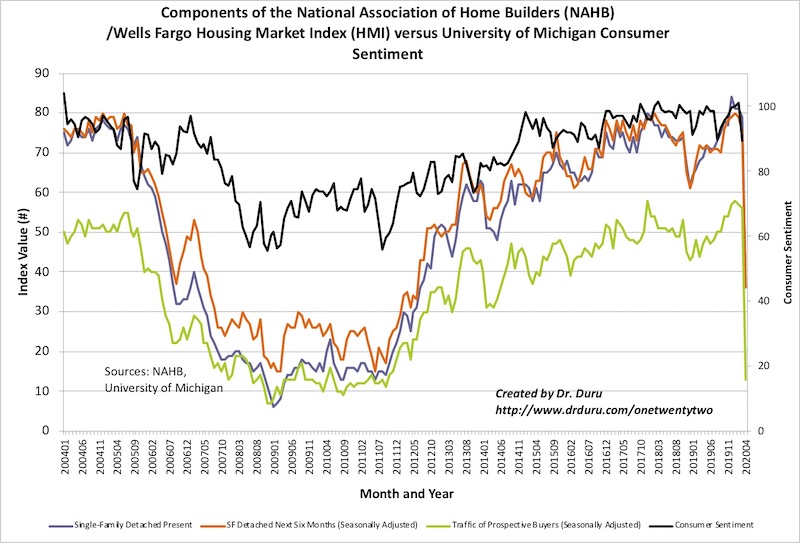

“…if not for the pandemic, the strong momentum going into the Spring may have actually sent confidence higher still. Instead, confidence will undoubtedly plunge in the next report. The consumer sentiment index plunged to a 4-year low as a leading indicator of where builder confidence will go.”

Housing Downturn: Put Spring’s Momentum On the Shelf – Housing Market Review (March, 2020)

Home Builder Confidence: The Housing Market Index – April, 2020

Last month I anticipated an imminent plunge in the Housing Market Index (HMI), but not the kind of absolute collapse that occurred for April. The National Association of Home Builders (NAHB) reported that the HMI collapsed from 72 in March to 30 in April. HMI has not been this low since it hit 29 in June, 2012 on the way out of the 2011/2012 trough of the last housing downturn. The HMI component “traffic of prospective buyers” led the way down by dropping from 56 to 13, a level unseen since August, 2011. The other two components, “single-family detached present” and “single-family: next six months”, both dropped to 36 from 79 and 75 respectively. These are levels last seen since July, 2012 and March, 2012 respectively. The chart below shows the unprecedented nature of this collapse since the NAHB started producing the HMI. Not even the bursting of the housing bubble and resulting financial crisis produced such a complete collapse in the HMI.

Source: NAHB

The NAHB was strangely half-optimistic in last month’s report by using the title “Builder Confidence Declines But Remains Solid Amid Rising Risks.” The NAHB seemed to imply that builders would somehow face down the coronavirus pandemic with their own inner resolve. The April report was not draped in this veneer of hope. The title “Builder Confidence Posts Historic Decline on Coronavirus Pandemic” was quite appropriate. Yet, the NAHB remains fundamentally optimistic about the back half of the year:

“Home building remains an essential business throughout most of the nation, and as the pandemic shows signs of easing in the weeks ahead, buyers should return to the marketplace…

…As social distancing and other mitigation efforts show signs of easing this health crisis, we expect that housing will play its traditional role of helping to lead the economy out of a recession later in 2020.”

I do not share this optimism. Not even close. Housing will once again lag the economic recovery just as it did coming out of the shock of the financial crisis. The reason is simple and straightforward. With incomes severely impaired, employment prospects softened, uncertainty about the future riding high, and prospects lingering for another winter fraught with coronavirus concerns, the LAST thing people will think about is committing to a mortgage. Home buyers classically wait for the “all clear” signals in the economy before feeling good about making the most important purchase of their lives. The people who buy homes in the coming months will be the ones who, for whatever reason, feel they absolutely must buy. On the flip side, the good news for prices is that people are also unlikely to sell unless they absolutely must. Sellers will have less interest than usual in moving given environment of high uncertainty.

Source: TradingView

Freddie Mac Overly Optimistic

I look at this plunge in the HMI as undercutting the surprising optimism in the latest housing forecast from Freddie Mac, one of the government-sponsored institutions operating in the mortgage market to maintain liquidity and stability. Freddie Mac’s April, 2020 forecast concluded:

“With much of the country under stay-at-home orders, we expect to see housing markets deviate from their typical spring surge. At a seasonally adjusted annual rate home sales fall 45% in the second quarter of 2020. Home sales bounce back but take a year to recover to the level reached in the first quarter of this year…”

Freddie Mac forecasted total annualized home sales of 3.4M in Q2, 5.3M in Q3, and 5.7M in Q4 for a total number of 5.4M for 2020. Freddie Mac forecasted 6.1M for 2021. Total annualized home sales were 5.9 in 2018 and 6.0 in 2019. So Freddie Mac is essentially forecasting a rapid rebound toward and back to normalcy. Home builders are as pessimistic as possible about the traffic from prospective buyers for the next 6 months, so Freddie Mac’s forecast would require a rebound in housing activity even more astounding than the plunge coming into this moment. Even the 56% leap in sales from Q2 to Q3 reads like a complete outlier for what the economy faces in trying to recover in Q3.

