Bitcoin Sentiment Riding High

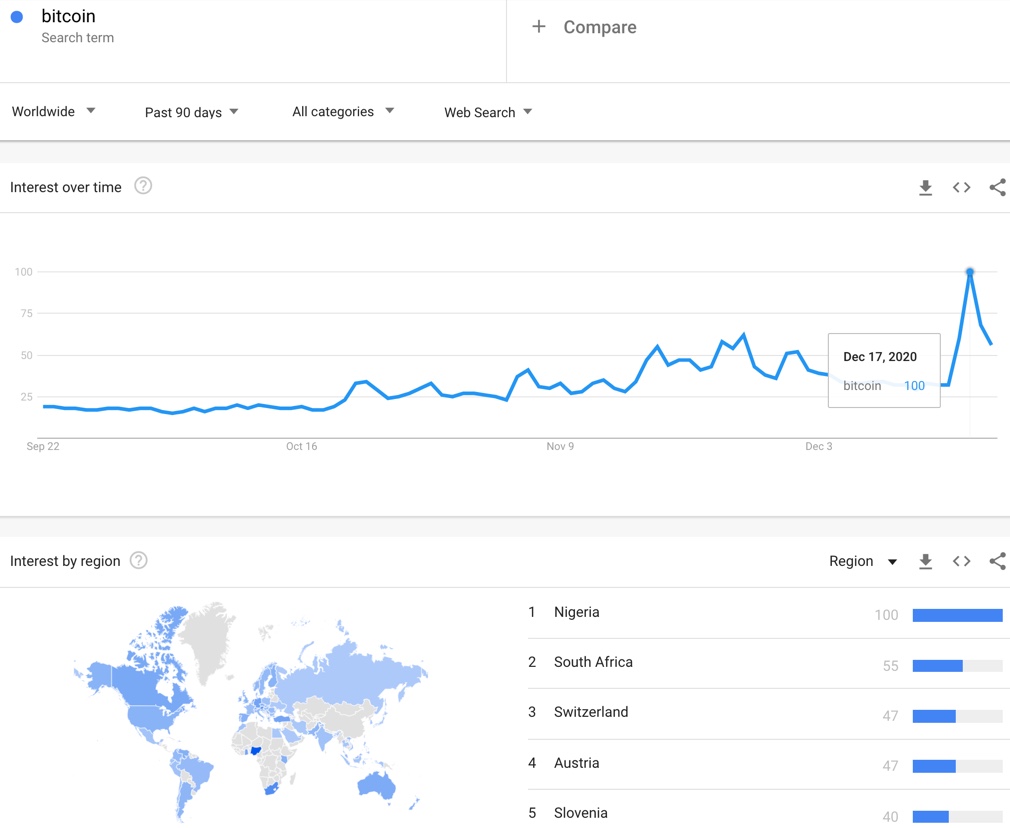

The Google Trend Momentum Check (GTMC) is staring down another test with Bitcoin (BTC/USD). A run-up in Google search interest in Bitcoin accompanied the run-up of Bitcoin to all-time highs. Google search interest is a proxy for sentiment. Accordingly, Bitcoin sentiment is running at extremes relative to recent levels. Per the GTMC, the two extremes of price and sentiment indicate an imminent (short-term) pause to the price trend and a pullback.

Google search interest reawakened in late October and slowly rose until the recent surge in Bitcoin sentiment. Along the way, BTC/USD enjoyed a breakout from the summer highs and a follow-through to the all-time highs on December 19th and 20th.

This week’s small pullback in BTC/USD is consistent with the GTMC. However, a larger pullback confirms the usefulness of the GTMC for trading. If BTC/USD goes on to make a fresh all-time high without a larger pullback, I will reset the trend watch.

A New Trade: Ethereum

While I am not willing to buy back into Bitcoin just yet, I dipped my crypto toe elsewhere. For the first time I bought Ethereum (ETH/USD). ETH/USD tested its uptrending 20DMA and created a good technical entry point. I figure if I miss the next run-up in BTC/USD, I should at least profit from riding coattails with ETH/USD.

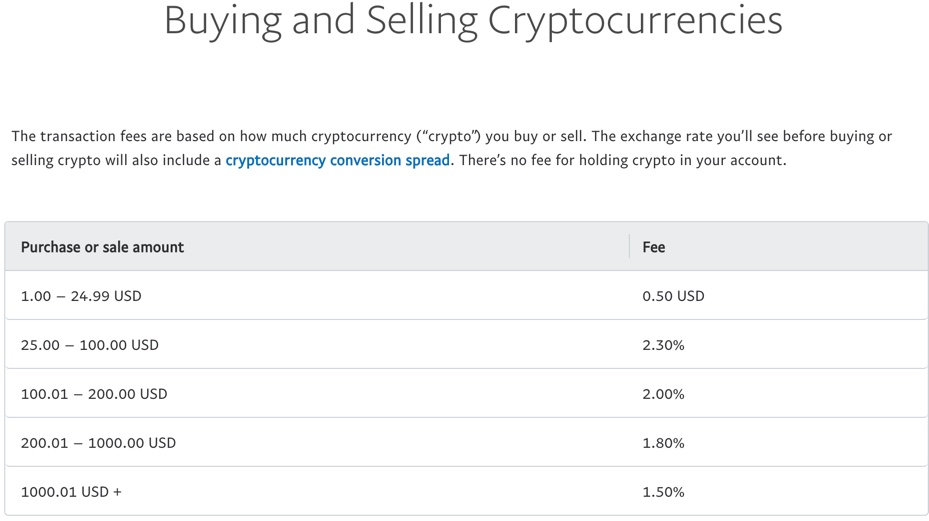

I also bought ETH/USD as a test of the Paypal Holdings (PYPL) cryptocurrency platform. Paypal recently launched crypto trading. The money transfer company is using fee-free trades as to grab market and mindshare. The fee structure after this month looks very reasonable and favors larger trade sizes. I expect PYPL to capture more and more traders over time.

Speaking of PYPL, the stock is on fire. Since breaking out to an all-time high on November 25th, PYPL is up 12.7%. I want to accumulate PYPL on the dips.

Be careful out there!

Full disclosure: long ETH/USD