Stock Market Commentary:

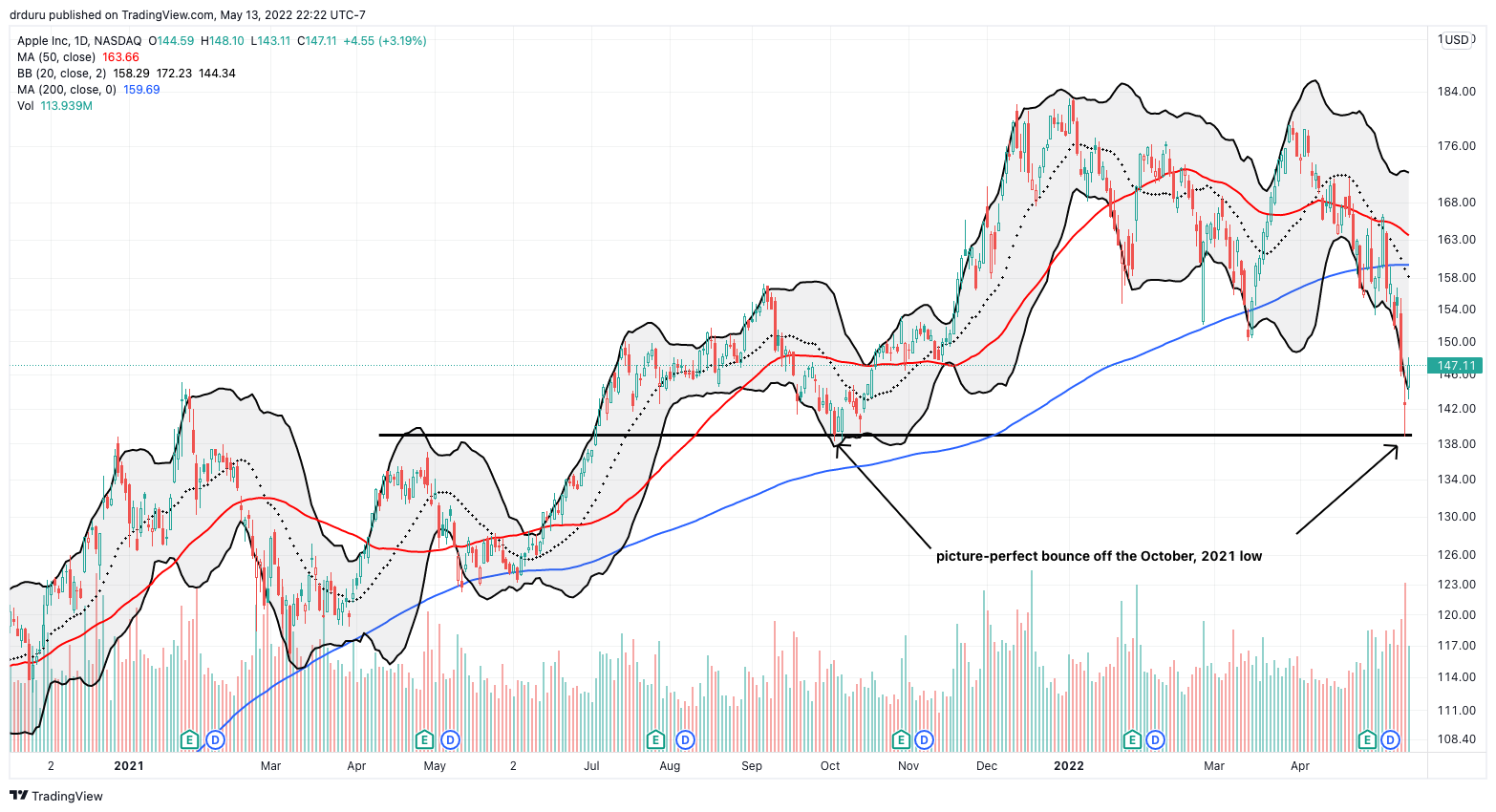

In the middle of last week, the S&P 500 was poised to hit bear market territory. Conditions were ripe with the stock market trading in deeply oversold territory and other indices toiling deeply in bear markets; a sharp rebound could happen at any time for any excuse. Both the S&P 500 and Apple Inc (AAPL) provided the excuse. Apple led the way for the bear market bounce. AAPL printed a picture-perfect rebound after tapping its October, 2021 low. AAPL lowered its loss for the day with a 2.7% drop. Friday’s 3.2% gain still left AAPL with a whopping 6.5% loss for the week. With AAPL leading the way, the S&P 500 stopped just short of its bear market line. That line represents a 20% loss from the index’s all-time high set in January. Traders and algorithms must have rounded up and declared “close enough.” Buyers took the wheel from there.

