“The Australian dollar has appreciated somewhat recently. In part, this reflects some increase in commodity prices, but monetary developments elsewhere in the world have also played a role. Under present circumstances, an appreciating exchange rate could complicate the adjustment under way in the economy.” – Statement by Glenn Stevens, Governor: Monetary Policy Decision, April 5, 2016 (emphasis mine)

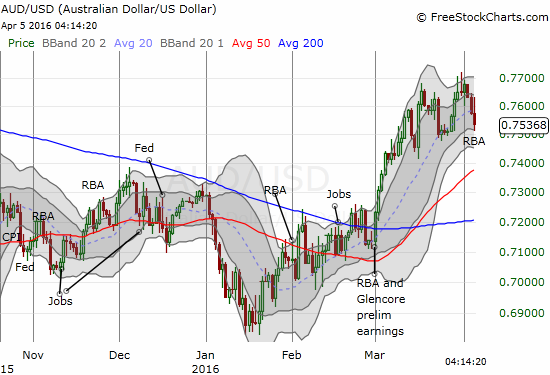

The Reserve Bank of Australia (RBA) has not referred to undesirable strength in the Australian dollar (FXA) in a very long time. The currency has had a very strong run against the U.S. dollar from the January lows although in the past month AUD/USD has swung wildly. Note how the rally accelerated after the LAST RBA meeting!

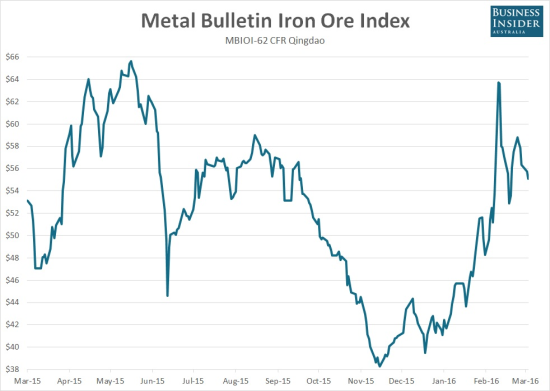

The Australian dollar has held up even as iron ore prices have tumbled off a recent and dramatic run-up.

Source: Business Insider Australia

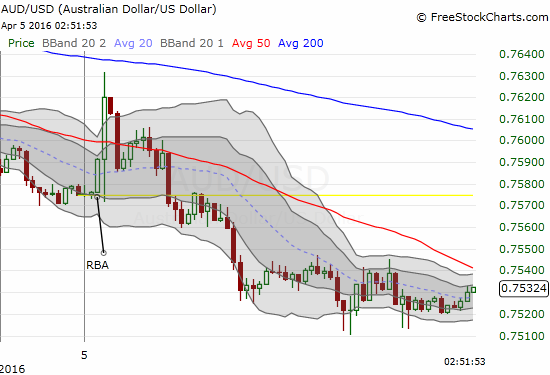

The intraday reaction to the RBA’s latest statement on monetary policy was very strange. The currency was very voaltile. The currency market could not decide what to think: an initial burst upward followed by a persistent sell-off.

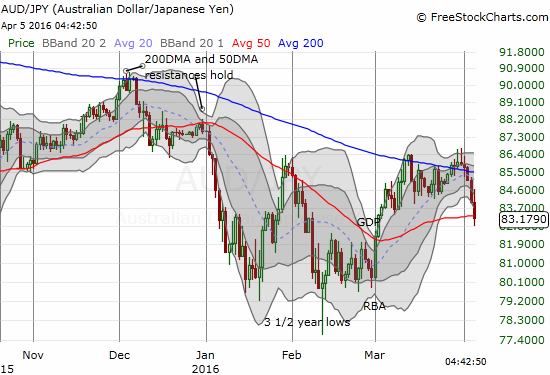

The intraday reaction to the RBA was surprising. Despite the RBA’s explicit reference to the problematic Australian dollar, the currency surged for the first 30 minutes or so. It took another 3 hours for that trigger reaction to reverse. As of the time of writing, the weakness is on-going. Perhaps most importantly, AUD/JPY has definitely failed its test with its 200-day moving average (DMA). Even the 50DMA is failing as support. I hear bears roaring in the distance…

Source for charts: FreeStockCharts.com

The rest of the RBA’s statement was pretty much boilerplate: China’s growth rate is still moderating, Australia’s terms of trade are much lower, global financial conditions remain accomodative, inflation is low, the economy is relatively sound overall, and the RBA thinks rates should stay where they are. The RBA still claims it remains ready to drop rates if needed. The housing market is one point of notable change: “Credit growth to households continues at a moderate pace, albeit with a changed composition between investors and owner-occupiers. The pace of growth in dwelling prices has moderated in Melbourne and Sydney and has remained mostly subdued in other cities.”

Overall, I am keeping a neutral stance on the Australian dollar. I remain short AUD/JPY, but I like to go long the Australian dollar against weaker currencies for short-term trades. This approach will naturally change if the Australian dollar suddenly becomes one of those weaker currencies.

Be careful out there!

Full disclosure: long and short various currencies against the Australian dollar