Redfin (RDFN) may have provided one of the first validations of the (presumed) investor fears that have weighed down the stocks of home builders since the February sell-off. In its last earnings report on August 9, 2018, RDFN provided this brief, yet significant, warning:

“We expect U.S. home sales growth to slow and even perhaps reverse in August and September…”

In several Housing Market Reviews this year, I have pointed out the patterns of deceleration in several important housing market data sets. So, RDFN’s forecast is not shocking. Still, it was a rare acknowledgement from a player in the U.S. housing market. The guidance was based on the last four weeks of housing market activity, making these expectations fresh and forward-leaning from the earlier earnings reports from home builders. The housing market slowdown will have a material impact on RDFN’s business. From the Seeking Alpha Transcript of the earnings conference call:

“We’re now forecasting slower revenue growth for the third quarter, based on an unexpected drop in Redfin’s bookings growth in the past three weeks, slowing traffic growth and a weakening real estate market.”

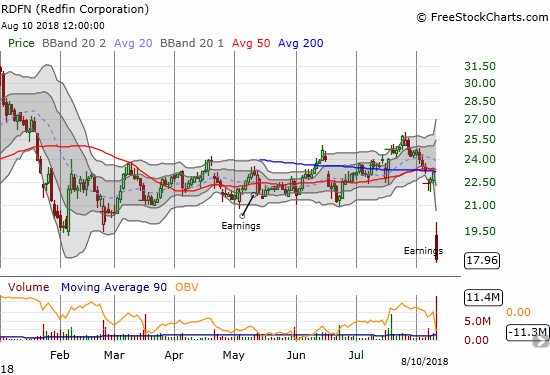

RDFN’s stock dropped 22.4% to a new all-time low in the wake of its earnings report. As if the slowing housing market was not enough, RDFN also reported a plunge in earnings per share due to a ramp in marketing spending and other costs. Investors never want to hear that a company’s business growth is highly dependent on the success of increased marketing (and/or sales) costs well in advance of revenue growth and during a year where the company expects to operate at a loss. Marketing spend in the second quarter increased a whopping 40% year-over-year (revenue increased 36%) and increased 35% year-over-year over the previous two quarters. Spending specifically on advertising media ramped 53% year-over-year in the second quarter. Fpr the third quarter RDFN expects to increase year-over-year growth in spending on selling and marketing. From the Business Outlook section of the earnings report:

“Net income between $1.2 million and $2.8 million, compared to net income of $10.6 million in the third quarter of 2017. This guidance includes approximately $5.6 million of expected stock-based compensation, $2.0 million of expected depreciation and amortization, and $1.6 million of interest expense from the convertible notes issued in July 2018.”

From the conference call:

“Net income didn’t improve from 2017 to 2018, because operating expenses grew 31% year-over-year, while gross profit grew 22%. Gross margin declined from 35.2% in the second quarter of 2017 to 31.7% in the second quarter this year. Some of this is the result of investments in personal service from Redfin’s buyers’ agents that we don’t expect to pay off until 2019. Some of it is due to growth in mortgage and title businesses that we expect to operate at margins similar to our brokerage business, but not for several years. And some of it is because of Redfin Now, our business of buying a home on our own account and then selling it.”

The conference call provided additional color on the weakness RDFN sees in the U.S. housing market.

- Home buyers are “frustrated” by the high cost of the few homes available for sale.

- Millennials are struggling in an “unbalanced” housing market.

- Most telling: “…for the first time in years, we are getting reports from managers of some market that homebuyer demand is waning, especially in some of Redfin’s largest markets.”

- In July, the percentage of homes selling above list price declined for the first time in over three years.

- Clarification on the recent slowdown: “We’ve had three bad weeks and one good week in the past four weeks..We haven’t seen this kind of week-to-week volatility much.”

RDFN dressed up its need to increase marketing spend by referencing the multi-year impact of television advertising and a need to increase brand awareness (currently in the low single digits). The company also discussed its deepening investment in personal service in order to increase customer engagement which improved for the first time in three years. I process these initiatives within the larger context of a more challenging housing market and a marketplace full competition for RDFN’s array of services, and I see little upside ahead for RDFN’s stock except as part of a relief rally.

Still, there could be a pairs trade opportunity going long RDFN versus short Zillow Group (Z). After its implosion, RDFN sells at 4x sales while Z sells for 8x sales (according to Yahoo Finance). Zillow likely needs to get much cheaper under the current conditions. Moreover, shorts are more bearish on RDFN than Z with 14.3% of RDFN’s outstanding shares sold short versus 8.3% for Z (at the time of writing, the percentage of float sold short was not available for Z). The larger short interest provides a relatively larger well of buying support when the selling in the stock gets well over-extended. I will likely wait a few days before pulling the trigger on this trade. For now, RDFN is oversold well below its lower-Bollinger Band (BB) and Z has bearishly broken down below its 200DMA support after suffering its own post-earnings sell-off.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: no positions