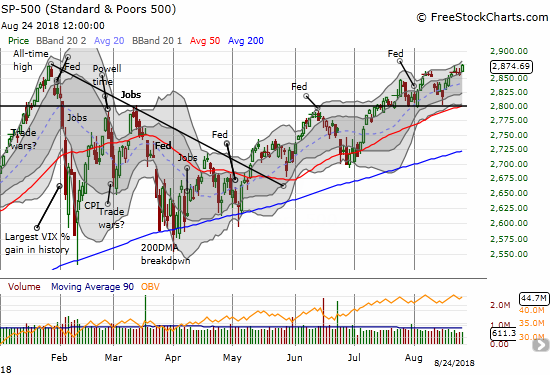

Federal Reserve Chair Jerome Powell delivered a speech at Jackson Hole, Wyoming last Friday that seemed to reassure financial markets. The S&P 500 (SPY) finally closed at a new all-time high, and the U.S. dollar cooled off a bit again.

Source: FreeStockCharts.com

Source: TradingView.com

Fundamentally, the speech contained no new news, but it did reaffirm the Fed’s gradual path of rate normalization within an environment where runaway inflation is not a concern. In other words, while the Fed will keep hiking rates, the path upward will stay slow and likely plateau sooner than later. Moreover, Powell reassured markets that the Fed is well aware of the risks of leaving rates too low and hiking rates too high. Powell expressed the dilemma in two questions:

“…two opposing questions that regularly arise in discussions of monetary policy both inside and outside the Fed:

1. With the unemployment rate well below estimates of its longer-term normal level, why isn’t the FOMC tightening monetary policy more sharply to head off overheating and inflation?

2. With no clear sign of an inflation problem, why is the FOMC tightening policy at all, at the risk of choking off job growth and continued expansion?”

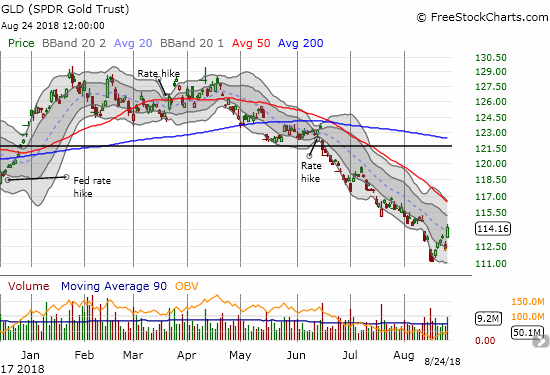

With Powell’s soothing answers bringing the U.S. dollar index back down to uptrending support at its 50-day moving average (DMA), gold and silver jumped higher. The SPDR Gold Shares (GLD) in particular confirmed its recent signs of a bottoming process. It looks like the dollar will not stand in the way of a more extended rally for gold and, hopefully, silver.

Source: FreeStockCharts.com

The divergence in performance between GLD and iShares Silver Trust (SLV) remains striking even as SLV actually gained more than GLD on Friday. While it seems I chose the wrong directions for my pairs trade, I am going to stick to plan and soon pair fresh GLD puts to my stacks of SLV calls.

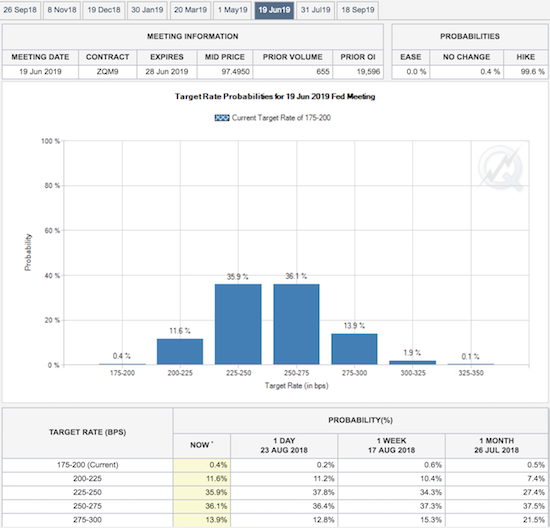

While Powell’s speech seemed to move the U.S. dollar index, it had little impact on the odds for the next set of rate hikes. The odds for a September rate hike are at 96%, down from Thursday’s 98.1% and up from 90.4% a month ago: these odds are all high enough to mean near certainty the Fed will hike in September. For December, the odds for a rate hike following a September rate hike are 63.7%. These odds were 68.6% on Thursday and also 68.6% a month ago. Again, the market is essentially expecting the Fed to hike in December after a September hike.