Technicals are shining in this period of high volatility. The market seemed relieved when Federal Reserve Chair Jerome Powell appeared to take a 75 basis points rate hike off the table: “So 75 basis point increase is not something the committee is actively considering” (from the transcript of the press conference). The S&P 500 soared 3.0% that day but collapsed the very next day by 3.6%. Fast forward to an interview with Marketplace, Powell clarified that the Fed will respond flexibly to the data (as always). NOTHING is off the table: “…if [things] come in worse than what we expect, we are prepared to do more” (the 6:30 market in the audio). That revelation did not stand in the way of the picture-perfect bear market bounce.

In other words, the episodic news hardly matters here given the more important looming interplay between high inflation and tightening monetary policy. On the technical side, I continue to watch important levels of support and resistance and, most importantly, oversold trading conditions.

The Stock Market Indices

If the oversold period remains extended, then the S&P 500 is working on a new (lower) churn zone. On Wednesday, the S&P 500 had just 98 points to go before hitting an official bear market. At its low the next day, the S&P 500 stopped just 22 points short. However, with a 19.55% loss from the all-time closing high, enough algorithms (whether human or robotic) decided the index got “close enough” to the automatic trigger for a bear market bounce (just round that number up to 20%, people!). With Friday’s positive open, I assumed traders carved out a kind of bottom, and I jumped on a fistful of SPY shares. With the index closing just below critical resistance from the May, 2021 low, I expect to take profits in the coming week.

The NASDAQ (COMPQX) was much less interesting from a technical standpoint. The NASDAQ is deep into its own bear market, so any bounce in this vicinity is a bear market bounce. The tech-laden index rebounded strongly enough on Thursday to close flat on the day even with AAPL closing deep in the red. Friday’s 3.8% gain for the NASDAQ put overhead resistance from the September, 2020 high into play.

I was all set to load up on QQQ call options once SPY closed in on the spot for a bear market bounce. I set my trigger or SPY at $385. SPY dropped to $385.15 for its low on Thursday. That small miss was HUGE! In retrospect, I should have manually triggered the buy after the bear market bounce got going.

The iShares Russell 2000 ETF (IWM) stopped short of a complete reversal of its November breakout. The ETF of small caps signaled a bottom on Thursday with a 1.2% gain after its bear market bounce from the lows. Friday’s 3.2% gain puts overhead resistance from the 20-day moving average (DMA) (the dotted line) into play.

Stock Market Volatility

The volatility index (VIX) played its part to signal an imminent bear market bounce. Despite on-going selling in the stock market, the VIX managed to churn and even lose ground for three days. The faders went to work on the index on Friday. The VIX lost 9.1% as the bear market bounce played out in full display. As I noted earlier, I had trouble knowing what to make of the VIX’s reticence. I could reason my way to anticipating an imminent surge just as easily as I could predict something similar to Friday’s implosion. With the tension resolved to the downside, buyers are free to relish the bear market bounce for a while. The next test is the uptrend represented by the dotted line below.

The Short-Term Trading Call With A Bear Market Bounce

- AT50 (MMFI) = 17.6% of stocks are trading above their respective 50-day moving averages (Day #5 oversold)

- AT200 (MMTH) = 22.8% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, surged to a close at 17.6%. Thursday’s bear market bounce and Friday’s follow-through demonstrate why I upgraded to cautiously bullish once the market flipped oversold. Recall that my on-going wariness compelled me to hold short positions longer than usual. I also waited longer than usual to buy into oversold conditions. Since the VIX failed to surge at the bottom, I did not get aggressive (like manually pulling the trigger on my contingent order for QQQ call options). Even with the VIX looking toppy, I now await a breakout by the S&P 500 to trigger aggressive buys.

Teaser alert: one potential exception to my patience might be the ARK funds. This bear market bounce may deliver a significant relief rally for the collection of beaten down ARK funds. I will dedicate a separate post to my latest musings on ARK. In the meantime, I refreshed some ARK shorts to pave the way for hedging more aggressive longs in the coming week or more.

Be careful out there!

Footnotes

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #2 under 20% (day #5 oversold), Day #7 under 30%, Day #16 under 40%, Day #27 under 50%, Day #32 under 60%, Day #303 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long SPY, long SVXY, short ARKQ, long ARKK calendar put spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, Twitter, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.