After Canada experienced a hot inflation print for the month of August (the Consumer Price Index (CPI)), I aggressively declared the Canadian dollar a buy, long Invesco CurrencyShares Canadian Dollar Trust (FXC) and short USD/CAD. I ignored the technicals of support at an upward sloping 50-day moving average (DMA) (the red line below) on USD/CAD at my own peril. The trade worked for a few days as USD/CAD kept fighting to break support and buyers kept defending support. The magnetic pull of other fundamental forces eventually overwhelmed the influence of the inflation print with a triple whammy.

- Blowback from Canada accusing India of a political assassination on Canadian soil.

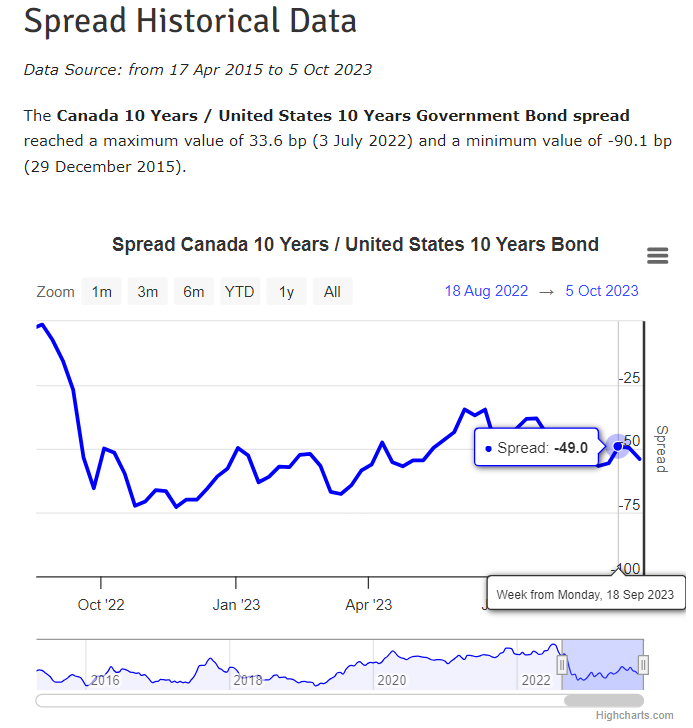

- A widening yield spread between the 10-year Canadian government bond and the 10-year U.S. government bond in favor of the U.S.

- An apparent peaking in oil prices.

The chart below summarizes recent signature events.

One Whammy

I cannot know for sure whether the controversy surrounding Canada’s accusations have impacted the Canadian dollar. However, I am guessing a currency is not helped when a country of over a billion is indignant over the words and actions of a country of 40 million. Moreover, the timing of the spat is “convenient” given it came right before the inflation report. The diplomatic crisis has grown ever since.

Two Whammy

I am much more confident that the widening spread between the 10-year government bonds of Canada and the U.S. have made the U.S. dollar relatively more attractive than the Canadian dollar. According to World Government Bonds, the spread has widened since it reached its narrowest point of the year in June. (The spread here is the Canadian yield minus the U.S. yield). Yet, at the point of the August CPI, the spread was on a narrowing trend…and that trend came to an end that week. The spread has started widening ever since largely thanks to surging bond yields in the U.S. (Astute observers will notice the rangebound movement in the spread roughly coincides with the USD/CAD trading range over the past year).

Triple Whammy

The Canadian dollar is known as a commodity currency given the strong influence of oil on the Canadian economy. Oil prices have surged since lows in June. Yet, contrary to typical correlations, the U.S. dollar also strengthened over this time. That strength did not spare the Canadian dollar. USD/CAD bottomed out in June and July. Today, oil fell over 5% and seemed to leave behind a peak in prices last week. The United States Oil Fund (USO) even broke down below its 50DMA. For now, that weakness seemed to add pressure on the Canadian dollar as the U.S. dollar just continued strengthening.

Business and finance headlines are pointing to recent, weak U.S. economic data to explain the sharp plunge. I think that is too simplistic given oil is not a major part to the U.S. economy. Still, U.S. gasoline consumption is at a seasonal 22-year low. So, I am surprised oil prices have been able to soar as much as they have to-date! Regardless, weakening oil prices will not help the Canadian dollar.

The Opportunity

The Canadian dollar faces a triple whammy that could get worse before it gets better. Yet, I remain bullish. USD/CAD has risen fast and hard toward its high of the one-year trading range. The rise in U.S. bond yields has become extreme. Sentiment on bonds has become extremely negative. The diplomatic row will get resolved or at least abate from the minds of traders. Oil prices will stabilize at some lower level. The opportunity from some kind of cooling is due sooner than later. Thus, my new bet on the Canadian dollar is for an eventual reversal of the sharp weakness over the past week.

Be careful out there!

Full disclosure: short USD/CAD, short USO shares and long USO call

Posted a follow-up on the InflationWatch blog: https://inflationwatch.wordpress.com/2023/11/11/canadas-version-of-higher-for-longer-inflation-risks-have-increased/