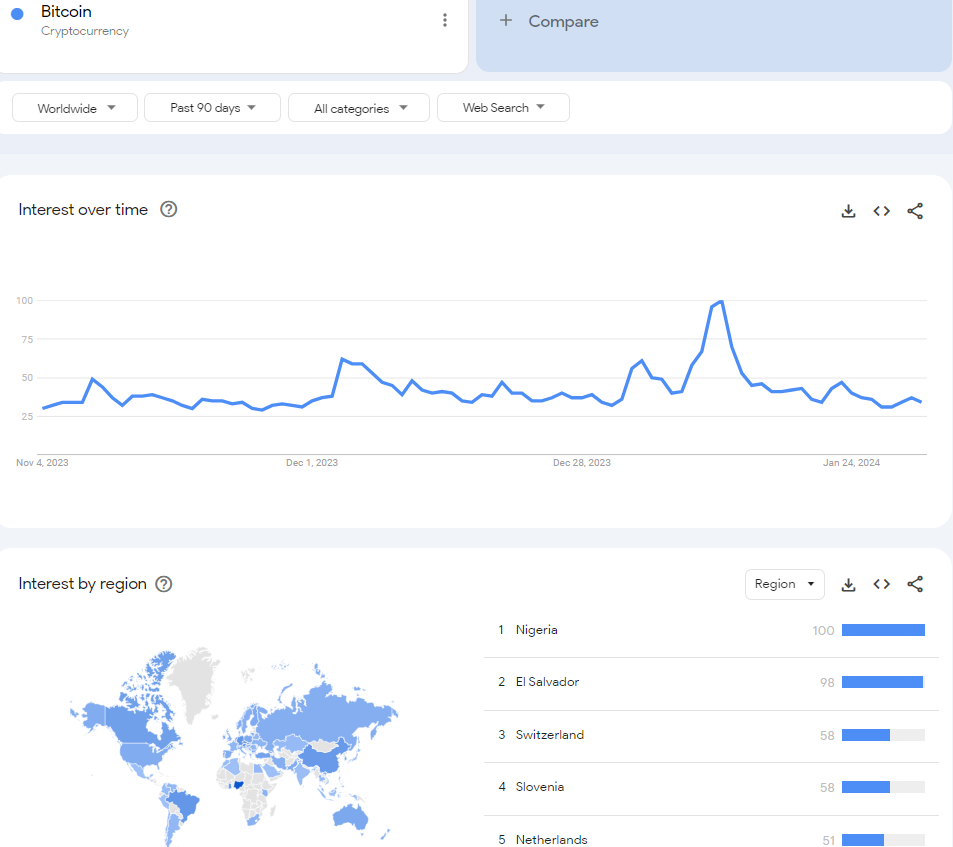

As the Nigerian naira plunges in value, Nigerians are scrambling for ways to protect their purchasing power. In this modern era, Bitcoin (BTC/USD) offers the promise of a digital store in value. Accordingly, Nigeria has returned to the number one spot in the world for national share of searches taken by Bitcoin according to Google trends ( see “Explore results by region” for a detailed definition of the regional view of Google search trends).

Nigeria was second to El Salvador in 2021 and 2022 in share of Google queries spent on Bitcoin after losing the #1 spot in 2020 when Ghana and South Africa rounded out the top three. The country jumped back to #1 in 2023 and remains there year-to-date for 2024.

While Nigerians lead the world in share of searches on Bitcoin, relative search interest within the country has remained stable since soaring to a peak in 2022. So the global comparison is key to understanding and contextualizing the intensity of interest in Bitcoin.

