Introduction

When I wrote about the third quarter earnings for M.D.C. Holdings (MDC), I wondered aloud: “MDC’s next report on orders should deliver a very telling challenge to investor sentiment.” MDC seemed to deliver on orders in its Q4 earnings report, up 49% year-over-year and up 13% for the whole year. Investors were initially excited as the stock opened up with a 5.9% gain. However, MDC closed the day with a 3.0% loss. The stock has yet to recover. Sentiment in MDC is clearly still wary.

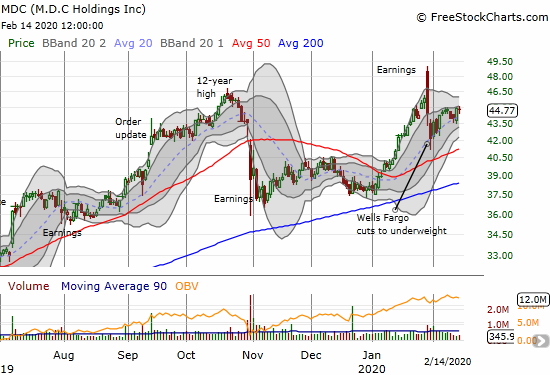

Source: FreeStockCharts

At the time I wrote about the Q3 report, the stocks of home builders were topping out. MDC ominously suffered one of the largest post-earnings losses I have seen in a long time in a major home builder. Fortunately, the stock never traded lower than the intraday low of that day. When MDC broke out above its 50-day moving average (DMA) in early January, the iShares Dow Jones U.S. Home Construction Index Fund ETF (ITB) was doing the same. MDC rode sector momentum all the way into its earnings report. The sector momentum is likely keeping sellers at bay for now. MDC is clinging to housing sentiment.

Overall Assessment

As with other home builders, MDC had an easy comparison for its Q4 report. Q4 2018 delivered a major slowdown in the housing market as higher interest rates sparked a large buyer’s retreat. A subsequent plunge in mortgage rates brought in an over-weighting of “affordable” buyers who no doubt learned a lesson that waiting is a failing strategy in the face of higher prices and the risk of higher rates. As a result, MDC’s share of sales in its lower-priced homes jumped to 64%. MDC’s average selling price also continues to face pressure both from the increase in lower-priced homes and softness in its California business. With the company unable to squeeze out extra margins from the affordable line of homes, MDC will have to get volume to improve results. With valuations creeping higher, other home builders offer better value.

Stock Performance

After Q3 earnings, MDC dropped as much as an astounding 17.9% before rebounding to an 11.2% post-earnings loss. After Q4 earnings, the stock printed what is known as a “gap and crap”, where a stock gaps higher at the open only to succumb to selling. Combined, these two bearish price patterns form a convincing double-top for MDC. As a result, I removed MDC from my list of stocks to buy as part of my strategy for investing and trading the stocks of home builders.

- One day after reporting Q4 2019 earnings: -3.0%

- Since the close after Q4 2018 earnings: +36.0%

- Since the close after Q3 2019 earnings: +15.7%

- For the year until the close before earnings: +20.0%; compare to +9.7% for the iShares Dow Jones US Home Construction ETF (ITB)

Valuation (from Yahoo Finance)

- 12-month trailing P/E: 12.0

- 12-month forward P/E: 9.7

- Price/book: 1.6

- Price/sales: 0.9

- Short % of float: 4.1%

Year-Over-Year Performance (3 months ended December 31, 2019 and quarter-ending values)

- Home sales revenue: +25%

- Unit deliveries: +31%

- Unit net orders: +49%

- Average selling price: -4%

- Average selling price of net orders: +2%

- Net income: +69%

- Gross margin from home sales: from 18.1% to 18.5%

- Earnings per diluted share: +61.4%

- Ending backlog value: +22%

- Cash and cash equivalents: +2.3%

- Approved lots: >+200%

- Controlled lots: +18% (highest in over a decade)

Year-Over-Year Performance (12 months ended December 30, 2019)

- Home sales revenue: +7.5%

- Unit deliveries: +13%

- Average selling price: -4%

- Net income: +13% (third highest in M.D.C. Holdings history)

- Gross margin from home sales: from 18.8% to 18.3%

- Earnings per diluted share: +9.7%

Year-Over-Year Guidance and targets for 1st quarter and the year

- Home deliveries (Q1): 1,550 to 1,650 (+14.1% to +21.5%)

- Average selling price (Q1): $450,000 to $460,000 (-5.6% to -3.4%)

- Gross margin from home sales (Q1): 18.8% to 19.2% (from 18.9%)

- Increase active community count for a third consecutive year.

Highlights from the Earnings Call

Market Conditions and Characteristics of Demand

- “…demand remained elevated to what is typically a less active selling season. We have seen this momentum carry into the New Year and believe that home shoppers are showing a noticeable interest in starting the home buying process now, rather than waiting until spring.”

- “We continue to see the strongest demand for home priced at or below the median level in our markets…”

- “demand for our more affordable product lines… [accounted] for 61% of our net new orders, compared with 54% a year ago.”

- No plans to increase specs going into the Spring selling season (down 15% year-over-year) – this means MDC’s bullishness on the market has a tight ceiling.

Regional housing markets

- More diversity in the source of revenues.

Pricing Power

- Raised prices in half of communities.

Margins and Costs

- Attributed the decline in gross margin as lower margins in California and a mix shift in Phoenix.

- Margins in Phoenix and Orlando were smaller than the company average but the margins are improving; all-season buyers require a bit extra incentive.

- Six or seven quarters ago, affordable products delivered higher margins. Now increasing share in this market will not impact margins up or down (meaning that the company will have to keep increasing sales volume to maintain improving results).

Balance sheet

- Issued over $300M in 10-year senior notes at 3.85%, the lowest for senior notes in MDC’s history.

Final Observations

M.D.C. Holdings kicked off the surge in home builders in the summer of 2019. With a double-top brewing and a less attractive investment narrative (not to mention the major downgrade from Wells Fargo!), MDC is a “show-me” stock.

Earnings sources

- 2019 4th quarter results: January 30, 2020

- 2019 3rd quarter results: October 30, 2019

- 2019 1st quarter results: April 30, 2019

- 2018 4th quarter results: January 31, 2019

- Seeking Alpha Transcripts: M.D.C. Holdings, Inc. (MDC) CEO Larry Mizel on Q4 2019 Results – Earnings Call Transcript

Be careful out there!

Full disclosure: long ITB calendar call spread and call options