Stock Market Commentary

It probably seems odd using “turnaround” as a descriptor for December’s trading. After all, the S&P 500 and the NASDAQ continued their respective melt-up trading action. Yet, small caps diverged and trickled downward all week. So I am intrigued by a collection of stocks that are making and often completing turnarounds from selling pressure from earlier this year. These turnaround stocks are happening without market breadth breaking above the overbought threshold and even sagging to start the month of December. The message from the market is a clear bias to buy. With so much of the market experiencing soaring rallies this year, the turnaround stocks provide an opportunity for latecomers and previous skeptics to play catch-up.

Meanwhile, the November jobs report showed little aggregate change but significant demographic shifts under the cover. As has been the case in recent months, the stock market barely responded to the jobs report. Apparently, the market also thinks the Fed remains on track to cut rates this month. The bond market delivered perhaps the most telling response as long-term yields dropped for the third straight day continuing a relief rally started after Trump’s pick to head the U.S. Treasury. Apparently this rally has legs. Thus, the stock market gains yet one more tailwind, and turnaround stocks should benefit further.

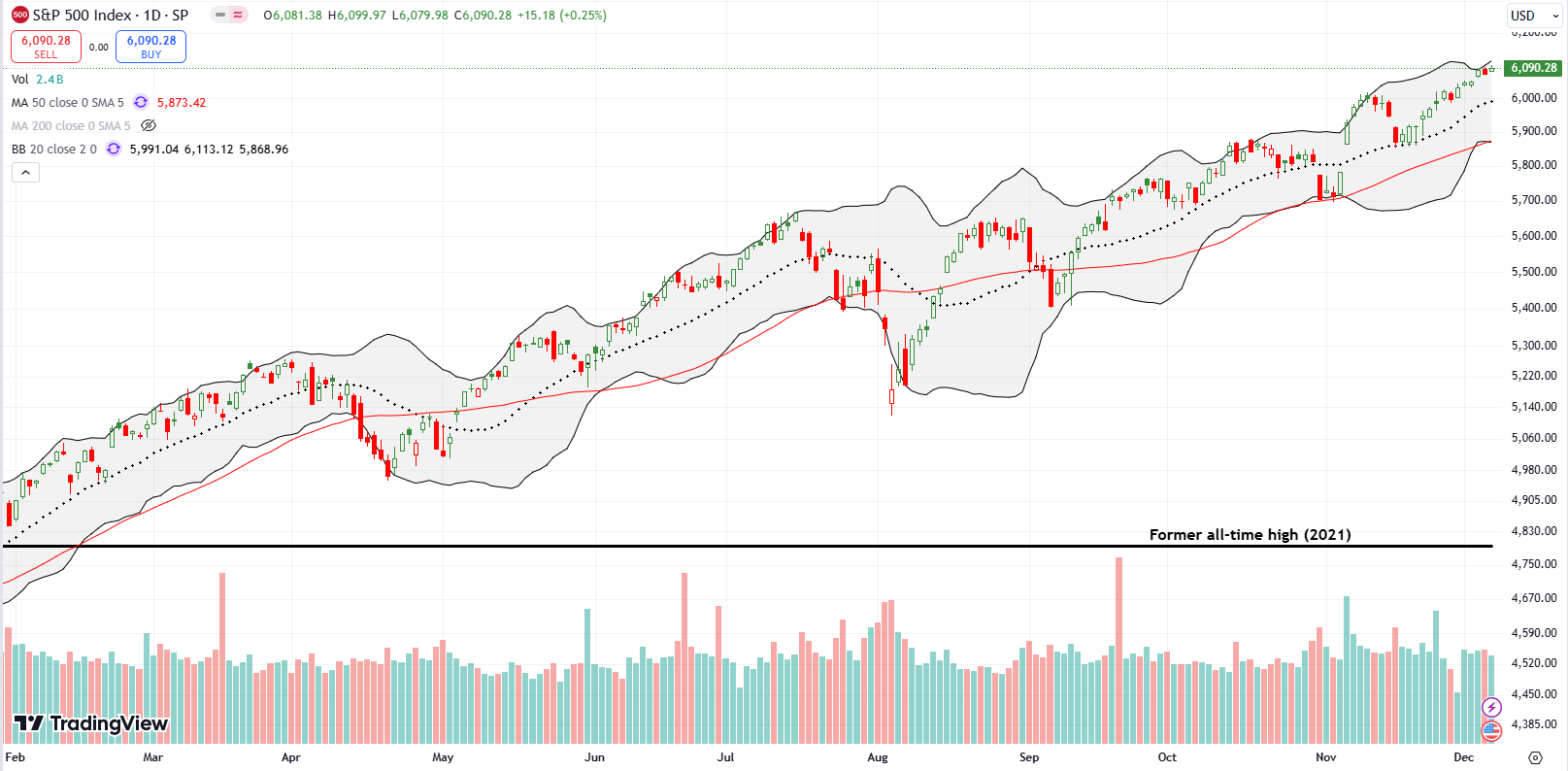

The Stock Market Indices

The S&P 500 (SPY) started the first week of December with a healthy 1.0% gain. The index has enjoyed a slow and steady uptrend since a test of support at its 20-day moving average (DMA) in the middle of November. Looking back, I can see how the (anticipated) reversal of the incremental post-election gains worked as a refresher for buying interest. The rebound also accomplished the typical rapid close of the window of opportunity for bears.