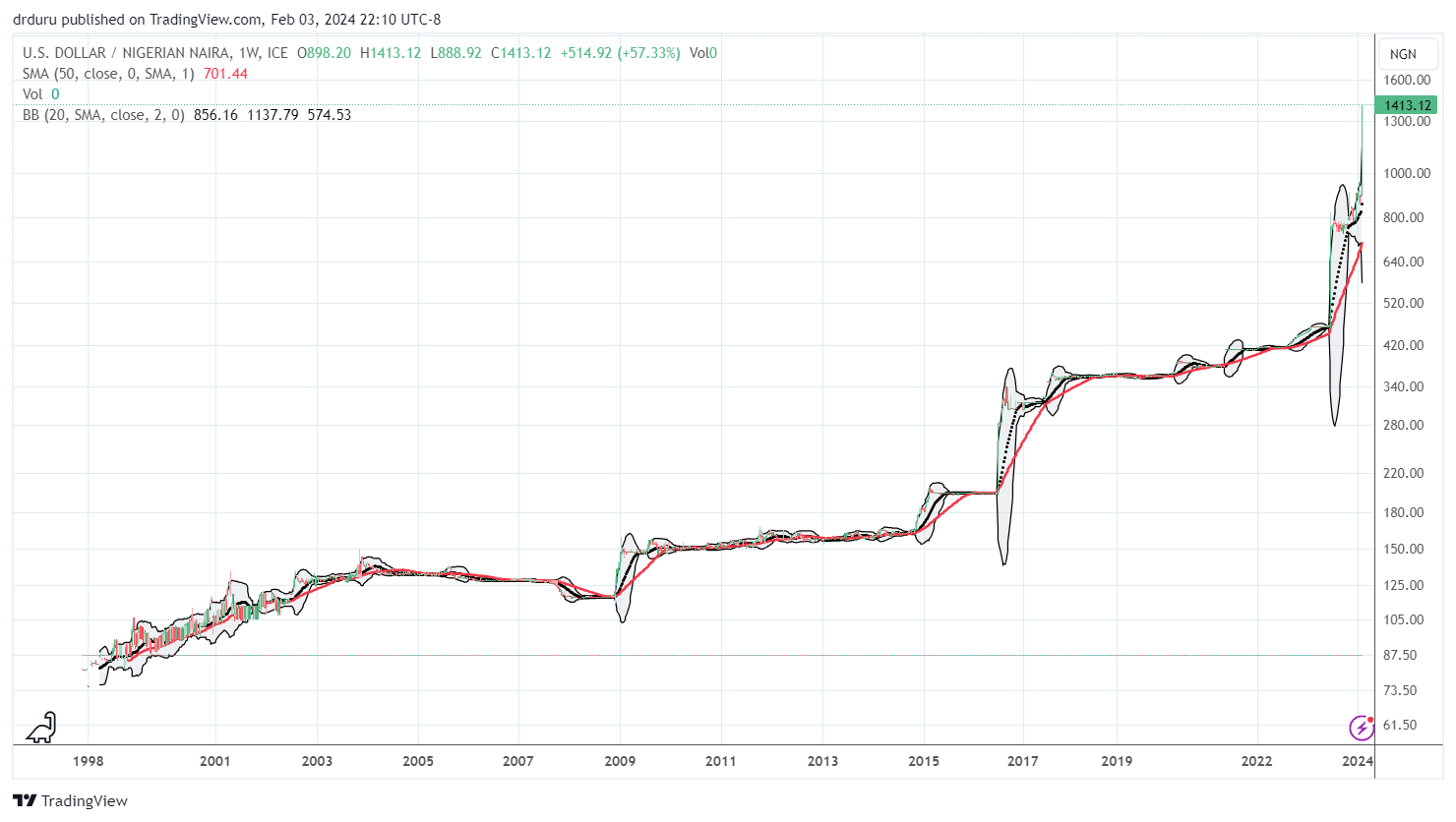

The Great Devaluation

Nigerians have suffered an on-going devaluation in the currency for years. The freefall accelerated in the past 9 months thanks to government action to rationalize the foreign exchange for the currency. Last year’s move was supposed to close the gap with the black market rates. This year’s action is supposed to attract investors to the country. If the gambit works, the subsequent growth could finally carve out a bottom for Nigeria’s economic prospects. Until then, Nigerians will continue to scramble for ways to preserve their purchasing power. The U.S. dollar has nearly tripled in value against the naira since last June.

The devaluation has also punished the Global X MSCI Nigeria ETF (NGE). Last year NGE looked like it was stabilizing albeit in a wide range. Last week’s trading action destroyed that hope. NGE closed last week at lows last seen at the trough of the pandemic.

Going forward, it is hard to imagine things getting much worse. Yet, of course, such a hope was expressed many times before. Still, this recent devaluation is swift and severe and should bring the currency in-line with real market values. While I would like to give NGE one more try, the ETF is being liquidated. As far as I know, there will be no other way to invest in a similar Nigeria-based ETF. {updated/corrected 2/4/2024}

Be careful out there!

Full disclosure: long NGE, long BTCUSD

Regarding NGE, you do know that the ETF is undergoing liquidation and has only two stock positions now which make up only 5% of the NAV? Not at all a good way to invest in Nigeria.

Thanks for that reminder!

Yes, a friend of mine was explaining that to me before I wrote the article, and I somehow let that slip my mind. I am revising the article accordingly. I told my friend that I now have no direct way to invest in Nigeria. He did not offer me any other ideas….

Thank you for the reply. I was thinking about buying some NGE after the big decline nad your article, but luckily I clicked on “Holdings” before doing that, and saw only two stocks! I searched some more and found out it is being liquidated.

Yep! Again, sorry for the omission! I also was wondering why the holdings had almost all disappeared. I had made a mental note to follow-up but then got distracted by finishing this article. My intent was really the crypto angle and not the Nigerian investment angle.