Bitcoin Boring

Bitcoin (BTC/USD) was pretty boring until this past weekend. After neatly failing at resistance from its 200-day moving average (DMA) in late March, BTC/USD settled back into what was starting to look like an extended trading range. However, the pressures of the bear market and a soaring U.S. dollar (DXY) proved too much to bear. On Monday (May 9th), Bitcoin plunged 11.6% and slipped by the $30K mark for the first time since the important lows in late July, 2021.

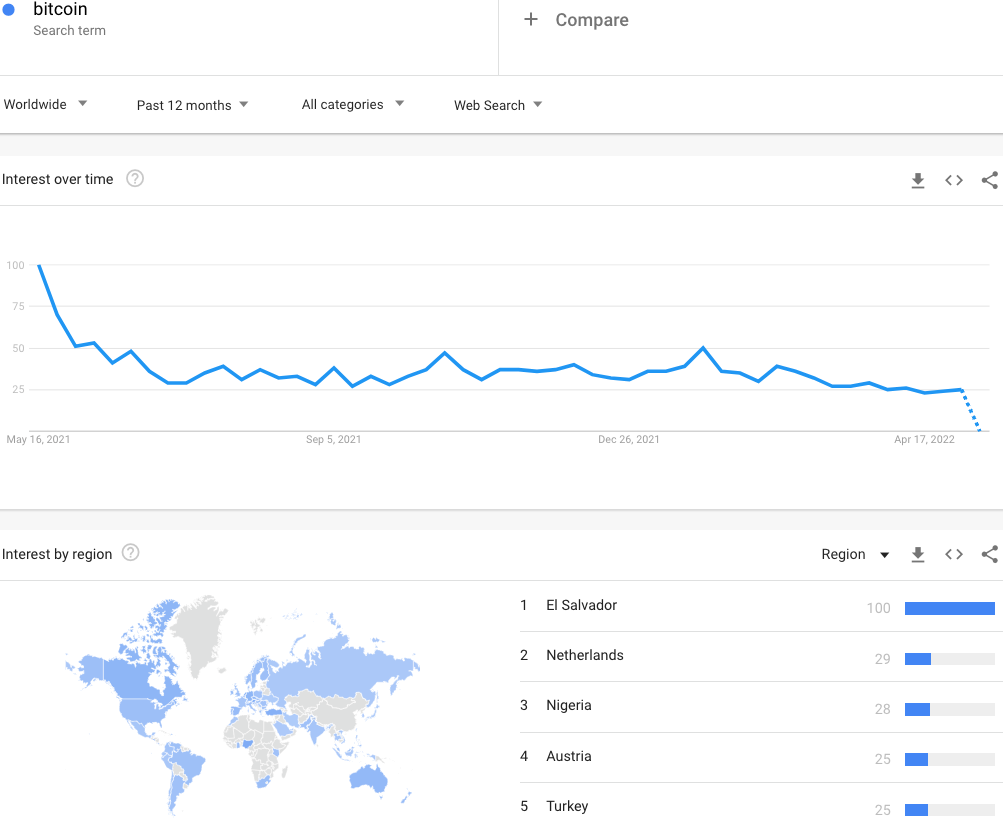

Google search trends confirmed the boring trading in Bitcoin. Worldwide searches on the word “Bitcoin” drifted downward all year and recently hit 12-month lows.

Searches were limping along so much that Google even projected a sharp drop for this week. Bitcoin’s plunge likely changed the forecast with a quickness.

Bitcoin Bursting

Esteemed chartist Carter Braxton Worth astutely pulled out the charts to call for a “quick decline” to around the $30K levels. All four chart patterns below converged on a single theme: a Bitcoin bursting. Worth demonstrated once again the great importance of technicals for understanding Bitcoin.

