The United States Oil Fund, LP (USO) has declined six straight Mondays and seven of the last eight. Prior to this streak, USO only declined 39% of Mondays in 2022 (where the market was trading on the prior Friday). Overall, the split is essentially 50/50 with 19 Monday blues versus 20 Monday gains. In other words, the recent streak of negativity has created a reversion to the mean for USO’s Mondays this year.

Despite this streak of Monday blues, USO has essentially traded in a range since confirming a breakdown below its 50-day moving average (DMA) (the red line below) on July 5th. Moreover, USO has maintained a slight uptrend from the September lows. In fact, at current prices, USO trades right where it sat over 8 months ago. The trading action since October has been more constructive as USO appears to accumulate energy to force a confirmed 200DMA (the blue line below) breakout.

The Data

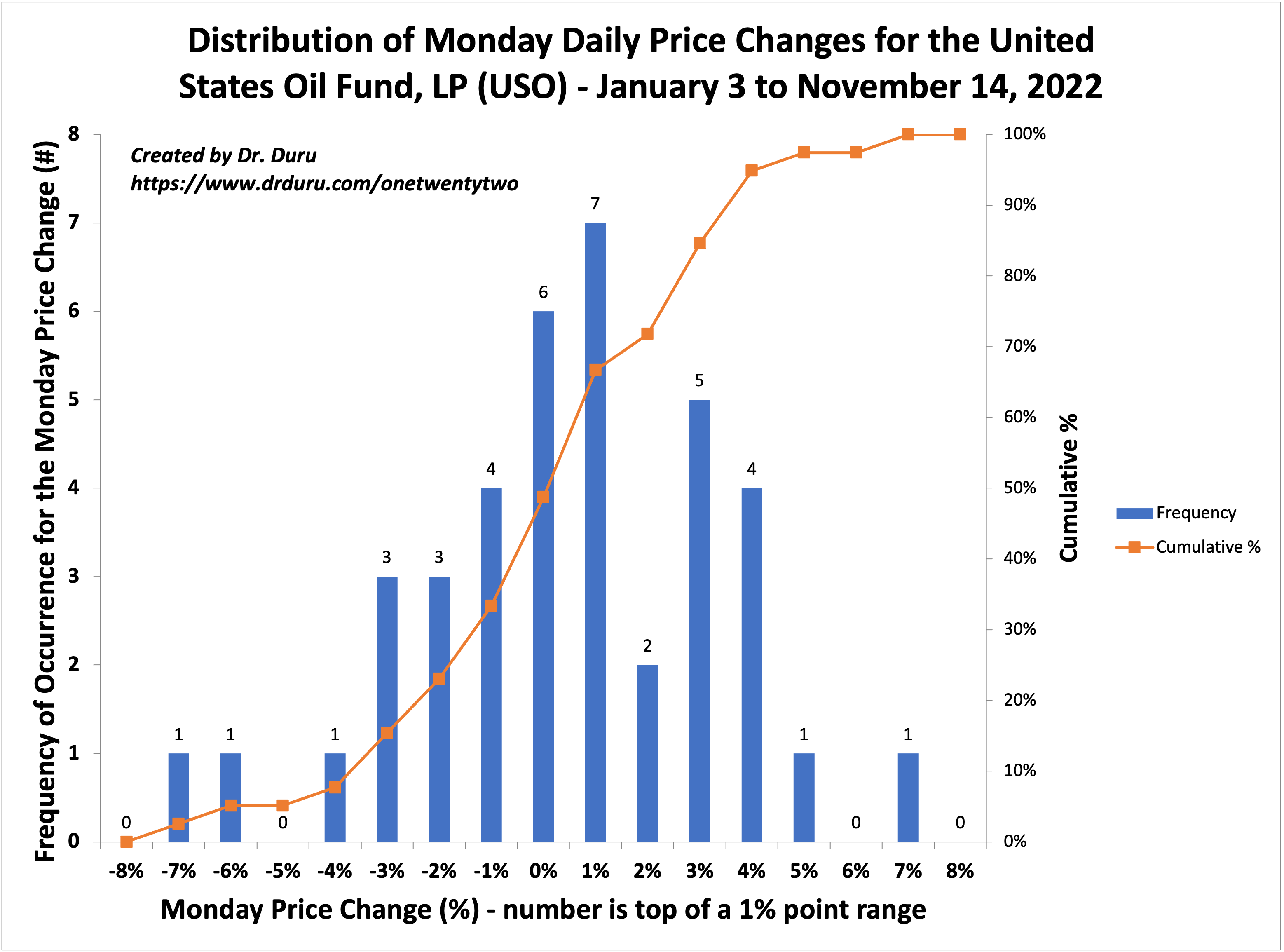

The 50/50 split on Monday price changes is also reflected in the 17 USO price changes between -1% and +1% out of 39 Mondays (44%) to-date. The histogram below shows the distribution of price changes in the blue bars and the cumulative share of all price changes, going from left to right, is represented by the orange line. The cumulative percentage hits 48.7% at the -1% to 0% range.

The Trade

So why care about the price change of USO on Mondays? Well, for several months, I have been selling out-of-the-money covered weekly calls on USO, mostly on Thursday or Friday (depending on technical positioning). To the extent USO falls on Monday and slowly recovers during the week, I end up with a positive trade. Occasionally, I have had to plow profits into USO puts to lower catastrophic downside risk. Two weeks ago, I reduced the downside risk further by buying an April $60 call paired with a Dec $62 put option. I will reconfigure the trade, if conditions look favorable, as the put approaches expiration.

The recent streak of Monday blues means that trading bots that are not already hopping around this pattern are likely to jump aboard… or contrarian bots will try to fade it. Either way, this regression to the mean challenges my trading strategy. Facing 50/50 odds on future direction, I will continue with the current trade until/if a short weekly call expires in the money. At that point, I will close out the entire trade and reevaluate the potential risk/reward.

Be careful out there!

Full disclosure: long USO diagonal call spread and put option