(This is an excerpt from an article I originally published on Seeking Alpha on October 14, 2014. Click here to read the entire piece.)

{snip}

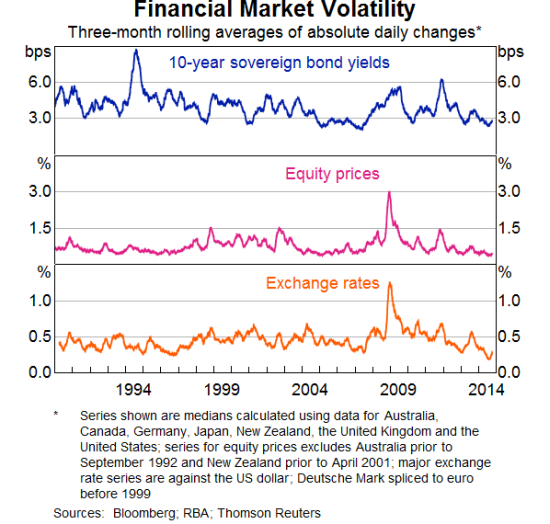

Guy Debelle, an Assistant Governor of the Reserve Bank of Australia (RBA), delivered a must read speech on pricing and volatility in financial markets. He was about as subtle as a ton of bricks in laying out a panoply of risks that lie ahead for traders and investors in bonds, stocks, and foreign exchange. Debelle spoke of sell-offs, corrections, and market disruptions in terms of “when”, not “if.” {snip}

Similar to the rhetoric we have heard from the world’s major central bankers, Debelle expressed surprise at the persistence of low volatility given all the disruptive events going on in the world:

{snip}

Later in the speech, Debelle implies that there is no rational explanation for this “state of affairs.” {snip}

However, Debelle completely ignores or at least attempts to step aside from the recent history. Seeing is believing for investors. In general, central banks have reacted only in one direction and have tended to show extreme caution and prejudice AGAINST data that suggest that the current course of monetary policy needs any dramatic adjustment. Even when discussing prospects for higher rates, the Bank of England (BoE) and the U.S. Federal Reserve speak of extraordinary gradualism. They speak in reassuring words that the ultimate destination for rates is much lower than what was considered normal not long ago. {snip}

What REALLY raised my eyebrows in this section of the speech was Debelle’s suggestion that we should NOT automatically believe and accept the pronouncements of central banks {snip}

Debelle seriously begs the question of what exactly kind of thinking do we need to do for ourselves? Read between the lines? Read the minds of central bankers? Quibble with their economic forecasts? Perhaps even bet against the printing press? I think not. I have frequently observed that the market is often hyper-sensitive to the words of central bankers, but cooler heads almost always prevail. Debelle’s statement made me wonder whether I should also be reading between the lines of this very speech. Hmmm…

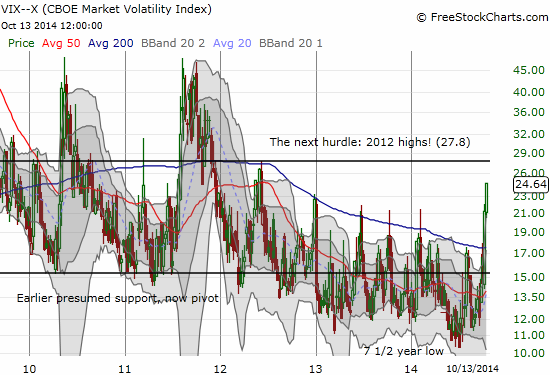

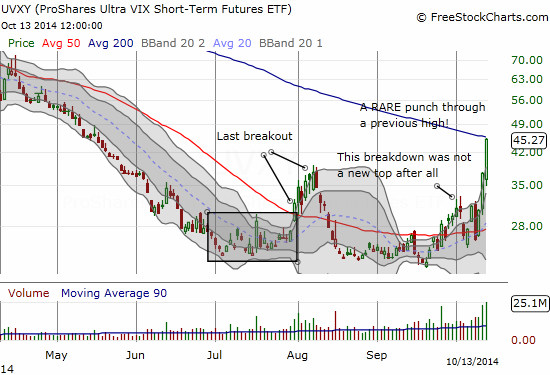

Anyway, things really get interesting, even disturbing at times, when Debelle discusses the possibilities for market disruptions. He first takes aim at institutions who think they are making easy money chasing yield by selling volatility protection at low premiums {snip}

{snip}

Source for charts: FreeStockCharts.com

{snip}

The disruptive impact of the sell-off will be driven by investors who are buying assets with “…the presumption of a level of liquidity which is not there.” If that is not a stern warning of a major crash-like event, I do not know what is:

{snip}

Source: St. Louis Federal Reserve

{snip}

This is definitely one area of analysis where market participants are thinking for themselves and essentially ignoring the constant reminders from the RBA that the currency is extremely over-valued. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 14, 2014. Click here to read the entire piece.)

Full disclosure: long the Australian dollar, short the euro, net long the U.S. dollar