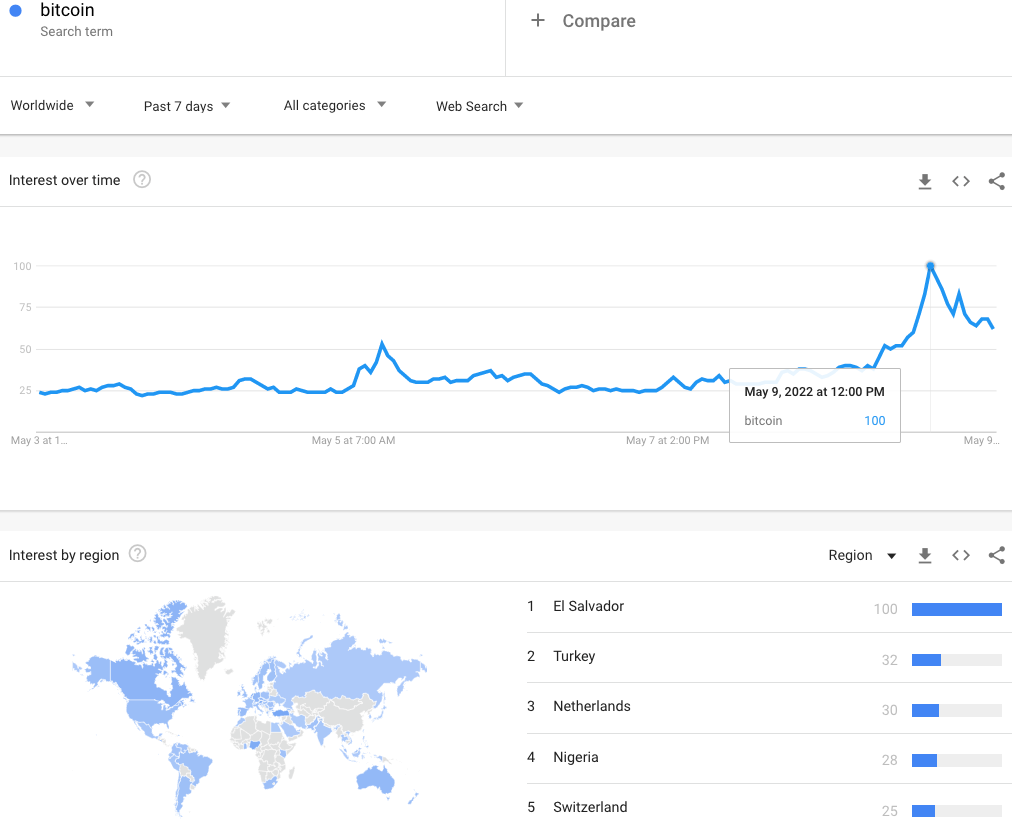

This bursting finally woke up Google searches for Bitcon. The 7-day daily chart below shows search interest spiked higher right at high noon on May 9th, one hour before U.S. markets closed for trading on the stock exchanges. Bitcoin soon traded lower from there but created a bottom ahead of the current resurgence.

Per the Google Trend Momentum Check (GTMC) this burst triggered a potential buying signal. I am waiting to see a full two days of search trend data to verify the sustained interest that delivers a strong buying signal.

Microstrategy Overhang: Bitcoin Collateral Damage

One reason for proceeding caution is the overhang created by the institutions that have piled into Bitcoin. Microstrategy Incorporated (MSTR) is one particularly important player has accumulated a virtual warehouse full of Bitcoin. Last week, MSTR revealed a huge potential overhang in the form of leveraged Bitcoins.

Microstrategy leveraged up on Bitcoin at exactly the wrong time, at least for the short-term. CEO Michael Saylor announced a major Bitcoin-backed bond offering. The terms of the agreement include a margin call on a decline of Bitcoin to $21,000. Such knowledge is dangerous in the hands of traders in a risk-off market environment. Bitcoin’s plunge caused an extra heaping of pain for MSTR. The stock dropped 25.6% and closed at a 17-month low.

Here are the terms of the loan (emphasis mine) (from the Seeking Alpha transcript):

“…our first ever Bitcoin backed term loan with Silvergate Bank. We raised $205 million as an interest-only loan for a term of three years, which is collateralized by Bitcoin. The loan matures on March 23, 2025. It bears monthly interest at a floating rate equal to the Secured Overnight Financing Rate or SOFR, 30-day average as published by the Federal Reserve Bank of New York’s website plus 3.70% with a floor of 3.75%. The low may be prepaid at any time, subject to modest prepayment premiums.

The loan had an initial loan to collateral value of 25%, which was thus collateralized closing by Bitcoin with a value of approximately $820 million. While the loan is outstanding, we are required to maintain an LTV ratio of 50% or less. Which essentially allows for an approximately 50% drop of Bitcoin prices from the time of transaction closing before we’re required to post any incremental collateral.

We’re also allowed to proactively manage the LTV ratio by posting any desired value of additional collateral, if we choose to.”

(Saylor clarified later in the press conference that a 50% drop meant a $21,000 Bitcoin level).

The ability to bolster the LTV is very important because Microstrategy has a big reservoir of Bitcoin to help stave off a margin call.

“…as of March 31, 2022, of the total of 129,218 Bitcoins held by the company. Roughly 14,100 Bitcoins are held at the MicroStrategy entity, all of which are held as collateral securing our 2028 secured notes. The remaining approximately 115,100 Bitcoins are held at the MacroStrategy subsidiary. Of the MacroStrategy of Bitcoins, approximately 19,500 Bitcoins are pledges collateral towards the Bitcoin back term loan and over 95,600 Bitcoins remain unpledged and unencumbered. We may consider additional opportunities to utilize the strategic asset in the future.”

Just ahead of his stock’s plunge, Saylor poked fun with a tweet featuring himself working at McDonalds (MCD).

While the tweet now looks a bit prophetic, I think MSTR will emerge from this latest Bitcoin swoon a little more humble, perhaps poorer, but still functioning. Accordingly, I am eyeing MSTR for an entry point alongside some stabilization in Bitcoin. Note well: shorts are all over the underlying weakness in MSTR caused by its massive Bitcoin exposure. According to Yahoo Finance, 27% of MSTR’s float is sold short.

A Surprising Bitcoin Short!

“Bitcoin baller” Brian Kelly revealed my biggest crypto surprise of the day. On CNBC’s Fast Money, Kelly revealed he is net short Bitcoin. In fact, he intends to stay net short “until things change.” I fully expected Kelly to trot out more permabull observations and target some buy points. Instead, he held out the possibility that Bitcoin could drop to $20K before bottoming. Michael Saylor look out below?

The Trade

My Bitcoin strategy remains the same as always. I treat sell-offs as buying opportunities. I treat plunges like golden buying opportunities, especially when accompanied by surges in Google search interest (per my Google Trend Momentum Check trade). Rallies get sold. I added to my BTC/USD Monday morning, so I was a bit over-eager. Now I just watch what happens next. I am looking for tags of $25K and/or $20K as next buying points if Bitcoin fails to pull off a substantial come back from current levels.

Be careful out there!

Full disclosure: long GBTC, BITO, BTC/USD