Stock Market Commentary:

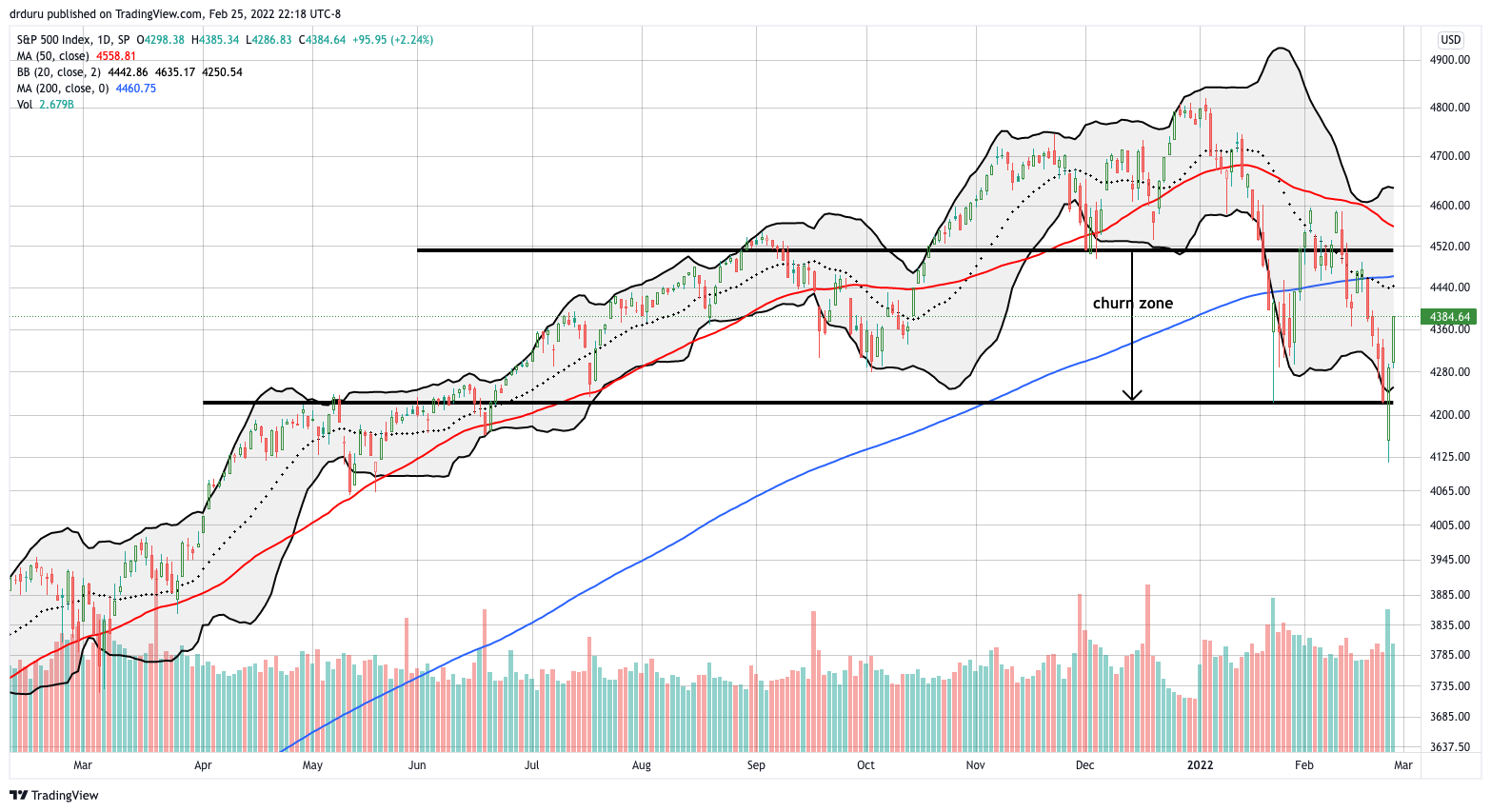

When Russia launched a full scale invasion of Ukraine, financial markets took heavy hits. Overnight, I anticipated a drop into oversold trading conditions for the U.S. stock market. Those oversold trading conditions were surprisingly and exceptionally brief. The major indices gapped down well below their lower Bollinger Bands (BB), and I waited to see whether the churn zones would act as overhead resistance on the rebound from over-stretched conditions. Buyers barely hesitated. In no time, they took the trading action right back into the churn zone. After the dust settled for the week, the S&P 500 and the iShares Russell 2000 ETF (IWM) actually celebrated gains for the week. The ability of the churn zones to survive oversold trading conditions further establishes these channels as important technical artifacts for the current stock market.

