I heard this tweet referenced twice in the financial media: the first time unsourced and the second time sourced. I must assume that the bizarre data points of the U.S. housing market from Glenn Kelman, Redfin’s CEO, went viral. Redfin’s commentary and observations on the housing market are typically astute and insightful, but this particular observation – “there are now more Realtors than listings” – called me to track down the original data (I am surprised Kelman did not provide his references). I cobbled together a few data points that tell me that realtors have outnumbered listings for quite some time. However, the data provide stark reminders of a housing market suffering from an extreme supply shortage.

Inventory Shortage, Realtor Glut?

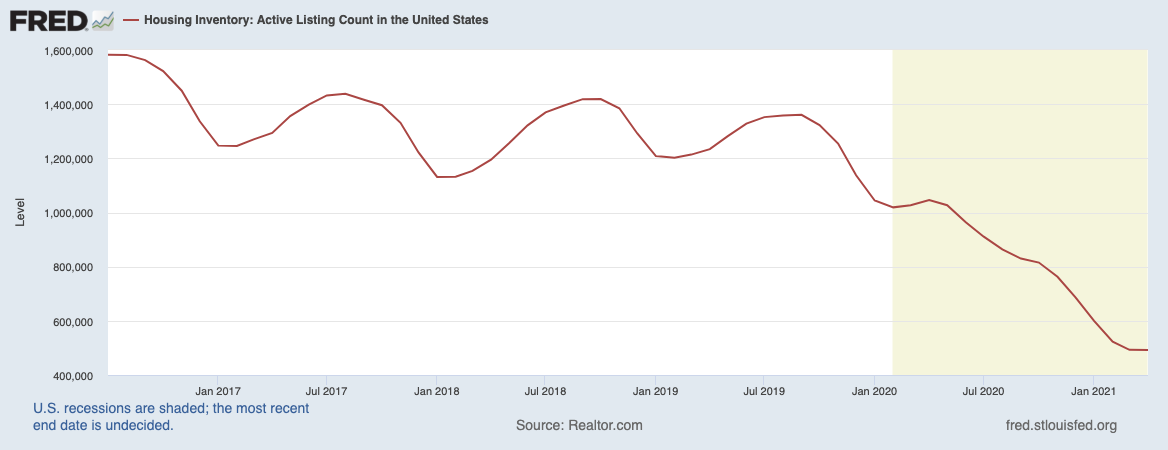

In previous Housing Market Reviews, I referenced plunging inventories of existing and new homes across the country and an outright implosion of active listings in California. California is not alone. Active listings across the U.S. imploded during the pandemic following a multi-year downtrend. From February, 2020 to April, 2021, active listings fell slightly over 50%.

Statista provides membership data for the National Association of Realtors (NAR). Nearly all these members should be licensed realtors. According to these data, the U.S. had 1.45M realtors in 2020. That number exceeds the active listings from 2018.

Find more statistics at Statista

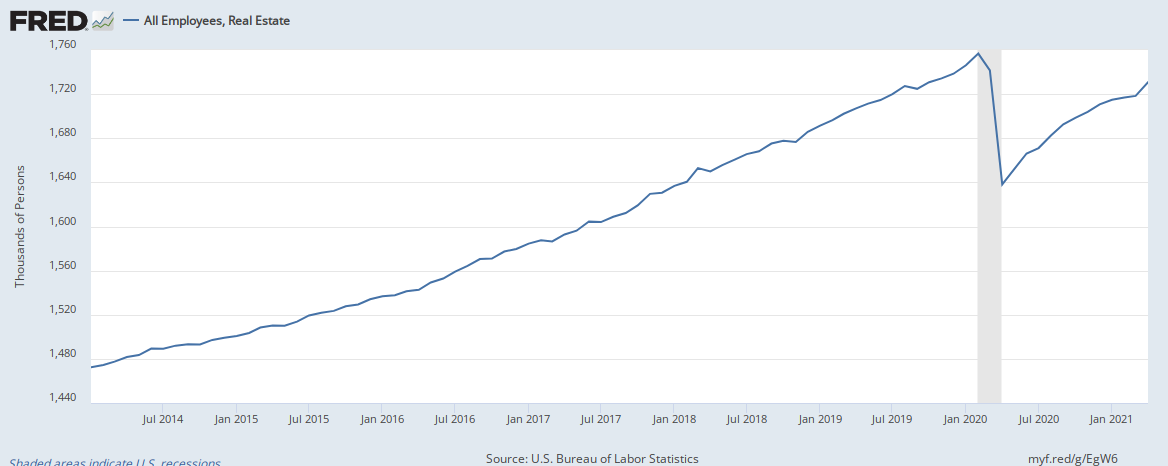

Since Statista does not have partial 2021 data, I turned to the U.S. Bureau of Labor Statistics jobs data for a count of all employees in real estate. Assuming the rebound of these employees reflects a similar rebound in realtors, I can safely assume that 2021’s number of realtors is the same, if not higher, than 2020’s count.

Employment in the industry rebounded sharply from the pandemic lows. Now near the pre-pandemic high, realtors may soon face down a kind of labor supply glut if housing inventory fails to respond to the ending of the pandemic.

