A week ago, the Central Bank of the Republic of Turkey (CBRT) hiked its policy interest rate another whopping 500 basis points to 40%. The response in currency markets was a collective yawn. The CBRT explained that while inflation performed in-line with expectations, “the existing level of domestic demand, the stickiness in services inflation, and geopolitical risks keep inflation pressures alive.”

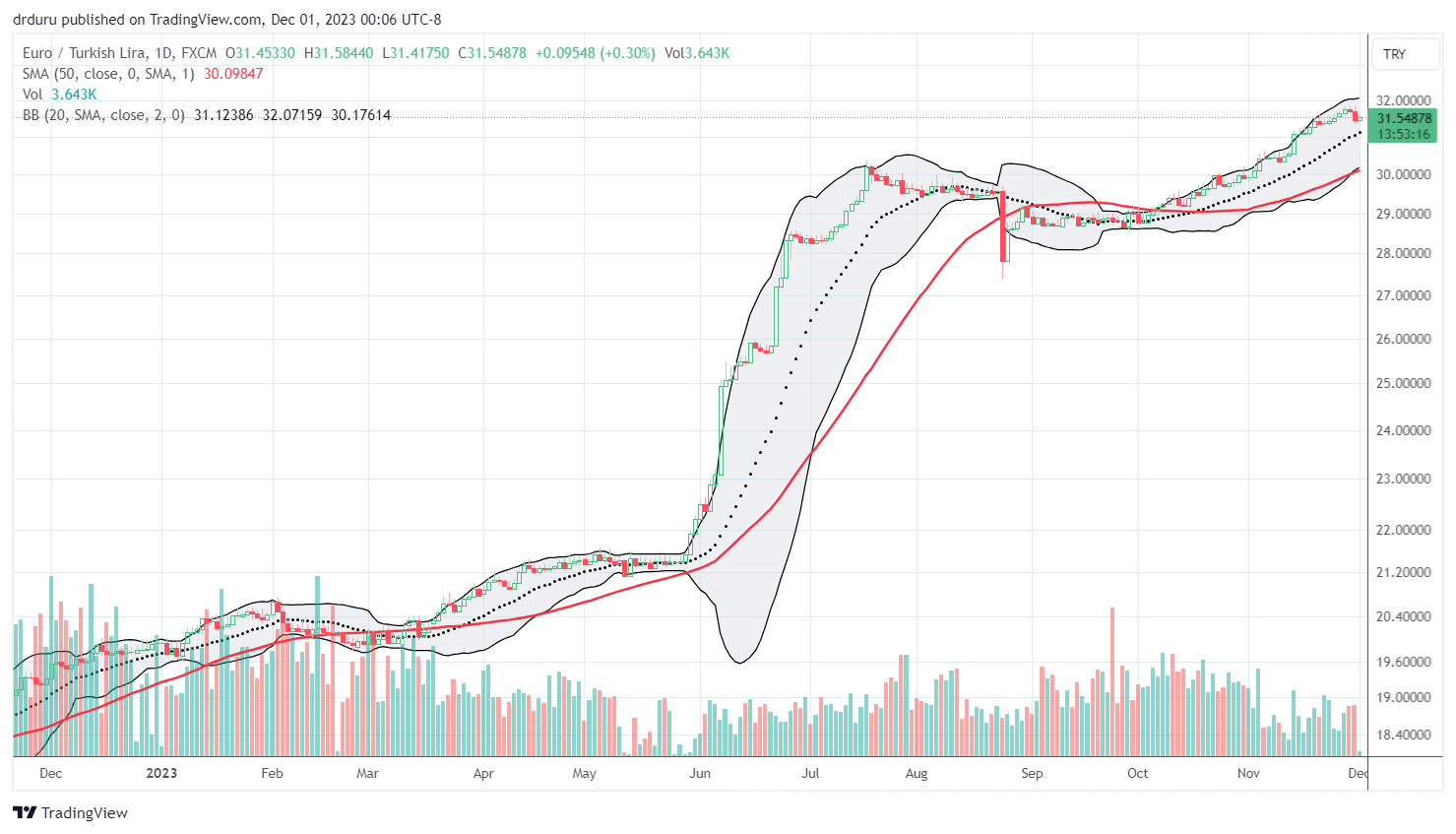

Despite the large rate increase, the Turkish lira barely budged and USD/TRY and EUR/TRY actually continued to drift higher. Perhaps financial markets responded to the implication of a peak in interest rates. The CBRT gave an encouraging assessment on the path of inflation and observed that its work through rate hikes is near completion: “The Committee assessed that the current level of monetary tightness is significantly close to the level required to establish the disinflation course. Accordingly, the pace of monetary tightening will slow down and the tightening cycle will be completed in a short period of time. The monetary tightness will be maintained as long as needed to ensure sustained price stability.”

Still, I interpreted the financial market’s response as an opportunity to take another shot going long on the lira, a shot that I would have otherwise missed. A while back, I took a loss on a previous position I accumulated in the wake of the last CBRT rate hike.

Reserves

A recent report from Reuters on currency reserve levels seemed to vindicate my renewed bullishness on the Turkish lira. These reserves are now at a new record $136.5B, surpassing the last high of $135.96B set in December, 2013. USD/TRY rose around 18% over the prior 11 years. Since the previous record, USD/TRY has soared by an astonishing factor of 15, a complete collapse in value for the Turkish lira. (No wonder worldwide Google search trends for “bitcoin” over the last 5 years rank Turkey 7th among nations but 13th over the last 90 days!)

Reserves have risen rapidly thanks to the CBRT getting serious about monetary policy with rate hikes starting in June. The CBRT reversed an ill-advised policy to CUT rates in response to increasing inflation. With the central bank also ending its policy of draining reserves in a failed attempt to prop up the lira, the currency should start to look better to investors and traders given the extremely high yield. Indeed, Reuters reported that banks like Deutsche Bank (DB) and JPMorgan Chase (JPM) are projecting that “lira-denominated instruments may be one of the best trades among emerging markets in 2024.”

The Trade

Like my last trade going long the lira, I am starting small and shorting the euro against the lira (EUR/TRY) instead of using the dollar. The euro enjoyed a particularly strong run in November while the U.S. dollar lagged. I prefer betting against the euro instead of the dollar after such a run.

Be careful out there!

Full disclosure: short EUR/TRY