(This is an excerpt from an article I originally published on Seeking Alpha on January 25, 2015. Click here to read the entire piece.)

Perhaps the market was really expecting a much lower inflation reading in Australia.

The Australian Bureau of Statistics reported the Consumer Price Index (CPI) in Australia for the fourth quarter of 2014 at 0.2% after a 0.5% reading in the previous quarter. This was below “expectations” for 0.3%. The CPI for the year came in at 1.7%. While this brings inflation below the Reserve Bank of Australia’s target range of 2 to 3%, the decline in CPI was greatly dominated by the fall of gasoline prices:

{snip}

So, it will be very easy for the Reserve Bank of Australia to look through the impact of oil prices to decide it can continue to wait before dropping interest rates. Notably, the housing component of the CPI was relatively strong for 2014:

{snip}

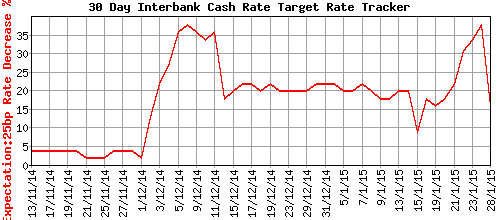

A delay in a rate cut is exactly what the market concluded as the odds for a rate cut in next week’s meeting on monetary policy plunged from 38% to 16%. This move completely reversed the gains inspired by the surprise rate cut from the Bank of Canada just last week.

Source: ASX RBA Rate Indicator

{snip}

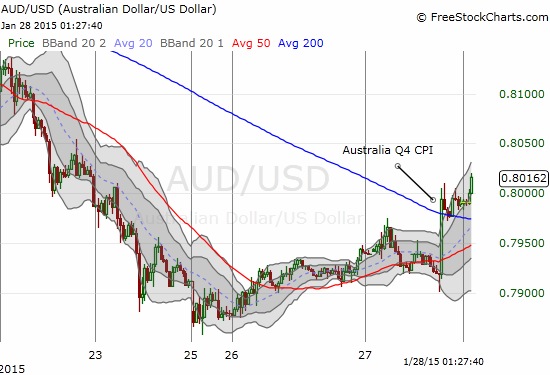

Source: FreeStockCharts.com

I am skeptical of the market’s conclusion. After all, one central bank after another has pointed to oil as a reason to proactively make a move against disinflationary forces. With iron ore freshly plunging this year, now at a 5 1/2 year low and down about 14% year-to-date already, the RBA has every excuse it needs to begin easing again at its next meeting.

Regardless, I consider this rally another opportunity to fade the Australian dollar. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 25, 2015. Click here to read the entire piece.)

Full disclosure: net short the Australian dollar