exposure without having to sort through single-stock risk. Short-term swing trades on individual stocks still follow the standard technical approaches and tend to greatly minimize single-stock risk.

Note that, as expected, ARKK is not making a clean break of resistance at its pre-pandemic high. Sellers quickly descended on Friday’s breakout. As planned, I am undeterred by the expected churn around this critical juncture. I bought my first shares in a long-term, core position on Friday. I bought a trading position on the pullback to support (a covered call position).

What About Renaissance IPO ETF (IPO)?

Over time, I still think Renaissance IPO ETF (IPO) is going to out-perform ARKK. For now, ARKK is closing the performance gap as it gains momentum ahead of the IPO boom that I expect to create fresh momentum for the IPO ETF. I expect lift-off in 2025 as the market’s current speculative fever translates into bold share issuances. There must be an entire herd of AI-related stocks chomping at the bit to jump into the public markets.

The chart below shows the year-to-date performance between IPO and ARKK. IPO is the dark, purplish line. The right axis shows the year-to-date percentage price change.

Conclusion and the Trade

You are likely getting quite uncomfortable with the stock market if you have been at this a long time. I am with you! The market is acting like there is some infinite supply of money pouring in on a daily basis. This is quite a sight to behold. Yet, we have to acknowledge risks at all times (and I am not even including incalculable political risks).

Today’s email newsletter from Reflexivity is quite telling with the title “Bears Are Falling Like Flies”: “TLDR: Bears are capitulating, and nobody cares about expensive valuations. Rings a bell?” Reflexivity recommends the following strategies to deal with an overheated market:

- For allocators, there’s a price in not being with a trending market. There’s also a price in massive drawdowns. Buy protection.

- For traders, momentum is a sweet nectar. On the short term, consider even put writing.

My own take for traders is DO NOT write puts. When a big correction comes (the downside of a relentless, euphoric rally is typically painful), a trader be loathe to hold the stock that gets put when price falls below the strike of the short put. Instead, stick to the technicals of support and resistance, follow the AT50 trading rules, and always, always know in advance how much money you are putting in risk and cut losses without prejudice.

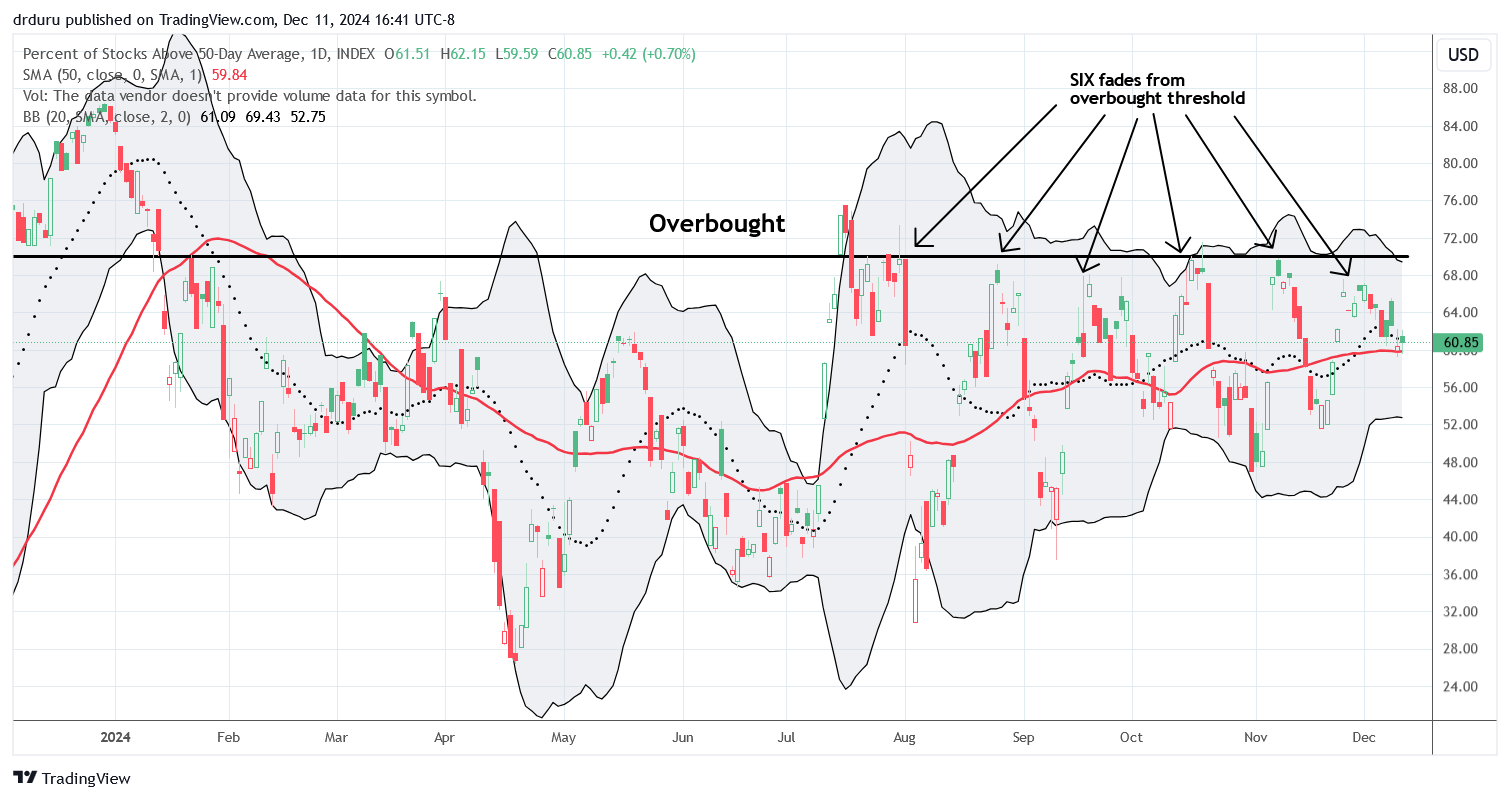

Having said all that, ironically enough, market breadth, the percentage of stocks trading above their respective 50DMAs is NOT overbought. In fact, my favorite technical indicator has cooled away from the overbought threshold as if it is resting for the push toward overbought conditions.

Be careful out there!

Full disclosure: long ARKK shares and short a call, long IPO

1 thought on “Navigating Momentum Madness with TSLA, ARKK, and Market Breadth”