The NASDAQ (COMPQX) seemed more interested in hugging its 20DMA support than the S&P 500. Once support released its gravitational pull, the NASDAQ shot nearly straight up. The tech laden index gained an impressive 3.3% for the first week of December. The NASDAQ even closed above its upper Bollinger Band (BB) two out of the last three days.

The iShares Russell 2000 ETF (IWM) looked like the tired member of the party. The ETF of small cap stocks moved in the exact reverse of the S&P 500 and the NASDAQ for a 1.2% loss on the week. This pullback was a different kind of turnaround December. Still, IWM looks set for another successful test of its 20DMA support even as the last all-time high looks like a new blow-off top. I bought an IWM call option on Thursday as IWM approached 20DMA support.

The Short-Term Trading Call With A Turnaround

- AT50 (MMFI) = 61.5% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 61.9% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: neutral

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, closed the week at 61.5%. My favorite technical indicator suffered the same negative turnaround as IWM. Usually under these circumstances I would declare a confirmed bearish divergence. However, sellers have proven this year over and over they are unable to follow through on bearish signals. Thus, I am keeping the short-term trading call at neutral….and I fully anticipate an imminent retest of the overbought threshold going into the Federal Reserve’s decision on monetary policy.

OK. Let’s look at some bullish turnaround stories.

Perhaps the most dramatic turnaround is Super Micro Computer, Inc (SMCI). SMCI started December with a 50DMA (red line) breakout on a 28.6% gain. Friday’s close confirmed the breakout and nearly closed last month’s gap down on news that the company’s public accounting firm threw up its hands and bailed. SMCI went on from there to trade at an 18-month low, off 84.9% from its all-time high.

From the SEC filing: “In the Resignation Letter, EY stated, in part: “we are resigning due to information that has recently come to our attention which has led us to no longer be able to rely on management’s and the Audit Committee’s representations and to be unwilling to be associated with the financial statements prepared by management, and after concluding we can no longer provide the Audit Services in accordance with applicable law or professional obligations.”” SMCI disagreed with EY’s decision to resign and continued a review by a special Audit Committee.

On December 2nd, SMCI announced the conclusion of its review. Among several actions, the company will replace its CFO and hire a Chief Accounting Officer. These changes look like window dressing given the review basically concluded nothing wrong happened: “The Special Committee does not believe that the resignation of Ernst & Young LLP (“EY”), the Company’s former independent registered accountants, or the conclusions reached by EY (as described in EY’s letter of resignation dated October 24, 2024 and described in the Company’s Current Report on Form 8-K filed October 30, 2024) is supported by the facts uncovered by the Special Committee or the findings set forth in the Special Committee’s report.” Something still does not seem right here, so I am eagerly looking to see whether the company can continue to produce reassurances in its next earnings report.

Last month I lamented missing the overdue turnaround in Bill Holdings, Inc (BILL). Last week, I missed a fresh leg higher in the turnaround after BILL perfectly bounced of 20DMA support. The stock closed the week at a 52-week high and right at the upper edge of a Bollinger Band (BB) squeeze. Given the momentum of this turnaround I expect an upside resolution to the BB squeeze.

A fresh share buyback program failed to satisfy investors in document and knowledge management software platform Asana, Inc (ASAN) two months ago. The stock proceeded to an all-time low and broke down lower at the end of September. ASAN started November with a 50DMA breakout followed by a quick confirmation. The bullish move escaped my attention. By the time I noticed the ASAN turnaround, the stock was surging an astonishing 43.5% after earnings. The move cleared a new high for the year and nearly reversed the entire gap from a post-earnings gap down a year ago. ASAN pulled off an amazing and quite abrupt turnaround.

ASAN was a buy at two other technical points where the stock successfully tested 20DMA support. The stock remains a buy on the dips, but I doubt the stock will provide a “comfortable” entry point any time soon!

I actively pursued the turnaround in lululemon athletica Inc (LULU). However, I was unwilling to press my luck through earnings. So I watched from the sidelines as LULU surged 15.9% post-earnings. This move puts LULU close to challenging the March post-earnings gap down that officially marked the change in fortunes for this pandemic darling stock. Closing this gap by the end of the year would make LULU one of the top turnaround stories of the year (for me anyway!).

