Apple Dividing Rally from Churn

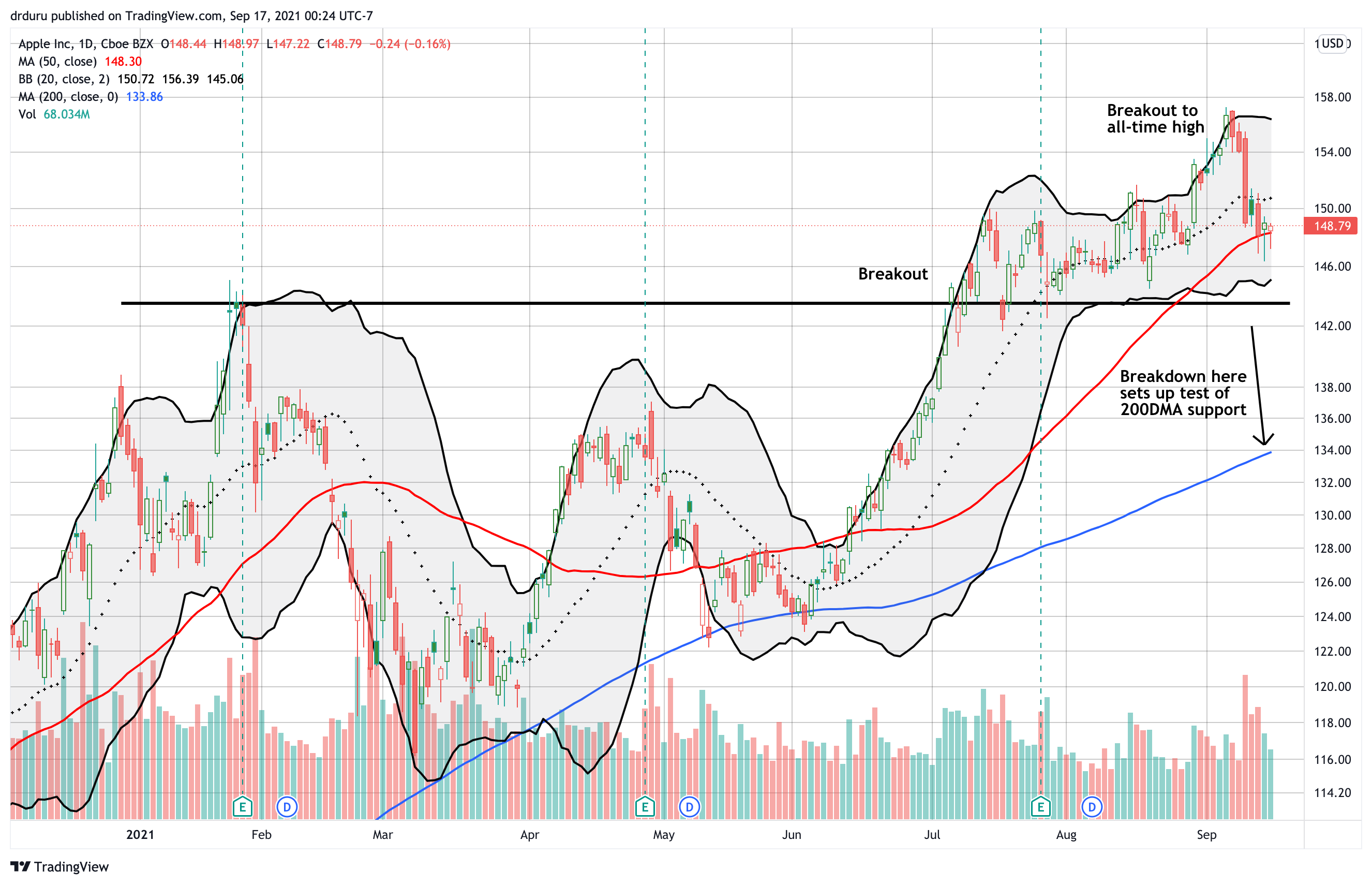

The latest cycle of the Apple Trading Model (ATM) happened between a legal setback for Apple and a product launch event. The week began somewhat hopeful with a small gain. Sellers ended the prospects for the Apple trade by fading the product announcement with a 1.0% loss and a close right on top of support at the 50-day moving average (DMA) (the red line below). Sellers twice more tried to close out AAPL with a 50DMA breakdown. However each day buyers stepped in to prevent triggering a bearish signal. Accordingly, this stalemate leaves AAPL perched on a line dividing a recharged rally from a return to churn. The strong trading volume accompanying this trading seems to confirm high stakes. A breakdown from current levels puts AAPL at risk for an eventual retest of 200DMA support.

The AAPL chart includes additional features of importance.

- Sellers completely reversed AAPL’s last breakout.

- The line defining the breakout above the January peak supported a loose trading range from July to August.

- A confirmed 50DMA breakdown could quickly test support from the previous breakout.

- A further breakdown puts AAPL at risk of retesting 200DMA support.

As a reminder, I only activate the Apple Trading Model when the stock trades above its 50DMA. The current marginal closes above the 50DMA are insufficient. In fact, I am content to wait for AAPL to close above its 20DMA before reactivating the Apple Trading Model. Trading above the 20DMA should confirm a recharged rally.

Zynga (ZNGA) Sidenote

After Apple lost a key provision in the Epic Games lawsuit over the Apple Store, a range of app software companies popped on the news. In general, that excitement is already over. For Zynga (ZNGA), maker of my favorite app game Words with Friends (take me on @DrDuru!), the thrill lasted for just a day. ZNGA jumped 6.3%, and sellers took over from there. The stock even tested its post-earnings lows from August when the company disappointed investors with news of game delays, revenue hits from Apple’s privacy efforts on IDFA, and tough comps confirming the pandemic-related headwinds are fading.

As a fanboy, I am actually keen to buy back into ZNGA at some point. The current lows are also testing November lows, so a breakdown from here could easily send the stock to $7 or lower. I am a “bargain shopper” at those levels.

Be careful out there!

Full disclosure: no positions