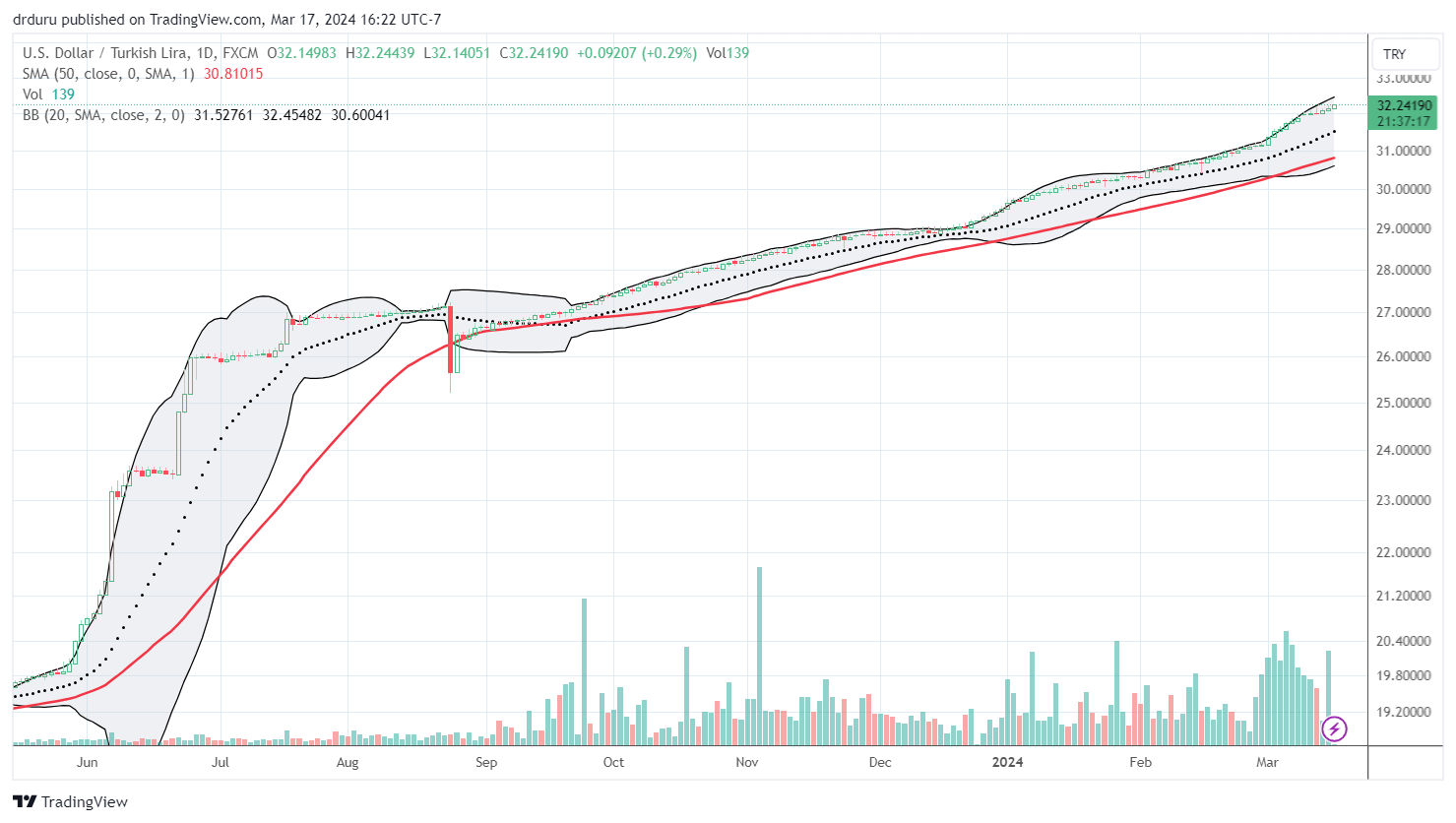

In early December, I was hopeful that the Turkish lira would finally find its footing. The Central Bank of the Republic of Turkey (CBRT) was aggressively hiking rates and currency reserves sat at record levels. The high interest rate (40% at the time) made betting on eventual currency appreciation appear worth the risk. While collecting substantial interest payments since then, persistent deterioration in the lira ate up those gains and then some. Almost every day, the U.S. dollar has gained ground on the lira. The series of record highs for USD/TRY have driven the currency pair to an 11.4% gain since my post. Commentary a week ago on stocktwits about the lira’s prospects forced me to belatedly reinterpret the price dynamics. The trend is clear. The trade is even clearer: follow the trend.

Combined with my recent experience getting caught in the massive devaluation of the Nigerian niara, I realized that following the trend makes sense. A sudden devaluation could also come for Turkey if the monetary authorities are forced to hit a reset button against massive inflation, now a crushing 67.1% and trending higher since previously bottoming last summer (and much higher than the current 45% interest rate on the lira). Accordingly, I flipped my positions from long to short the lira. However, I did reduce my overall exposure given elections are coming in Turkey at the end of the month.

On February 22, the CBRT held interest rates steady while stating (emphasis mine): “External financing conditions, level of foreign exchange reserves, improvement in current account balance, and demand for Turkish lira denominated assets continue to contribute to exchange rate stability and the effectiveness of monetary policy. The determination in tight monetary stance will continue to contribute to Turkish lira’s real appreciation process, which is a key element of disinflation.” The chart above alone contradicts the core tenet of these claims. Monetary policy has not been effective.

To wit, the CBRT is scrambling once again to figure out how to get the deteriorating situation under control. At the end of last week, the CBRT moved to tighten policy further without hiking interest rates. As with prior policy moves the lira failed to respond. I now know to defer to the signals in the currency exchange market. I have little need to try to get ahead of a change in dynamics. As many forex traders learn: just follow the trend. (My motto: “The trend is your friend until it ends. The extreme is your team once it runs out of steam.”)

Be careful out there!

Full disclosure: long USD/TRY