“…do we need eight pressers per year, because a lot of analysts think, when you see the previews of the analysts, it is often no change, no change, no change for this year. Could be different in the future, but would it be something maybe the strategy will discuss on the frequency of the monetary policy meetings with the presser?”

Journalist at the Press Conference for the European Central Bank (ECB), January 23, 2020

I laughed when I heard that during the press conference for the European Central Bank (ECB). The big build-ups to many of the meetings of central bankers so often create anti-climactic events. The ECB has tinkered ever so slightly with interest rates over the last 6 years during a consistent campaign to maintain confidence in the economy even as the pressure to go and stay negative on rates says the exact opposite.

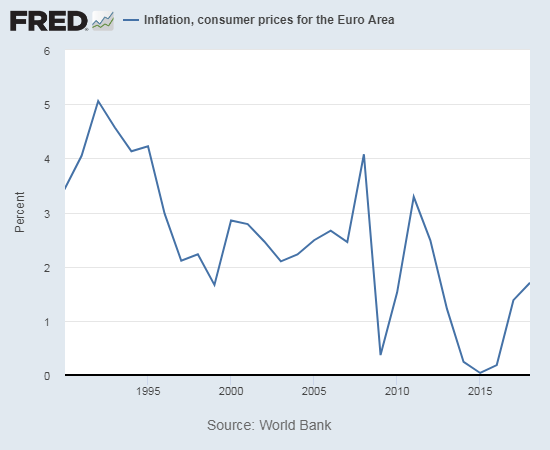

The European Central Bank decided to keep its key ECB interest rates steady in last week’s decision on monetary policy. The ECB last changed its rate on September 18, 2019 when it dropped a key rate from -0.4% to -0.5%. The rate was last non-negative on June 10, 2014. The slow drip over these years is a good metaphor for the sluggishness of the eurozone economy and why Christine Lagarde, President of the ECB, was compelled to repeat the familiar refrain of her predecessor, Mario Draghi: “We expect [key ECB interest rates] to remain at their present or lower levels until we have seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within our projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.”

At 1.7% or so, the inflation rate looks like it is already close to attaining the ECB’s requirements. Yet, the ECB’s caution and hesitation to declare victory comes from years of an overall decline in inflation.

Source: World Bank, Inflation, consumer prices for the Euro Area [FPCPITOTLZGEMU], retrieved from FRED, Federal Reserve Bank of St. Louis, January 30, 2020.

The sluggishness in the euro area/zone has kept me inclined to short the euro, especially against the U.S. dollar, for many years. For about two years the trade on the euro has stayed short EUR/USD.

Source: TradingView.com

The slide will likely take some time, but I fully expect EUR/USD to retest its low around 1.089 from September of last year. The current rebound looks like a technical break from many months of decline. At some point in the coming weeks or months that decline should resume as the U.S. economy remains stronger, and perhaps increasingly stronger, than the euro zone economy. With the ECB’s rate stuck in negative territory, I can collect payments for waiting.

Be careful out there!

Full disclosure: short EUR/USD