Other Reference Points

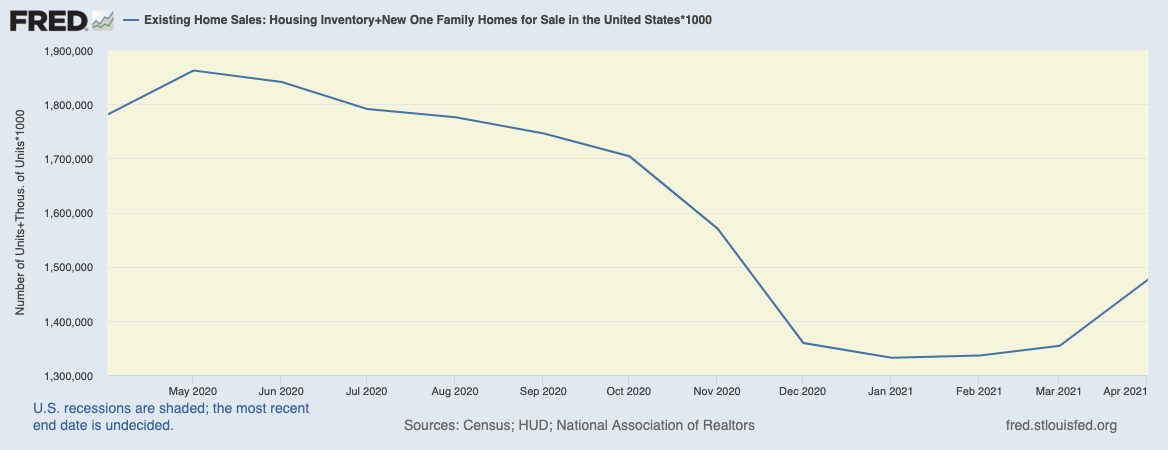

Just for other reference points, I added together the annualized new and existing homes for sale. For April, 2021, that combined number is 1.46M, exactly the same number of realtors. March’s total was 1.35M. (The NAR only provides the last 12 months of data).

Notably, existing home inventory finally increased month-over-month. However, sales for existing homes actually declined. This divergence warrants close watching.

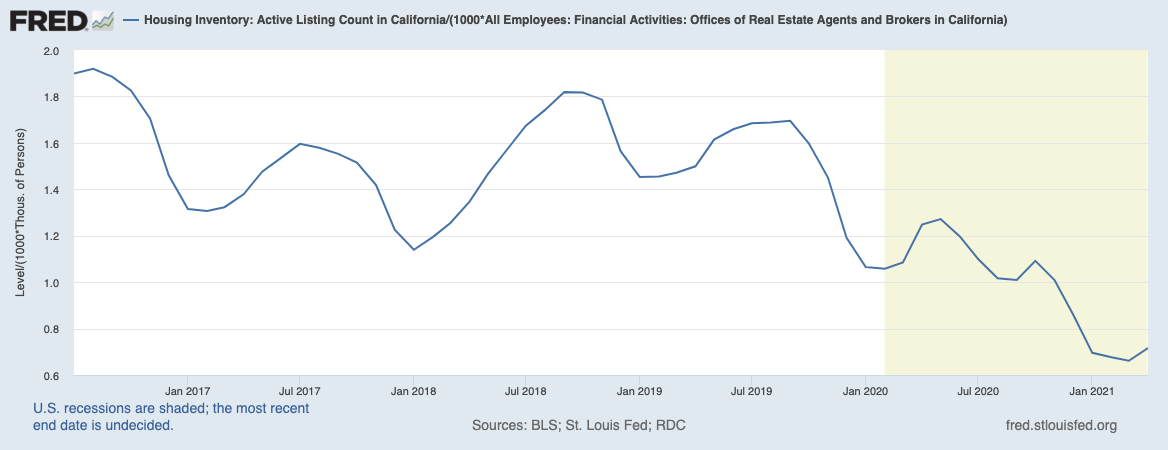

Perhaps most representative of the recency of Gelman’s observation is the active listing count versus the “offices of real estate agents and brokers.” FRED includes data for California and New York but not nationally. The graph below shows the ratio for California. Starting December, 2020, active listings dropped below the number of real estate agents and brokers.

The Trade (intraday snapshots)

Given the dearth of housing inventory, I am surprised the real estate service companies that rely on transactions are doing so well. For example, Realogy (RLGY), which includes well-known real estate brands like Century 21, Coldwell Banker, Sotheby’s International Realty, and Better Homes and Gardens, sits comfortably at 27-month highs. RLGY rebounded from its pandemic low around $2.00 with brief pullbacks along the way to today’s highs.

Zillow Group (ZG) and Redfin (RDFN) show more of the recent pain of limited inventories and constraints on transactions. Both ZG and RDFN are well off all-time highs and down significantly year-to-date. Both stocks peaked at all-time highs in February and suffered during the growth tantrum that took down stocks with high revenue growth (or growth potential), low to negative earnings, and extremely high valuations.

RDFN suffered large losses after both of this year’s earnings reports. ZG did well at its first of the year, but the stock plunged after the company’s second earnings report. However, both stocks are now in bottoming processes. RDFN is sprinting off its bottom. Accordingly, it has a decent chance to break through stiff overhead resistance from its 50 and 200-day moving averages (DMAs). ZG is drifting higher and should experience a greater challenge breaking out. Since ZG looks relatively weaker, I dipped my toe into a June put spread on the stock. Both stocks become buys on breakouts above resistance.

Be careful out there!

Full disclosure: long ZG put spread

This seems fairly simple to me: the level of time and effort required for a broker to sell a house decreases with the amount of houses available to sell.

Remember there is typically a realtor on both sides of the deal. Realtors for buyers end up spending a lot MORE time when there are fewer homes because it takes more offers to get one deal.