With two more rate hikes pretty much a lock for 2018, I searched down the calendar to calculate when the market expects the first rate hike for 2019. According to the CME FedWatch, the odds do not pass 50% until June, 2019: the market has priced in a 52% chance of a rate hike to at least 250-275 basis points (bps) or 2.50% to 2.75%. The current range is 175-200 bps.

Source: CME FedWatch

The 2019 odds are now the larger pivot point for rate-driven dollar moves. It will take quite a shock to push the Fed off its path of rate hikes for 2018 (not even President Trump’s increasing complaints will move this needle). With the market relaxing about the prospects for a 2019 rate hike, risks should exist to the upside. Anything that pulls expectations earlier (like to March, 2019) should send the U.S. dollar hurtling upward.

Powell’s speech was worthwhile reading and a good review of some important monetary policy issues from the last few decades. He spent much of the speech answering the questions posed above. I pulled out some sections that interested me the most.

Powell made it clear that the Fed is well-aware of the dilemmas it faces in questions about the speed of rate normalization.

“These questions strike me as representing the two errors that the Committee is always seeking to avoid as expansions continue–moving too fast and needlessly shortening the expansion, versus moving too slowly and risking a destabilizing overheating. As I will discuss, the job of avoiding these errors is made challenging today because the economy has been changing in ways that are difficult to detect and measure in real time.”

The Fed is also well aware it faces a dynamic economy which defies economic models of the past.

“…the FOMC has been navigating between the shoals of overheating and premature tightening with only a hazy view of what seem to be shifting navigational guides. Our approach to this challenge has been shaped by two much discussed historical episodes–the Great Inflation of the 1960s and 1970s and the “new economy” period of the late 1990s.”

Moving slowly and incrementally as long as the economic environment allows is the answer to the Fed’s dilemmas.

“I see the current path of gradually raising interest rates as the FOMC’s approach to taking seriously both of these risks. While the unemployment rate is below the Committee’s estimate of the longer-run natural rate, estimates of this rate are quite uncertain. The same is true of estimates of the neutral interest rate. We therefore refer to many indicators when judging the degree of slack in the economy or the degree of accommodation in the current policy stance. We are also aware that, over time, inflation has become much less responsive to changes in resource utilization.”

Inflation expectations are a bedrock of monetary policy. No matter what else is going on in the economy or even with monetary policy, as long as inflation expectations are “anchored” to the Fed’s target rate then the economy will find its footing in due time. (Emphasis mine)

“When longer-term inflation expectations are anchored, unanticipated developments may push inflation up or down, but people expect that inflation will return fairly promptly to the desired value. This is the key insight at the heart of the widespread adoption of inflation targeting by central banks in the wake of the Great Inflation. Anchored expectations give a central bank greater flexibility to stabilize both unemployment and inflation. When a central bank acts to stimulate the economy to bring down unemployment, inflation might push above the bank’s inflation target. With expectations anchored, people expect the central bank to pursue policies that bring inflation back down, and longer-term inflation expectations do not rise. Thus, policy can be a bit more accommodative than if policymakers had to offset a rise in longer-term expectations.”

With inflation expectations well-anchored, financial stability becomes a greater focus of attention for the Fed.

“Part of the reason inflation sends a weaker signal is undoubtedly the achievement of anchored inflation expectations and the related flattening of the Phillips curve. Whatever the cause, in the run-up to the past two recessions, destabilizing excesses appeared mainly in financial markets rather than in inflation. Thus, risk management suggests looking beyond inflation for signs of excesses.”

Inflation is reaching the Fed’s 2% target, but the Fed is not changing its “steady and slow” approach as a result. This combination suggests that a June rate hike as the first move in 2019 makes a lot of sense. Only the threat of overheating will pull those odds forward.

“While inflation has recently moved up near 2 percent, we have seen no clear sign of an acceleration above 2 percent, and there does not seem to be an elevated risk of overheating. This is good news, and we believe that this good news results in part from the ongoing normalization process, which has moved the stance of policy gradually closer to the FOMC’s rough assessment of neutral as the expansion has continued. As the most recent FOMC statement indicates, if the strong growth in income and jobs continues, further gradual increases in the target range for the federal funds rate will likely be appropriate.”

Powell’s Jackson Hole speech provided plenty of clear guidance on the Fed’s go-forward plans. Powell effectively took the Fed out of the equation for near-term investment decisions. Only sudden and abrupt changes in the economic environment will cause any potential concern.

Be careful out there!

Full disclosure: net long the U.S. dollar, long SPY puts