Strangely enough, Freddie Mac admits their “forecast is relatively optimistic for the economy and there are significant downside risks.” I do not understand why the agency felt the need to publish such rosy numbers given the clear, obvious and significant downside risks to this position. I full expect Freddie Mac to reduce its forecasts significantly in coming months.

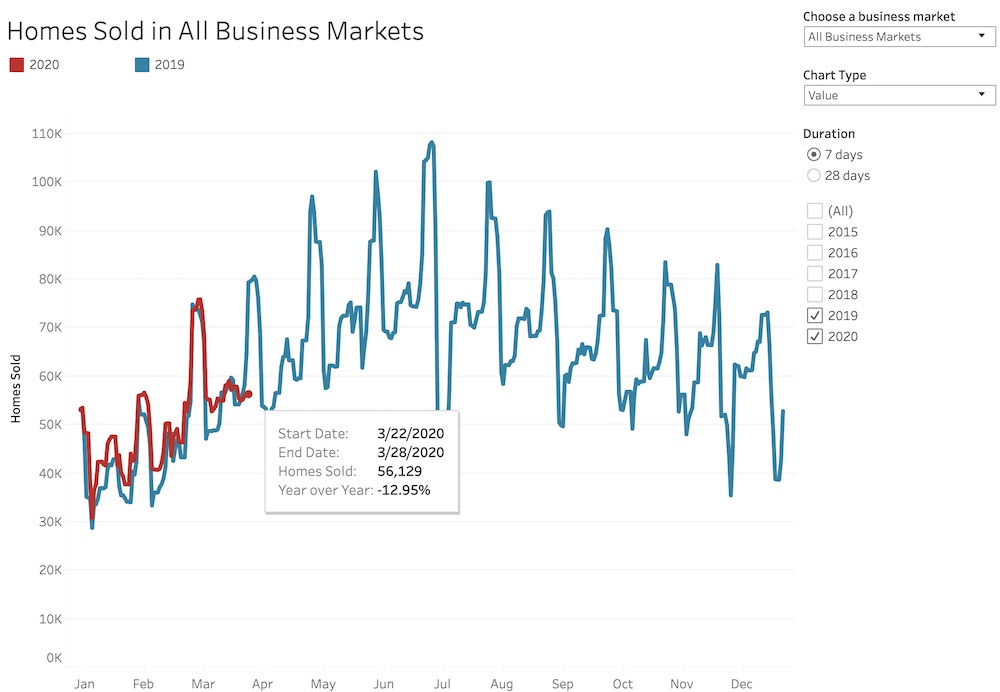

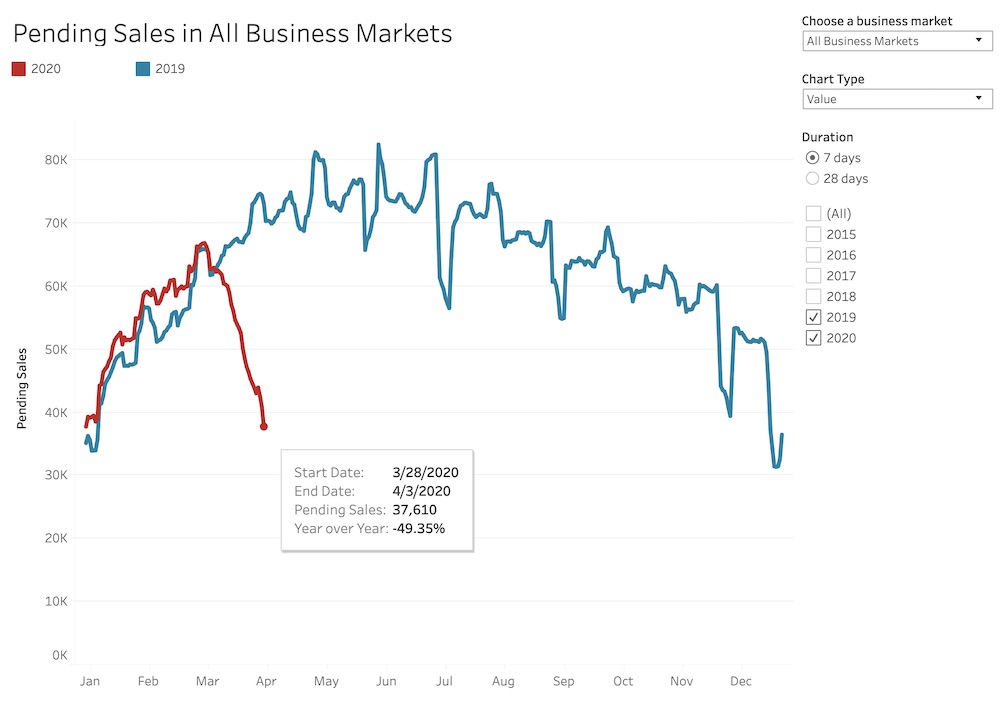

Total and Pending Home Sales

With buyers and sellers eager for information in these unprecendented times, Redfin (RDFN), a housing market services company, provided extra market data on its website. Weekly data provides very timely views into housing market activity. The last week of March suffered a 13% year-over-year decline in a week where sales should be surging through the Spring selling season.

Source: Redfin

These data should be useful in checking against the myriad of forecasts that economists and pundits will provide as conditions continue to change rapidly. I suspect that sales are not even worse because there are people who went down the road of buying and decided to proceed. Once this pipeline pushes through the system, I expect sales to go even lower…and soon force Freddie Mac and others to revise forecasts downward.

Source: Redfin

Be careful out there!

Full disclosure: long ITB shares and call options, long RDFN