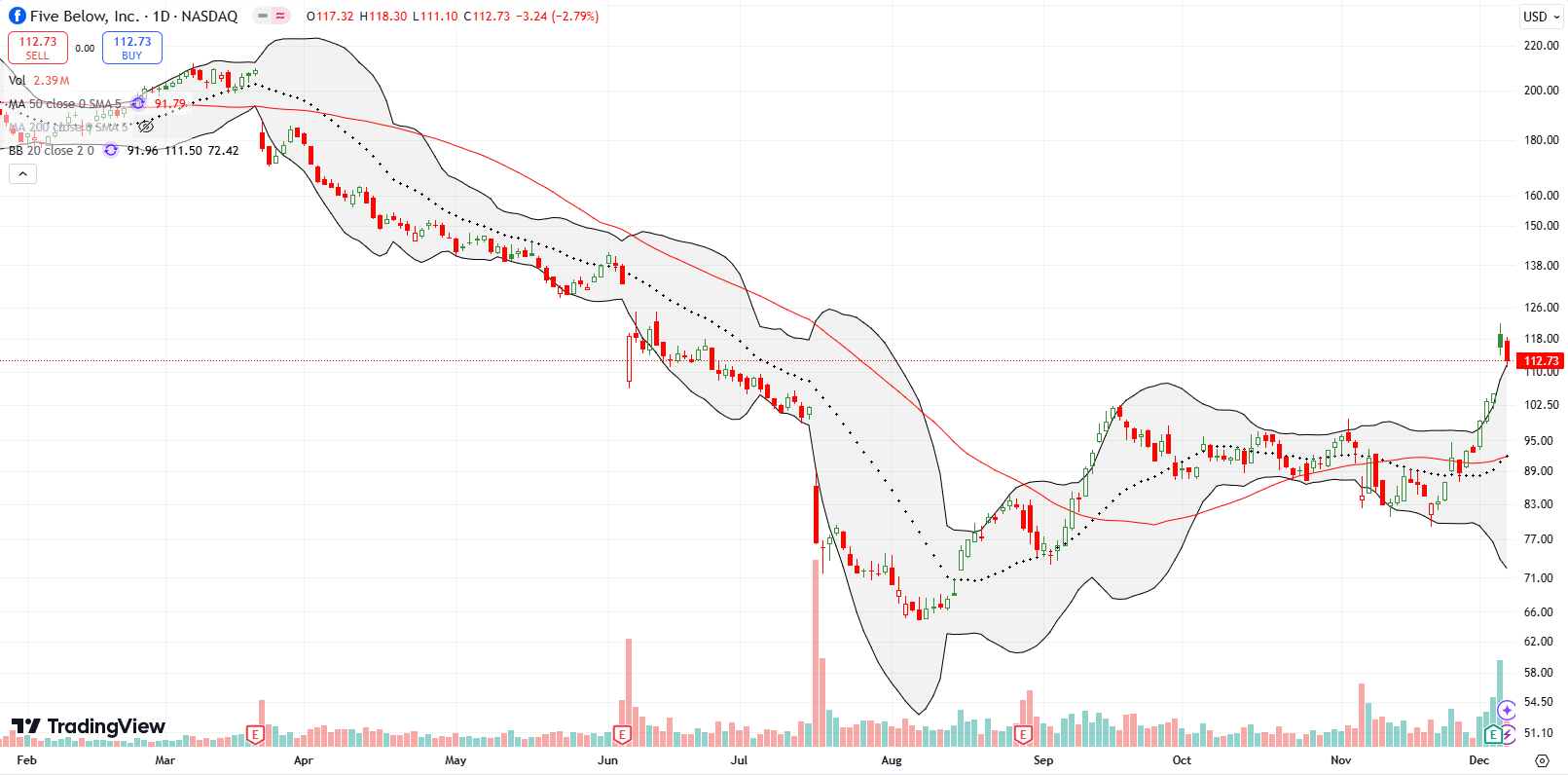

Five Below, Inc (FIVE) looked primed to prove itself a turnaround stock going into earnings. Given the recency of the breakout, I dared to open a pre-earnings position. The monthly calendar call spread at the $120 strike worked out perfectly. However, the spread on the bid/ask did not allow me to close out the position where I wanted. I am still holding going into the coming week with an eye to preserve profits.

And then there is the failed turnaround for Intel Corporation (INTC). In my last Market Breadth post, I announced my readiness to get back to between earnings trades on INTC. My call options seemed poised to deliver big as INTC opened the month announcing the replacement of its CEO. The INTC turnaround looked ready to resume as the stock gained as much as 5.9%. Unfortunately, sellers faded INTC right back to flat on the day.

I was still hopeful a fresh day would bring a fresh perspective and a subsequent bounce off 50DMA support. Instead, sellers sliced INTC right through support and maintained the pressure until Friday. At least I was right that INTC would make a big move up OR down. Now I get to worry about my INTC shares.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #260 over 20%, Day #159 over 30%, Day #83 over 40%, Day #21 over 50%, Day #10 over 60% (overperiod), Day #98 under 70% (underperiod)

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long SPY put spread, long IWM call option and shares, long QQQ put spread, long FIVE calendar call spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.