The Stock Market Indices

The S&P 500 (SPY) gapped down 1.6% on Thursday’s open. At the intraday low, the index reached a 9-month low. The buyers took over from there and stayed busy all the way into Friday’s close. The buying was so strong that the S&P 500 finished the week with a 0.8% gain. Essentially, the impact of the invasion of Ukraine is already in the rear view mirror. Buyers rushed into overstretched conditions and helped the S&P 500 survive oversold trading conditions. The churn zone looks more and more firm.

The NASDAQ (COMPQX) gapped down 3.4% on Thursday’s open where it precisely tested the closing low from March, 2021. That move also finished wiping out all of the tech-laden index’s gains for last year. The buying force from there was impressive and even startling. When the dust settled on Thursday, the NASDAQ finished UP 3.3%. The NASDAQ added 1.6% on Friday for good measure and delivered a 1.1% gain for the week. I was even able to salvage some value out of one of my QQQ call spreads. As planned, I reset my buys of various QQQ call spreads on the assumption that a sustainable bottom is in place. My upside target is again the top of the churn zone.

The iShares Russell 2000 ETF (IWM) managed to survive oversold trading conditions without suffering a significant technical breach. At Thursday’s gap down open, IWM perfectly tested the 2022 intraday low and rebounded from there. Like the S&P 500, IWM ended Friday with a weekly gain, in this case a healthy 1.5%. I was tempted, but I did not add any fresh IWM positions.

Stock Market Volatility

The volatility index (VIX) remains elevated. However, the VIX’s reversal was as dramatic as the rebound of the stock market from oversold conditions. At its high, the VIX almost tested the year’s intraday high. From there, the VIX lost 27.0%. As with almost every other extreme surge in the VIX, that moment was too late to sell, too late to panic, and too late to get bearish. Now the VIX is in a zone where it can spurt up or down in the next few days. Either way, last week’s top should represent a large amount of exhaustion for sellers. Previous lows at 24 and especially 20 are key levels of fresh support for the VIX.

I took profits on my SVXY shares on Friday (I mentioned the trade in the comments of my last post).

The Short-Term Trading Call As Markets Survive Oversold Trading Conditions

- AT50 (MMFI) = 38.7% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 35.6% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, traded as low as 18.3%. Like the oversold episode in January, I did not wait until the close to trigger the oversold trading rules. There is little need to wait when the market creates the power dual extreme of AT50 trading below 20% and major indices rushing well below their lower BBs. If not for the potential of overhead resistance from the bottom of the churn zone, I would have been more aggressive than just buying SVXY shares.

I delayed my trades until Friday when the odds of clearing that resistance looked good. The follow-on buying looked very convincing. Indeed, the churn zone looks as solid as ever. The promising divergence from the previous week suffered the detour of an exogenous shock, but it apparently revealed underlying buying pressures. Oversold extremes unleashed the buying strongly enough to plant the major indices above the point where I noted the promising divergences.

Many market observers will call this extreme trading action characteristic of bear market conditions. I am more circumspect. Sellers will have to punish markets below the churn zones to convince me that a true bear market is potentially underway. Until then, I trade as if the bottom of the churn zone is relative support. The upside potential from here is a bigger hurdle. For example, AT50 is already about 5 points away from its February peak.

Be careful out there!

Footnotes

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #469 over 20%, Day #1 over 30% (overperiod ending 1 day under 30%), Day #6 under 40% (underperiod), Day #36 under 50%, Day #69 under 60%, Day #249 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long QQQ call spreads, long IWM call spread, long SPY call spread, long SPY

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.