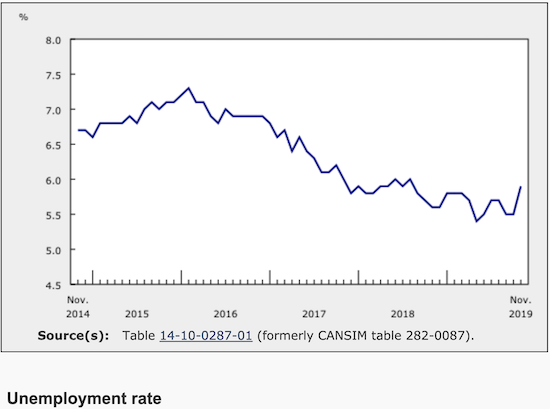

My now wavering bullish case for the Canadian dollar (FXC) took a major hit with the November, 2019 Labour Force Survey. Statistics Canada reported worsening unemployment rates both sequentially and year-over-year. November’s 5.9% unemployment rate was an increase from October’s 5.5% and the 5.6% in November, 2018. The chart below suggests an end to the downtrend in the unemployment rate in place since the 2015/2016 oil shock peak.

Source: Statistics Canada

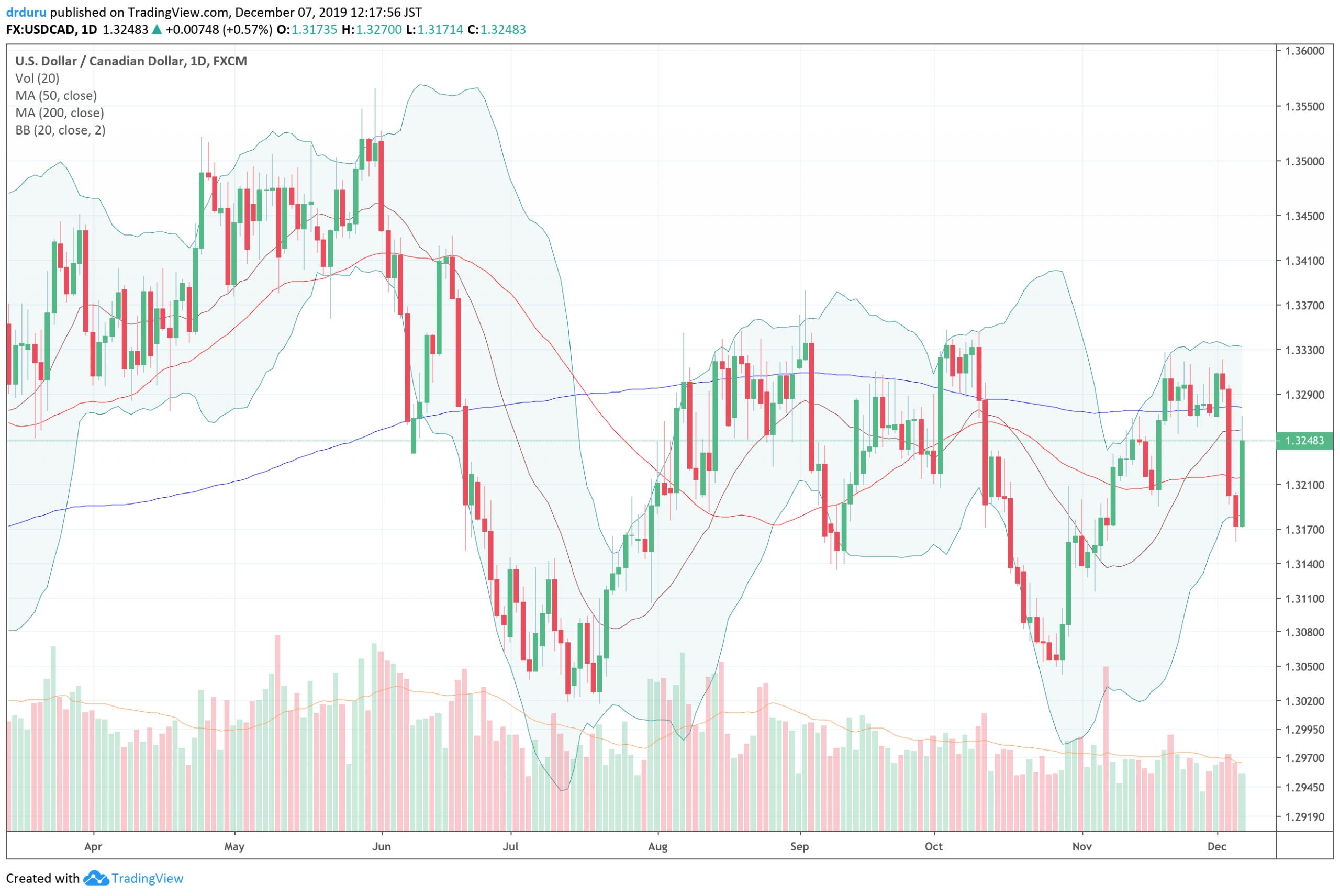

The weak jobs report spooked the currency market as the Canadian dollar sold off broadly against major currencies. The USD/CAD pair reacted particularly sharply given the strength in the U.S. jobs report the same morning.

Source: TradingView

Despite the rise in the unemployment rate, potentially good news exists, and it is good enough to keep me long the Canadian dollar. The number of jobs grew year-over-year by 293,000, a 1.6% gain. As a bonus, the majority of this increase came from full-time work. Moreover, the total number of hours worked increased 0.2%.

From a technical perspective, I think USD/CAD will remain rangebound for the foreseeable future. The 200-day moving average (DMA) has flattened, the double-bottom from July and October looks confirmed, and overhead resistance is holding strong at the peaks formed since August. However, under the current economic circumstances, I will exit my short USD/CAD position on a breakout above the range.

Be careful out there!

Full disclosure: short USD/CAD