(This is an excerpt from an article I originally published on Seeking Alpha on December 9, 2014. Click here to read the entire piece.)

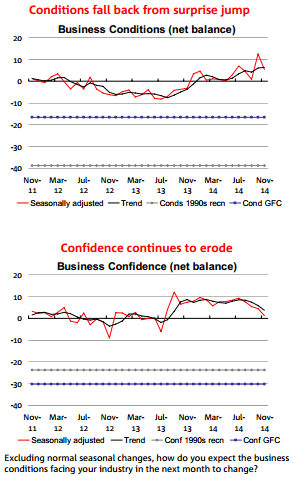

The DailyFx lists the the National Australia Bank’s (NAB) monthly indices for Business Confidence and Business Conditions as having a low impact on currency markets. As a result, I do not have this report on my radar for analysis or trades. However, “this time was different.” The DailyFx listed “expectations” for Business Conditions as 13 and Business Confidence as 5. The actuals came well under at 5 and 1 respectively. I think the higher expectations were extrapolations from a relatively strong and encouraging October report. The response in overnight currency markets was immediate; the selling in the Australian dollar (FXA) is on-going at the time of writing.

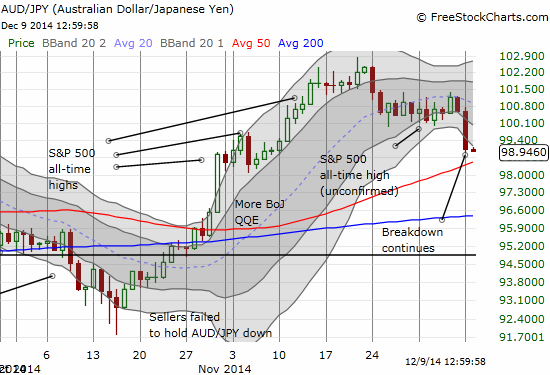

Per the strategy I outlined in early November, I trigger shorts (or increase them) on the Australian dollar on confirmed weakness. {snip}

Source of charts: FreeStockCharts.com

{snip}

Source: National Australia Bank

The NAB notes that the trend for business conditions are much better than 12 to 18 months ago. The large spike in conditions in October was “broad based” while November’s plunge was narrowly “concentrated in retail, manufacturing and service industries.” However, there were three items with potentially large implications for the Australian dollar.

{snip}

No surprise that the confidence numbers are highest in construction and in finance/property given Australia’s hot housing markets, especially in Sydney. Ironically, these very same markets are likely making the RBA hesitant to cut rates to new historic lows. All other sectors plunged. Mining was of course the worst performer of all.

Perhaps ironically, forward looking indicators do not (yet?) reflect much of the current doldrums. {snip}

The bottom-line is that the Australian dollar’s weakness has inherited its own momentum now. Traders are now very willing to take the currency lower: no more “stubbornly strong Australian dollar.” The RBA need do little to nothing from now until the February monetary policy decision. I expect the Australian dollar to its low point well ahead of that meeting and then churn into it as market participants await confirmation of a freshly dovish RBA…whether in the form of a rate cut or the promise of imminent cuts.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 9, 2014. Click here to read the entire piece.)

Full disclosure: net short the Australian dollar