It was fun while it lasted.

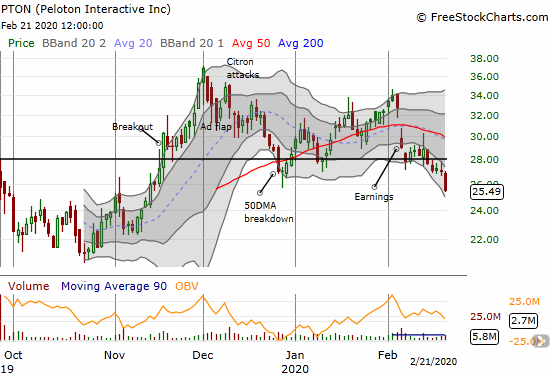

I first made the case for buying shares in Peloton Interactive (PTON) in the wake of a flap over a strange commercial for the exercise bike and service. The stock rallied a bit from there, but a well-timed short-seller attack stopped the rebound cold in its tracks. I bought more shares when PTON tested support at its 50-day moving average (DMA). After a bottoming pattern developed the next day, I presented a new rule for buying into PTON. PTON followed a choppy path upward, and I took profits after the stock rebounded from a second 50DMA breakdown. The on-going churn wore down my patience. I also had a wary eye on upcoming earnings: I did not want to hold shares through such a high-risk event.

PTON lost 11.3% after reporting earnings. The stock delivered its 4th 50DMA breakdown in 6 weeks. Last week’s selling confirmed the 50DMA breakdown as well as confirmed the end of the bullish breakout from November. These developments are bearish for the stock. This selling is like shark bait for shorts except shorts have already gorged on PTON’s current float to the tune of 84.5% of the current float.

Source: FreeStockCharts

More Peloton shares are on the way.

Shorts are currently 12.6% of outstanding shares. Parallel to the earnings announcement came news of an early end to PTON’s post-IPO lock-up. On Monday February 24th PTON will allow insiders to dump as much as 227M shares onto the market, 87% of the 317M outstanding shares. I am not surprised that a deluge of that scale demotivated buyers in the stock. Friday’s selling was the last scramble of holders to get out the way despite what looked like strong guidance from the company during its earnings report.

“For fiscal 2020, we are raising our guidance on revenue to $1.53 billion to $1.55 billion, representing 68% year-over-year growth at the midpoint. Our gross margin outlook reflects efficiencies in both connected fitness and subscription margin. Our improved connected fitness margin guidance includes product cost improvements, which are offsetting the negative margin impact of the mix shift of sales to Tread and international. Subscription contribution margin guidance reflects savings in streaming costs and faster leveraging of fixed content production costs. Additionally, we are not assuming any incremental content cost for past use at this time.”

Peloton Interactive, Inc. (PTON) CEO John Foley on Q2 2020 Results – Earnings Call Transcript from Seeking Alpha

The Trade

With PTON trading below its $29 IPO price, insiders are likely to dump and sell indiscriminately to lock in profits while they have them. If the stock market remains in a bearish mood, then a low appetite for absorbing PTON shares could translate into a swift return of the stock toward the $21-$22 level. That level represents a good risk/reward buy for the stock. I could consider stopping out of PTON on a breakdown to a new all-time low. I could also consider adding shares at a further discount in anticipation of the stock rallying again going into the next earnings report.

The buying opportunity in PTON depends on the company delivering on its improved guidance. The stock market is essentially showing skepticism in the company’s ability to deliver. A disappointing Q3 2020 report would likely spell the beginning of the end of the buying opportunity in PTON….and usher in a lot more short interest.

Be careful out there!

Full disclosure: no positions